|

|

2020年8月25日,蚂蚁集团的A股科创板IPO申请在当日正式向上交所申报。笔者赶快找来招股说明书(申报稿)(“招股书”)读,以了解金融科技巨头的万亿估值生意。在学ACCA时,记得高顿财经老师有讲,国内企业会计准则日益趋同IFRS国际财务报告准则,近乎95%的准则与IFRS准则的规定保持一致,在读招股书时也感受到这一点。本系列文不作财报分析,仅做搬运工,将招股书中阐述的编制蚂蚁集团财报遵循的重要会计政策,列出对应的IFRS准则(非逐句翻译),供有兴趣了解IFRS准则和学习会计英文术语的伙伴以参考。

相关阅读:

1.读蚂蚁IPO招股书, 了解IFRS准则-资产减值

2.读蚂蚁IPO招股书, 了解IFRS准则-外币折算

招股书第338页v.s. IFRS13 Fair Value Measurement

公允价值计量的假设

公允价值,是指市场参与者在计量日发生的有序交易中,出售一项资产所能收到或者转移一项负债所需支付的价格。

Fair value refers to the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

公司以公允价值计量相关资产或负债,假定出售资产或者转移负债的有序交易在相关资产或负债的主要市场进行;不存在主要市场的,公司假定该交易在相关资产或负债的最有利市场进行。主要市场(或最有利市场)是公司在计量日能够进入的交易市场。

公司采用市场参与者在对该资产或负债定价时为实现其经济利益最大化所使用的假设。以公允价值计量非金融资产的,考虑市场参与者将该资产用于最佳用途产生经济利益的能力,或者将该资产出售给能够用于最佳用途的其他市场参与者产生经济利益的能力。

IFRS 13 provides the guidance on the measurement of fair value, including the following:

- Fair value measurement assumes an orderly transaction between market participants at the measurement date under current market conditions [IFRS 13:15]

- Fair value measurement assumes a transaction taking place in the principal market for the asset or liability, or in the absence of a principal market, the most advantageous market for the asset or liability [IFRS 13:24]

- A fair value measurement of a non-financial asset takes into account its highest and best use [IFRS 13:27]

- The fair value of a liability reflects non-performance risk, including an entity s own credit risk and assuming the same non-performance risk before and after the transfer of the liability [IFRS 13:42]

公允价值计量的层次

在财务报表中以公允价值计量或披露的资产和负债,根据对公允价值计量整体而言具有重要意义的最低层次输入值,确定所属的公允价值层次:

If the inputs used to measure fair value are categorised into different levels of the fair value hierarchy, the fair value measurement is categorised in its entirety in the level of the lowest level input that is significant to the entire measurement (based on the application of judgement). [IFRS 13:73]

- 第一层次输入值,在计量日能够取得的相同资产或负债在活跃市场上未经调整的报价;

Level 1 inputs are quoted prices in active markets for identical assets or liabilities that the entity can access at the measurement date. [IFRS 13:76]

A quoted market price in an active market provides the most reliable evidence of fair value and is used without adjustment to measure fair value whenever available, with limited exceptions. [IFRS 13:77]

- 第二层次输入值,除第一层次输入值外相关资产或负债直接或间接可观察的输入值;

Level 2 inputs are inputs other than quoted market prices included within Level 1 that are observable for the asset or liability, either directly or indirectly [IFRS 13:81]. Level 2 inputs include:

o quoted prices for similar assets or liabilities in active markets;

o quoted prices for identical or similar assets or liabilities in markets that are not active;

o inputs other than quoted prices that are observable for the asset or liability;

o inputs that are derived principally from or corroborated by observable market data by correlation or other means ( market-corroborated inputs ).

- 第三层次输入值,相关资产或负债的不可观察输入值。

Level 3 inputs are unobservable inputs for the asset or liability. [IFRS 13:86]

Unobservable inputs are used to measure fair value to the extent that relevant observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity for the asset or liability at the measurement date. [IFRS 13:87-89]

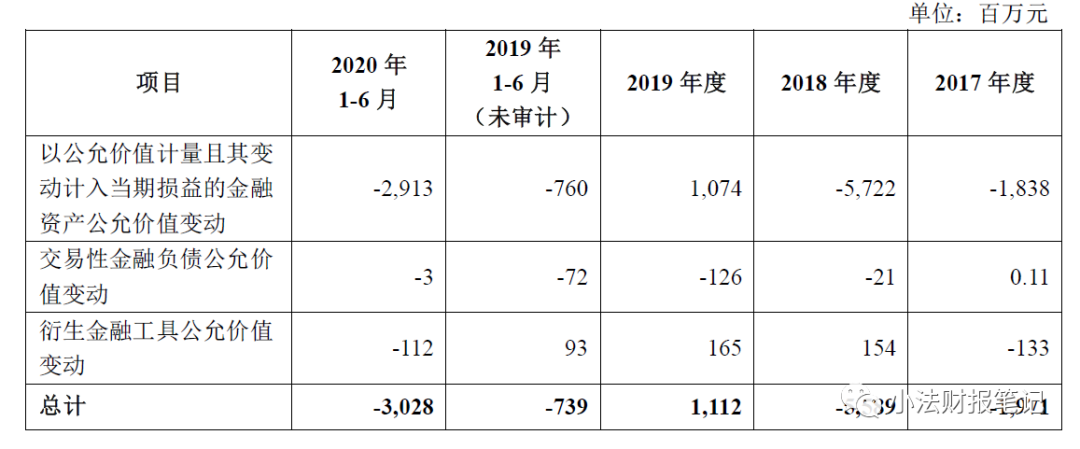

招股书第374页披露的公允价值损益如下:

2017 年度、2018 年度、2019 年度和2020 年1-6 月,公司公允价值损益分别为-19.71 亿元、-55.89 亿元、11.12 亿元和-30.28 亿元,占营业收入的比例分别为-3.01%、-6.52%、0.92%和-4.18%,达到重要性(materiality)水平。

尤其2018年“以公允价值计量且其变动计入当期损益的金融资产公允价值变动”高达57.22亿元。此类金融资产列报为交易性金融资产,再看招股书第303页披露的交易性金融资产,当年金额为113.56亿元,跌去一半价值。具体原因,招股书中未作解释,但倒是与2018年熊市的宏观环境相呼应。

|

|

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱liwei03@51shebao.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱liwei03@51shebao.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱liwei03@51shebao.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱liwei03@51shebao.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

【全网最全】31个省市!残保金政策汇编及申

【全网最全】31个省市!残保金政策汇编及申

全网最全|2022年失业保险稳岗补贴政策汇总

全网最全|2022年失业保险稳岗补贴政策汇总

2021年个税汇算容易出现哪些错误?税务总局

2021年个税汇算容易出现哪些错误?税务总局

【全网最全】历史上最高规模退税减税!2022

【全网最全】历史上最高规模退税减税!2022