|

|

SOCIAL SECURITY ACT,

B.E. 2533 (1990)1

BHUMIBOL ADULYADEJ, REX. Given

on 11th Day of August B.E. 2533; Being the

45th Year of the Present Reign.

His Majesty King Bhumibol Adulyadej is graciously pleased to proclaim that: Whereas it is expedient to revise the law on social security;

Be it, therefore, enacted by the King, by and with the advice and consent of the National Assembly as follows:

Section 1. This Act is called the “Social Security Act, B.E. 2533”

Section 2. This Act shall come into force as from the day following the date of its publication in the Government Gazette except the provisions of chapter 2 of title 2

shall come into force after one hundred and eighty days from the date this Act comes into force and the provisions of section 40 shall come into force within four years from the date this Act comes into force.2

Section 3. The Social Insurance Act, B.E. 2497 shall be repealed.

All the other laws, by-laws and regulations in so far as they have already

provided in this Act or are contrary to or inconsistent with the provisions of this Act shall be replaced by this Act.

1 As last amended by the Social Security Act (No.3), B.E. 2542 (1999) (published in the Government Gazette Vol.116, Part 22 a, dated 31st March B.E. 2542 (1999)

2 Published in the Government Gazette Vol. 107, Part 161, Special Issue, dated 1st September B.E. 2533 (1990)

Section 4. This Act shall not apply to

(1)3 public officials, permanent employees, daily temporary employees and hourly temporary employees of Central Administration, Provincial Administration and Local Administration but excluding monthly temporary employees;

(2) Employees of foreign government or international organizations;

(3) employees of employers who have offices in the country and being stationed abroad;

(4) teachers or headmasters of private schools under the law on private school;

(5) students, nurse students, undergraduates or interning physicians who are

employees of schools, universities or hospitals;

(6) other activities or employees as may be prescribed in the Royal Decree.

Section 5. In this Act:

“employee” means a person agreeing to work for an employer in return for wages irrespective of designation but excluding an employee who is employed for domestic work which does not involve in business;

“employer” means a person agreeing to accept an employee for work by paying him or her wages, and includes a person entrusted by an employer to act on his or her behalf, in the case an employer is a juristic person, it shall include the person authorized to act on behalf of such juristic person and the person entrusted by such authorized person to act thereon;

“wages” means all types of money which are paid by an employer to an employee in return for the work done during normal working hours and days, whether to be calculated by the duration or the result of the work being done, and includes money which an employer pays to an employee for holidays and leaves on which the employee does not work, regardless of the way it is specified, calculated or paid, in any nature or method, and the name used;

“working day” means a day scheduled for an employee to work normally;

3 As amended by section 3 of the Social Security Act (No.2), B.E. 2537 (1994)

“insured person” means a person who pays contributions which provides entitlement to benefits under this Act;

“confinement” means the delivery of an infant from mother’s womb in which a period of pregnancy is not less than twenty-eight weeks, irrespective of whether the infant is alive or not;

“invalidity” means loss of physical organ or loss of physical or mental capacity to the extent that such employee is unable to work according to the criteria as may be determined by the Medical Committee;

“unemployment” means an insured person ceases to work resulting from cessation of legal relations between an employer and an employee under hire of services contract;

“Fund” means the Social Security Fund; “Office” means the Social Security Office ;

“Committee”means the Social Security Committee;

“member” means a member of the Social Security Committee;

“competent official” means a person appointed by the Minister for the execution of this Act;

“Secretary – General” means the Secretary- General of the Social Security Office;

“Minister” means the Minister having charge and control of the execution of this Act.

Section 6.4 The calculation of wages for payment of contribution shall be based on the monthly basis.

In the case an employee does not receive a monthly wages, the calculation

shall be based on monthly basis, and it shall be considered that actual wages received by the employee is monthly wages.

4 As amended by section 4 of the Social Security Act (No.2), B.E. 2537 (1994)

For the purpose of counting time for paying contribution of insured person, it shall be deemed that contribution being deducted from wages paid to the employee in any month, shall be payment of such specified month and, no matter such contribution is computed or is monthly paid, it shall be deemed that the contribution equals to one month.

Section 7. The Minister of Labour and Social Welfare5 shall have charge and control of the execution of this Act and shall have the power to appoint competent officials, issue Ministerial Regulations prescribing fees not exceeding the rates provided in the schedules hereto attached, granting exemption from fees, and prescribing other activities for the execution of this Act.

Such Ministerial Regulation shall come into force upon their publication in the Government Gazette.

5 By virtue of the Act on the Organization of Ministries, Sub-Ministries and Departments (No.8), B.E. 2536 (1993), the Ministry of Labour and Social Welfare is established, and under the Act Transferring Some Parts of the Powers, Duties and Administration of the Ministry of Interior to the Ministry of Labour and Social Welfare, B.E. 2536 (1993), the power and duties of the Minister of Interior, in respect of the execution of the law

which is under the powers and duties of the Social Security Office, Ministry of Interior, shall be transferred to the Minister of Labour and Social Welfare.

TITLE 1

General Provisions

Chapter 1

Social Security Committee

Section 8. There shall be a Committee called the “Social Security Committee” consisting of the Permanent Secretary for Labour and Social Welfare as Chairman, a representative of the Ministry of Finance, a representative of the Ministry of Public Health, and a representative of the Bureau of the Budget, and five representatives of employers and five representatives of employees appointed by the Minister, as members and the Secretary - General shall be a member and secretary6.

The Committee may appoint any person to be assistant secretaries.

The Minister may appoint not more than five qualified persons as advisers of the Committee, of whom shall at least, be qualified persons in social security system, labour affairs, medical affairs, legal affairs and others.

Section 9. The Committee shall have the following powers and duties;

(1) to submit opinions to the Minister in regard to policy and implementation of social security under this Act;

(2) to consider and give opinions to the Minister in respect of the issuance of Royal Decrees, Ministerial Regulations and other regulations for the execution of this Act;

(3) to issue regulations, with the approval of the Ministry of Finance, in regard to receipts, payment and safe-keeping of the Fund;

(5) to issue regulations, with the approval of the Ministry of Finance, in regard to the productive investment of the Fund;

6 As amended by section 5 of the Social Security Act (No.2), B.E.2537 (1994)

(5) to review balance sheet and statement of the receipts andexpenditures of the Fund and annual report on the performance of the Office in regard to social security under this Act;

(6) to provide consultations and advices to other Committee or the Office;

(7) to perform other functions as prescribed in this Act or any other laws to be those of the Committee or as entrusted by the Minister.

In the performance of the duties under paragraph one, the Committee may assign the Office to perform and report to the Committee for future proceedings.

Section 10. A member or an adviser appointed by the Minister shall hold office for a term of two years.

The member or adviser who vacate office may be reappointed, but not more than two consecutive terms.

Section 11. In addition to vacating office at the end of term under section 10, a member or an adviser appointed by the Minister shall vacate office upon:

(1) death;

(2) resignation;

(3) being removed by the Minister;

(4) being a bankrupt;

(5) being insane or mental infirmity;

(6) being imprisoned by a final judgement to a term of imprisonment,except for an offence committed through negligence or petty offence.

In the case where a member appointed by the Minister vacates his or her office before the expiration of his or her term, the Minister may appoint another person of the same description of qualification according to section 8 to replace him or her and the appointee shall hold office for the remaining term of the member so replaced.

In the case where an additional adviser is appointed by the Minister during the term of advisers already appointed, the appointee shall hold office for the remaining term of the advisers already appointed.

Section 12. In the case where members appointed by the Minister have completed the term of office but new Committee has not yet been appointed, the members who vacate office upon the expiration of the term of office shall remain in office for carrying out duties until the newly appointed members assume their duties.

Section 13. At a meeting of the Committee, the presence of not less than one-half of the total number of members is required to constitute a quorum.

If the Chairman does not attend the meeting or is unable to perform his or her duties, the members present shall elect one among themselves to preside over the meeting.

The decision of the meeting shall be made by a majority of votes. Each

member shall have one vote. In case of an equality of votes, the person presiding over the meeting shall have an additional vote as the casting vote.

Section 14.7 There shall be a Medical Committee consisting of a Chairman and other members, totally not more than sixteen persons, appointed by the Minister, and representative of the Office shall be member and secretary.

Chairman and other members under paragraph one shall be appointed from qualified persons in the fields of medical science and shall hold office for a term of two years.

Section 10 paragraph two, section 11, section 12 and section 13 shall apply mutatis mutandis.

Section 15. The Medical Committee shall have the following powers and duties:

(1) to submit opinions to the Committee in regard to the performance in rendering medical services;

7 As amended by section 6 of the Social Security Act (No.2), B.E.2537 (1994)

(2) to determine rules and rates of benefit in respect of medical services provided to insured persons under section 59, section 63, section 66, section 68, section 70 and section 72;

(3) to submit opinions to the Committee in respect of the issuance of Ministerial Regulations under section 64;

(4) to give advices and recommendations on medical matters to the Committee, the Appeal Committee and the Office;

(5) to perform other functions as prescribed in this Act to be those of the Medical Committee or as entrusted by the Minister or by the Committee.

Section 16. The Committee or the Medical Committee may appoint a sub- committee to consider or carry out any matter as entrusted by the Committee or the Medical Committee.

Section 13 shall apply mutatis mutandis to the meeting of the sub-committee.

Section 17. The Committee, the Medical Committee and the sub - committee shall have power to summon any person to submit documents or data which are necessary for consideration. In this respect, they may order the persons concerned to give statement.

Section 18. The members, the advisers, the Medical Committee, the Appeal Committee and the sub-committee may receive meeting allowance, transport expenses, allowance, lodging expenses and other expenses in performing their duties under this Act in accordance with the regulation prescribed by the Minister, with the approval of the Ministry of Finance.

Chapter 2

Social Security Office

Section 19. There shall be established the Social Security Office under the Ministry of Interior8 having the following powers and duties:

(1) to perform the administrative works of the Committee, other Committee and sub-committee under this Act;

(2) to collect, compile and analyse data in regard to social security;

(3) to organize the registration of employers and insured persons who are required to pay contributions;

(4) to perform other functions as prescribed in this Act or any other laws to be powers and duties of the Office;

(5) to carry out other activities as entrusted by the Minister, the Committee, other Committee or the sub-committee.

Section 20. There shall be Secretary - General with the duties to generally supervise the performance of official affairs of the Office and command officials in the Office. In this respect, there shall be one or more Deputy Secretary - General to assist in the performance of official duties.

The Secretary - General and Deputy Secretary - General shall be ordinary government officials.

8 By virtue of the Act on the Organization of Ministries, Sub-Ministries and

Departments (No.8) B.E. 2536 (1993), the Ministry of Labour and Social Walfare is established and in this regard the Social Security Office is now under the Ministry of

Labour and Social Welfare.

Chapter 3

Social Security Fund

Section 21. There shall be a Fund in the Social Security Office called the “Social Security Fund” to be utilized for providing benefits under the provision of title 3 to insured persons and to be used as expenses under section 24 paragraph two.

Section 22.9 The Fund shall consist of :

(1) contributions from the government, employers and insured person under section 40 and section 46;

(2) additional payment under section 39, section 49, and section 53,

(3) interest of the fund under section 26;

(4) fee under section 45;

(5) donation or subsidy;

(6) money becoming property of the Fund under section 47, section 47 bis, section 50, section 53 and section 56;

(7) subsidy or advanced money which the Government has paid under section 24 paragraph three;

(8) fine collect through settlement under section 102;

(9) other incomes.

Section 23. The Fund under section 22 shall belong to the Office and is not required to be remitted to the Ministry of Finance as State revenue.

Section 24. The Fund shall be utilized for benefits under this Act.

The Committee may allot the Fund not exceeding ten per cent of annual contributions for expenses under section 18 and for administrative expenses of the Office.

9 As amended by section 7 of the Social Security Act (No.2), B.E. 2537 (1994)

In the case where the fund is not sufficient to cover expenses under paragraph one or two, the Government shall subsidize or provide advanced money as it deems necessary.

Section 25. The receipts, payments and safe-keeping of the Fund shall be in accordance with the regulations prescribed by the Committee, with the approval of the Ministry of Finance.

Section 26. The productive investment of the Fund shall be in accordance with the regulations prescribed by the Committee, with the approval of the Ministry of Finance.

Section 27.10 The Committee shall, within six months from the last day of the calendar year, submit the balance-sheet and statement of incomes and expenditures of the Fund in the foregoing year to the Office of the Auditor - General of Thailand to be audited and certified before submitting to the Minister.

The Minister shall submit the said balance-sheet and statement of incomes and expenditures to the Prime Minister to further submit to the Parliament for information and such balance-sheet and statement shall be published in the Government Gazette.

Chapter 4

Survey of Social Security

Section 28. For the purpose of social security under this Act, the Royal Decree may be issued to make survey on problems and data concerning labour matters.

10 As amended by section 8 of the Social Security Act (No.2), B.E. 2537 (1994)

The Royal Decree under paragraph one shall specify at least the following particulars:

(1) the purpose of the survey;

(2) the officer or competent official who shall carry out the survey;

(3) the period of enforcement which shall not exceed two years.

Section 29. When the Royal Decree under section 28 has been issued, the Secretary - General shall notify the followings:

(1) form of survey;

(2) the period of time in which the officer or competent official will submit the form of survey to employer;

(3) a period of not less than thirty days within which the employer is required to return the duly filled form of survey to the officer or competent official, the details of which shall be mentioned in the form of survey.

The Notification under paragraph one shall be published in the Government Gazette.

Section 30. The form of survey under section 29 (1) shall be sent to the employer by registered post with returned receipt or by hand delivery of the officer or competent official at domicile or resident or office of the employer during sunrise to sunset or during working hours of the employer. In the case where the employer is not present at his or her domicile or resident or office, the form may be delivered to a sui juris person who lives or works in the home or office apparently belongs to the employer.

In the case where the delivery as specified under paragraph one can not be made, the form of survey shall be posted in a conspicuous place at the office of the employer. After having completed such delivery and a period of fifteen days has elapsed, the employer is deemed to have received such form of survey.

Section 31. After receiving the form of survey, the employer shall truthfully complete every item in the form of survey and return the filled form of survey to the officer or competent official within a period of time specified under section 29(3)

Section 32. All information or figures filled out in the form of survey shall be confidential. It shall be forbidden for the officer who performs the duties under this Act to disclose such information or figures to any person who has no duties under this Act except in the case where it is necessary for the benefits of social security or labour protection or for the benefits of investigation or trial.

TITLE 2

Social Security

Chapter 1

Insured Person

Section 33.11 The employee who has been over fifteen years of age and not more than sixty years of age, shall be insured person.

The insured person under paragraph one who has become sixty years of age and has continually been an employee of the employer under this Act, shall be deemed to be an employee who is an insured person.

Section 34. An employer who employs employees being insured persons under section 33 shall submit the statement specifying names of insured person, rate of

wages and other information, in accordance with the form prescribed by the Secretary - General, to the Office within thirty days as from the date on which the employees become insured persons.

11 As amended by section 9 of the Social Security Act (No.2), B.E. 2537 (1994)

Section 35. In the case where the principal who employs employees by the wholesale wages method has sub-contracted the execution of work and the responsibility for paying employees wages to other person, or has sub-contracted any person for the supply of labour which is not employment service business and the sub-contracted work is a part in the process of production or of business which is undertaken in the establishment or working place of the principal and the essential equipment for such work is provided by the principal, the principal shall be an employer who is required to perform duties under this Act.

In the case where the entrepreneur who has been sub-contracted by the wholesale wages method under paragraph one is acting as an employer by submitting the statement to the office under section 34, such entrepreneur shall have responsibility to comply with this Act in the same manner as the employer. In this case, the principal shall discharge from the responsibility for payment of contribution and additional money, for the amount of which the entrepreneur who has been sub-contracted by the wholesale wages method, has paid to the office.12

Section 36. When an employer has submitted the form under section 34, the Office shall issue to the employer a social security certificate of registration and to the employee a social security card in accordance with the form, rules and procedures prescribed in the Ministerial Regulations.

Section 37. In the case where it is appeared to the Office or an employee complains that the employer fails to submit a form under section 34 or having submitted such form but the name of some employees who are insured persons under section 33 are omitted, the Office, upon the determination of relevant evidence, shall have power to record details in the form under section 34, and shall issue the social security certificate of registration to the employer and/or a social security card to an employee under section 36, as the case may be.

12 As added by section 10 of the Social Security Act (No.2), B.E. 2537 (1994)

In exercising the power under paragraph one, the Secretary- General or the person authorized by the Secretary - General may investigate the matter before proceed to any procedure.

Section 38. An insured person under section 33 shall cease to be insured

person upon:

(1) death;

(2) cessation of being an employee.

In the case where the insured person who ceases to be an employee under (2) has paid full amount of contribution, according to the condition of time which shall entitle him or her to receive benefits under title 3. The said insured person shall be entitled under chapter 2, chapter 3, chapter 4 and chapter 5 for a further period of six months from the date his or her employment is terminated or for a period of time prescribed in the Royal Decree which shall not be longer than twelve months from the date his or her employment is terminated13.

Section 39.14 Any person who is an insured person under section 33, has paid contribution for a period of not less than twelve months and, subsequently ceases to be insured person in pursuance of section 38(2), if such person wishes to continually be insured person, he or she shall, within six months from the date of his or her termination to be insured person, notify his or her statement to the Office according to the regulations prescribed by the Secretary - General.

13As amended by section 3 of the Social Security Act (No.3), B.E. 2542 (1999) 14 As amended by section 12 of the Social Security Act (No.2), B.E. 2537 (1994)

The amount of money using as basis for calculating contribution which the insured person under paragraph one has to pay to the Fund under section 46 paragraph two, shall be in accordance with the rate prescribed in the Ministerial Regulations and with due consideration of suitability of economic situation.

The insured person under paragraph one, shall pay monthly contribution to the Fund within the fifteenth day of the following month.

The insured person under paragraph one, who does not pay contribution or cannot pay full amount of contribution within the prescribed time under paragraph three, shall pay an additional amount at the rate of two per cent per month of the unpaid contribution or of the late payment contribution starting from the day following the due date. For any fraction of the month, if it is fifteen days or more, it shall be counted as a month, if less, it shall be disregarded.

Section 40. Any other person who is not an employee under section 33 may apply to be an insured person under this Act by notifying his or her intention to the Office.

Rules and rate of contributions, type of benefits to be received under section 54 including rules and conditions of entitlement shall be prescribed in the Royal Decree. Section 41.15 An insured person under section 39 shall cease to be insured

upon:

(1) death;

(2) having subsequently become an insured person under section 33;

(3) resigning from being insured by notifying his or her intention to the

Office;

(4) paying none contributions for an uninterrupted period of three months;

(5) paying contributions on his part within the period of twelve months, less than contribution specified for the period of nine months.

15As amended by section 13, ibid.

The termination of being insured person under (4) shall be from the first month where none contribution is paid and the termination of being insured person under (5) shall be from the month where the payment of contribution is less than contributions specified for the period of nine months.

In the case an insured person whose insurance being terminated under (3),(4) and (5) has paid full amount of contribution according to the conditions of time which shall entitle him or her to receive benefits under title 3, the said insured person shall be entitled under chapter 2, chapter 3, chapter 4 and chapter 5 for a further period of six months from the date his or her insurance is terminated.16

Section 42. For the purpose of creating entitlement for an insured person to receive benefits under the provisions of title 3, each period of being insured under section 33 and/or section 39 shall be computed together.

Section 43. Any undertaking which is subjected to this Act shall continue to be so subjected until it ceases to operate, even it subsequently has less employees than the prescribed number and the remaining shall stay so insured. In the case where such undertaking has employed a new employee, the said employee shall be an insured person under this Act, even the total number of employees are less than the prescribed number.

Section 44.17 In the case where the fact relating to the content in the particulars submitted to the Office, has changed, the employer shall apply in writing to change or amend such particulars within the fifteenth day of the month following the month of which the changing has occurred.

The provisions of section 37 shall apply to the case where the employer does not comply with this section, mutatis mutandis.

16 As amended by section 4 of the Social Security Act (No.3), B.E. 2542 (1999) 17As amended by section 14 of the Social Security Act (No.2), B.E. 2537 (1994)

Section 45. In the case where the social security certificate of registration or social security card is lost, destroyed or materially defaced, the employer or the insured person shall, within fifteen days from the date he or she is aware of the loss, destruction or defacement, file an application to the Office for a substitute of the social security certificate of registration or social security card, as the case may be. The filing of application thereof shall be in accordance with the regulations prescribed by the Secretary - General.

Chapter 2

Contributions

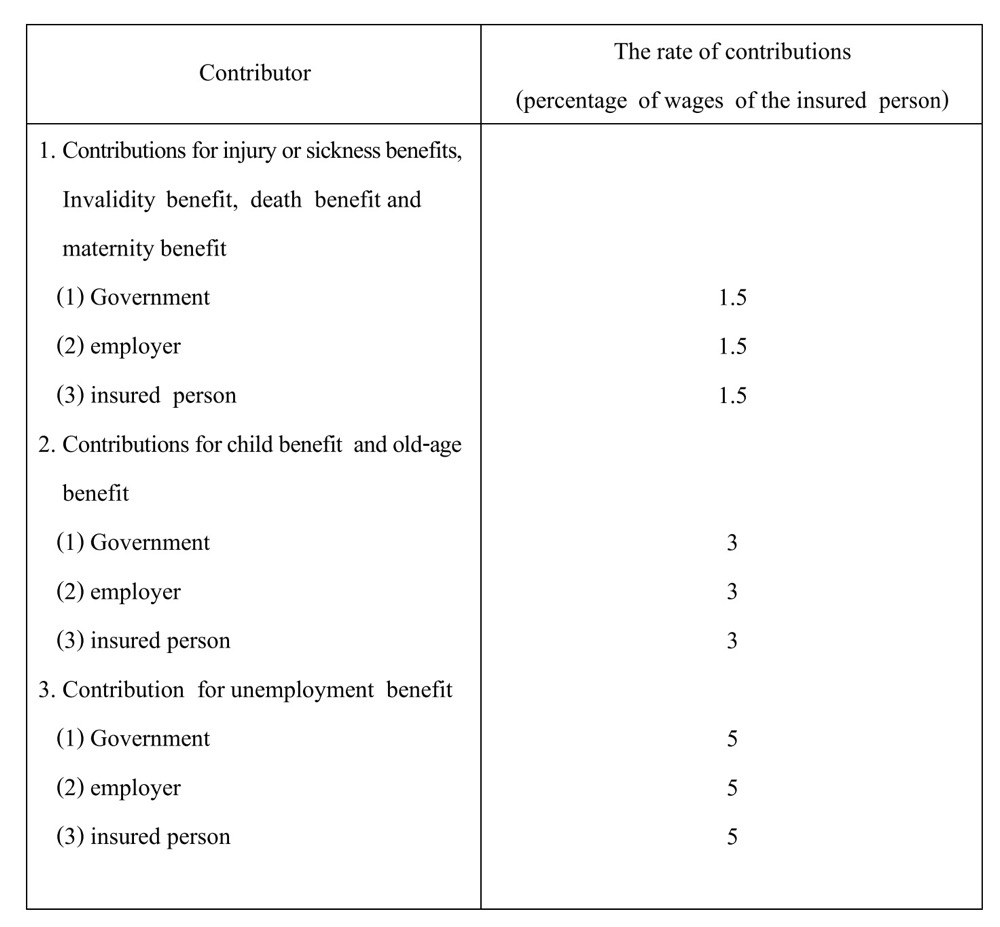

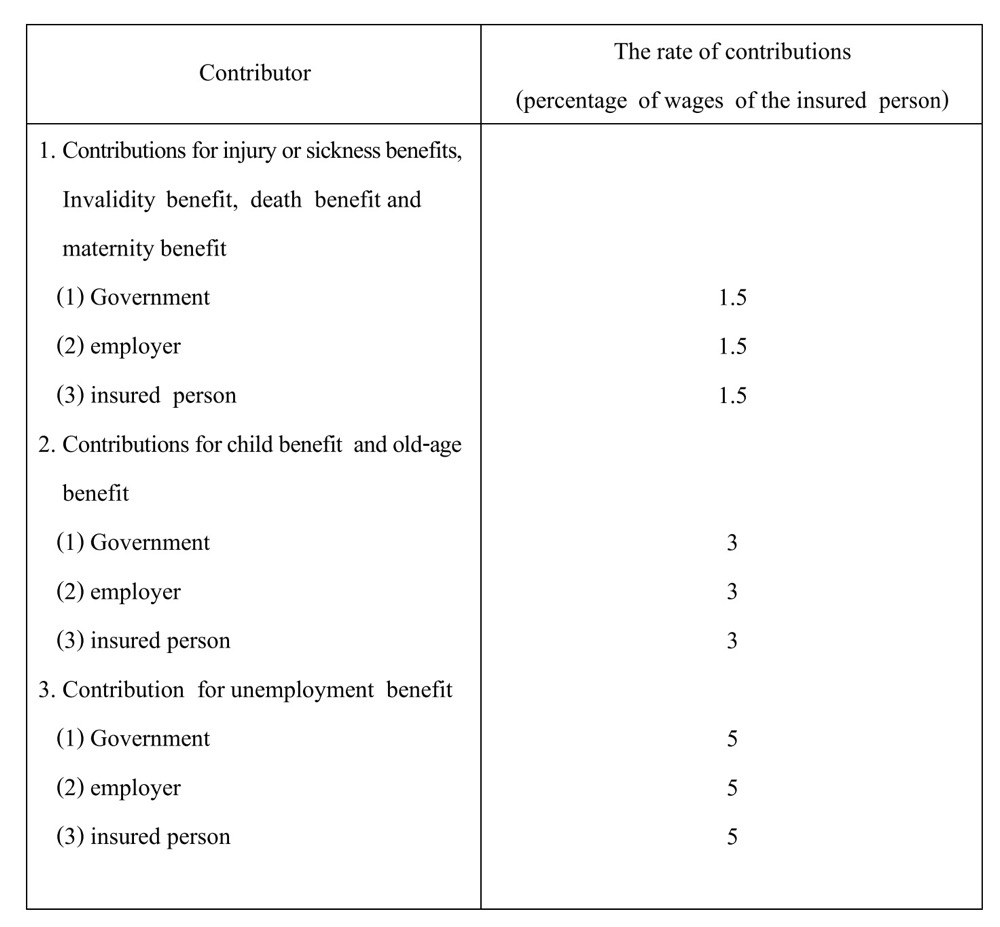

Section 46.18 The Government, an employer and an insured person under section 33 each shall pay contributions equally to the Fund at the rate prescribed in the Ministerial Regulations for payment of benefits relating to injury, sickness, invalidity, death and maternity, but the contributions thereof shall not exceed the rate of contributions appended to this Act.

The Government, an employer and an insured person under section 33, shall pay contributions to the Fund at the rate prescribed in the Ministerial Regulations for payment of benefits relating to child benefit, old-age benefit, and unemployment benefit, but the contributions thereof shall not exceed the rate of contributions appended to this Act.

For the insurance under section 39, the Government and an insured person shall pay contributions to the Fund in the proportion that the Government paying one time and an insured person paying double of the rate of contributions at which each party is required to pay as prescribed in paragraph one.

18 As amended by section 5 of the Social Security Act (No.3), B.E.2542(1999)

In determining the rate of contributions under paragraph one and two, it shall be taking into account the benefits payment and administrative expenses of the Office under section 24.

Minimum and Maximum wages which are used as basis of calculating contribution of each insured person under section 33 shall be in accordance with the Ministerial Regulations. In calculating contribution of each insured person, the fraction of contribution as from the amount of fifty stangs shall be counted as one bath, if less,it shall be disregarded. In the case where the insured person works for several employers, contributions shall be calculated from wages which such insured person received from each employer.

Section 47.19 For every payment of wages, the employer shall deduct wages of an insured person at the amount to be paid for contributions on the part of the insured person under section 46. After the deduction thereof, it is deemed that the insured person has paid his or her contribution from the date of deduction.

The employer shall pay contributions on the part of an insured person which is deducted under paragraph one and on the part of the employer, to the Office within the fifteenth day of the month following the month of deduction and shall submit statement showing payment of contributions according to the form as prescribed by the Secretary - General.

If an employer fails to pay wages in due time, the employer shall have duty to pay contributions under paragraph two and it is deemed that there has been a payment of wages.

19 As amended by section 16 of the Social Security Act (No.2), B.E. 2537 (1994)

insured person, or on the part of the employer to the Office in excess of the amount need to be paid, the employer or the insured person shall apply for reimbursement according to the regulations prescribed by the Secretary - General. If the employer or the insured

person does not apply for reimbursement within one year as from the date of receiving the notice to reimburse the money, such money shall belong to the Fund.

Section 47 bis.20 In the case where an employer does not pay the contribution or cannot pay full amount of contribution within the prescribed time under section 47 paragraph two, the competent official shall send the notice in writing ordering the employer to pay contribution due with additional payment within the prescribed time which must not less than thirty days as from the date of receiving the said notice. If the employer, upon receiving such notice, does not pay contributions due and additional payment within the prescribed time, the competent official has powers to assess the contribution and notify in writing ordering the employer to pay, as follow:

(1) If the employer had paid any contribution before, it shall be deemed that

the amount of contribution to be paid by the employer within each following month equals to the amount of contribution of the month where the employer paid for the whole last month.

(2) If the employer who has duties to comply with this Act, does not

submit particulars under section 34 or submit particulars under section 34 but has never paid any contribution of submit particulars under section 34, by indicating the number and the list of the employees’ name less than the actual number of the employees, it shall be calculated from the particulars submitted by the employer or from the number of employees whom the competent office has examined, as the case may be, and it shall be deemed that each employee received the monthly wages at the rate specified in the particulars so submitted.

20 As added by section 17, ibid.

particulars, it shall be deemed that each employee receives the monthly wages, not less than the minimum daily wage, according to the law on labour protection being enforced within that locality, multiplying by thirty.

In the case where there is the investigation within two years as from the date of notice of contribution assessment under paragraph one, that the actual amount of notice of contribution to be paid by the employer is more or less than the amount assessed by the competent official under (1) or (2), the Office shall send the notice to the employer notifying such investigation within thirty days as from the date of knowing the result of investigation in order that the employer shall pay the additional contribution within thirty days as from the date of receiving the notice or filing an application for reimbursement. If the employer does not receive reimbursement within one year as from the date of knowing the result of investigation, the said money shall belong to the Fund.

For serving notice, notification of the amount of contribution assessment, and notification of the result of investigation, the provisions of section 30 shall apply mutatis mutandis.

Section 48. In the case where an insured person works for more than one employer, all of the employers shall have duties to comply with the provisions of section 46 and section 47.

Section 49. An employer who does not pay contributions on his or her part or on the part of insured person of fails to pay full amount of contributions within the prescribed time under section 47, shall have to pay an additional payment at the rate of two per cent per month of the outstanding contributions which has not yet been paid or of the missing amount as from the day following the due date. For any fraction of a month, if it is fifteen days or more, it shall be counted as a month, if less, it shall be disregarded.

contribution or has deducted but not in full amount of contributions according to section 47 paragraph one, the employer shall be liable for the full or unpaid amount of contributions of such insured person and shall pay an additional payment of this undeducted or unpaid amount under paragraph one as from the day following the due date. In such case, the right of the insured person shall be treated as if he had paid full

amount of contribution.

Section 50. The Secretary - General has the power to issue written order to seize, attach and sell by auction the properties of the employer who fails to pay contributions and/or an additional payment or fails to pay full amount of contributions under section 49 to the extent as necessary to cover the outstanding contributions.

The order to seize, attach or sell by auction the properties under paragraph one may be issued after having dispatched a written notice ordering the employer to pay the outstanding contributions and/or additional payment within a fixed period of not less than thirty days as from the date the employer, upon receiving the said notice, fails to pay within the prescribed time.

Rules and procedures of seizure, attachment and sale by auction of properties under paragraph one shall be in accordance with the regulations prescribed by the Minister, in this respect the rules and procedures under the Civil Procedure Code shall apply mutatis mutandis.

The proceeds obtained from such sale by auction shall be deducted for expenses in the seizure, attachment and sale by auction and for payment of outstanding contributions and additional payment.Any remainder shall be immediately returned to the employer. If the employer does not claim for this remainder within five years, it shall become the property of the Fund.

Section 51. In the event of debt to non-payment of contributions and /or additional payment, the Office shall have preferential right on all properties of the employer who is debtor and shall be same rank with the preferential right on account of taxes and rates according to the Civil and Commercial Code.

Section 52. In the case where an employer is a sub-contractor, the preceding sub-contractors, if any, including the first sub-contractor shall all be jointly liable with the sub-contractor who is obliged as an employer for payment of contributions on the part of employer under this Act.

Section 53.21 The provisions of section 49, section 50 and section 51 shall apply to the sub-contractor under section 52, who does not pay contribution or cannot pay full amount of contributions within the prescribed time, mutatis mutandis.

TITLE 3 Benefits

Chapter 1 General

Section 54. An insured person or a person under section 73 shall be entitled to receive the following benefits from the Fund:

(1) injury or sickness benefits;

(2) maternity benefits;

(3) invalidity benefits;

(4) death benefits;

(5) child benefits;

(6) old-age benefits;

(7) unemployment benefits except for an insured person under section 39.

21 As amended by section 18 of the Social Security Act (No.2), B.E. 2537 (1994)

Section 55. In the case where an employer has, before the date of enforcement of this Act, provided welfare in respect of non-occupational injury or

sickness or invalidity or death, or maternity or child allowance or old - age, or unemployment to an employee who is an insured person under section 33 and has been employed before the date of enforcement of this Act, if such welfare has provided benefits in any case higher than any benefits under this Act, the employer shall present work regulation, hire of services contract or conditions of employment, which specifies such welfare to the Committee to apply for a discount of the rate of contributions in respect of the type of benefits from the rate at which the employer has provided to the rate at which an insured person and an employer are required to pay to the Fund under section 46, and the employer shall use the rate of contributions after discount to compute the amount of contributions on the part of an insured person and of the employer to be paid to the Fund for other benefits.

The application for a discount of the rate of contributions and the determination of a discount of the rate of contributions under paragraph one shall be in accordance with rule, procedure and conditions prescribed by the Committee.

Section 56.22 An insured person or any person who thinks that he or she is entitled to any benefit as prescribed under section 54 and wishes to receive said benefit, shall file an application according to the form prescribed by the Secretary - General, to the Office within one year from the date of such entitlement and the Secretary - General or the person entrusted by the Secretary - General shall consider such application promptly.

In the case the benefit under paragraph one is a sum of money, if the insured person or the entitled person does not receive such money within two years from the date of receiving the notice from the Office, the said money shall belong to the Fund.

22 As amended by section 19 of the Social Security Act (No.2), B.E. 2537 (1994)

Section 57.23 In the calculation of daily wages for payment of income

replacement to an insured person under section 33, it shall be computed from the first three month of wages employed which the employer uses as a basis in calculating contributions to be paid to the Office within the retroactive nine months and divided by ninety. If the insured person has an evidence proving that wages employed of

another three month during the period of such retroactive nine moths shall produce the better output than the first one, it should be calculated by using wages employed of such another three months and divided by ninety. In the case where an insured person paid contributions less than nine months, it shall be computed by using the last three month of wages employed which the employer used as a basis in calculating contributions to be paid to the Office and divided by ninety.

For the calculation of daily wages for payment of income replacement to an insured person under section 39, it shall be computed from the average wages used as basis for calculation of contribution under section 39 paragraph two.

Section 58. In case the benefits under this Act are medical services, an insured person or his or her spouse shall receive such services from the hospitals or other places rendering medical services as prescribed under section 59.

Details and conditions of medical services to an insured person or his or her spouse shall be in accordance with the regulation prescribed by the Secretary - General, with the approval of the Committee.

Section 59. The Secretary - General shall publish in the Government Gazette

the area of coverage and the names of hospitals or other places rendering medical services at which an insured person or his or her spouse shall be entitled to receive medical services.

23 As amended by section 20 of the Social Security Act (No.2), B.E. 2537 (1994)

An insured person or his or her spouse, who is entitled to receive medical services and is employed or has domicile in a locality, shall receive medical services at the hospital or places prescribed under paragraph one in such locality, except no hospital or other places under paragraph one thereof are existed in such locality or if the insured person or his or her spouse has justifiable reason that he or she is unable to receive medical services at the hospital or places prescribed thereof. Upon such reason, the medical services may be rendered at the hospital or places as prescribed under paragraph one in another locality.

In the case where an insured person or his or her spouse receives medical services at hospital or places other than those prescribed under paragraph two, the insured person shall be entitled to reimburse for the cost of medical services being paid at the amount fixed by the Office, taking into account the conditions of injury or sickness, maternity, economic situation in each locality and nature of medical services

having received . In this respect, it shall not exceed the rate prescribed by the Medical Committee, with the approval of the Committee.

Section 60. In the case where an insured person or his or her spouse who has received medical services at the prescribed hospital or place ignores or does not comply with the recommendations or instructions of the doctor without justifiable reason, the Secretary - General or a person entrusted by the Secretary - General, with the approval of the Medical Committee, may determine to reduce benefits which such insured person or his or her spouse is entitled.

Section 61.24 An insured person or a person under section 38 paragraph two, section 73 or section 73 bis shall not be entitled to benefits when there is any cause showing that the above mentioned person intentionally causes the injury or sickness or invalidity or death to be happened or permits other person in doing such

incidents thereof.

24 As amended by section 21 of the Social Security Act (No.2), B.E. 2537 (1994)

Section 61 bis.25 In the case where an insured person is entitled to income replacement under section 64 and section 71 and, simultanously, entitled to allowance for work - leave as a result of child delivery under section 67, the said person shall be entitled to receive only one category of benefit, either income replacement or allowance for work-leave as a result of child delivery, by stating his or her intention according to the form prescribed by the Secretary - General.

Chapter 2

Injury or Sickness Benefits

Section 62.26 An insured person shall be entitled to non - occupational injury or sickness benefits when he or she has paid contribution for a period of not less than three months during period of fifteen months before the date of receiving medical services.

Section 63. Benefits for non-occupational injury or sickness shall consist of:

(1) medical examination expense;

(2) medical treatment expense;

(3) lodging, meals and treatment expenses in hospital;

(4) medicine and medical supplied expenses;

(5) cost of ambulance or transportation for patient;

(6) other necessary expenses

The above mentioned expenses shall be in accordance with the rules and rates prescribed by the Medical Committee, with the approval of the Committee.

25 As added by section 22, ibid.

26 As amended by section 23 of the Social Security Act (No.2), B.E. 2537 (1994)

The insured person who is taking work-leave to receive medical treatment under the instruction of doctor, shall, also, be entitled to income replacement according to the prescribed criteria under section 64.

Section 64. In the case where an insured person suffers from non- occupational injury or sickness, the insured person shall be entitled to income replacement at the rate of fifty per cent of wages employed under section 57 for a period the insured person has take work-leave to receive medical treatment under the instruction of doctor which shall not exceed ninety days on each occasion and not more than one hundred and eighty days in a calendar year. Except for sickness from chronic disease as prescribed in the Ministerial Regulations, the said insured person shall be entitled to income replacement for more than one hundred and eighty days but not exceeding three hundred and sixty - five days.

The calculation period for receiving income replacement shall be computed from the first day of work - leave under the instruction of doctor until the last day specified by the doctor or until the last day of work - leave in case insured person has returned to work before the fixed date under the instruction of doctor but not exceeding the periods of time under paragraph one.

If an insured person is entitled to receive wages from the employer during sick leave for medical treatment according to the law on labour protection or entitled according to work regulation, hire of services contract or conditions of employment, as the case may be, the insured person shall not be entitled to receive benefits under paragraph one until the entitlement to receive wages is subsequently exhausted, and shall only be entitled to receive the said income for the remaining period. However, if the wages received from employer in any case is less than the income replacement payable by the Fund, the insured person shall be entitled from the Fund, the income replacement for the difference.

Chapter 3

Maternity Benefits

Section 65.27 The insured person shall be entitled to maternity benefits for herself or for the spouse or for the women who cohabits publicly as husband and wife with the insured person according to the regulations prescribed by the Secretary - General, in case the insured person has no wife. In this regard the insured person must have paid contribution for not less than seven months, during the period of fifteen months before the date of receiving medical services.

The insured person shall be entitled to receive maternity benefits for not more than two time of child delivery.

Section 66. Maternity benefits shall consist of:

(1) medical examination and child bearing expenses;

(2) medical treatment expense;

(3) medicine and medical supplies expenses;

(4) confinement expense;

(5) lodging, meals and treatment expenses in hospital;

(6) new - born baby nursing and treatment expenses;

(7) cost of ambulance or transportation for patient;

(8) other necessary expenses

The above mentioned expenses shall be in accordance with the rules and rates prescribed by the Medical Committee, with the approval of the Committee.

The insured person who has to take work-leave for child delivery, shall be entitled to receive work-leave allowance for child delivery according to the prescribed criteria under section 67.28

27 As amended by section 24 of the Social Security Act (No.2), B.E. 2537 (1994) 28 As amended by section 25 of the Social Security Act (No.2), B.E. 2537 (1994)

Section 67.29 In the case where the insured person has taken work-leave for child delivery, such insured person shall be entitled to receive work-leave allowance for child delivery not more than two time by lump sum payment at the rate of fifty per cent of the wages under section 57, within ninety days.

Section 68. If the insured person or his or her spouse is unable to receive the benefits under section 66, by reason that the child delivery is taken in the hospital other than those prescribed under section 59, such insured person shall be entitled to maternity benefits according to the rules and rates prescribed by the Medical Committee, with the approval of the Committee.

Chapter 4

Invalidity Benefits

Section 69.30 The insured person shall be entitled to invalidity benefits

according to the cause unrelated to work when he or she has paid contribution for a period of not less than three months during the period of fifteen months before being invalid.

Section 70. Invalidity benefits shall consist of:

(1) medical examination expense;

(2) medical treatment expense;

(3) medicine and medical supplied expenses;

(4) in-patient, meals and treatment expenses in hospital;

(5) cost of ambulance or transportation for invalid person;

(6) physical, mental and occupational rehabilitated expenses;

(7) other necessary expenses

29 As amended by section 26,ibid.

30 As amended by section 27 of the Social Security Act (No.2), B.E. 2537 (1994)

The above mentioned expenses shall be in accordance with the rules and rates prescribed by the Medical Committee, with the approval of the Committee.

Section 71.31 In the case where the insured person has become invalidity by the cause unrelated to work, such insured person shall be entitled to receive income replacement at the rate of fifty per cent of the wages under section 57 through his or her life.

Section 72. In the case where the Medical Committee has determined that the

invalidity of an insured person being rehabilitated under section 70 (6) has been developed to be in better condition, the Secretary - General or the person entrusted by the Secretary -General may decide to reduce income replacement in accordance with the rules and procedures prescribed by the Medical Committee, with the approval of the Committee.

In the case where there is a reduction of income replacement under paragraph one, and the invalidity has subsequently become worse, the Secretary - General may, upon the decision of the Medical Committee that the invalidity has become worse than the result considered under paragraph one, consider an additional income replacement.32

Chapter 5

Death Benefits

Section 73.33 In the case where the insured person has died without sustaining injury or sickness due to work, if the insured person has paid contribution for a period of not less than one month during the period of six months before his death, the following benefits shall be paid, in case of death:

31As amended by section 28,ibid.

32 As added by section 29 of the Social Security Act (No.2), B.E. 2537 (1994) 33As amended by section 30,ibid.

(1) funeral expenses according to the rate prescribed in the Ministerial Regulations, but the total amount must not less than one hundred times of the maximum

rate of daily minimum wage under the law on labour protection, to the following persons in respective order.

(a) person whom the insured person has specified to be the administrator of his funeral and having been the administrator as such;

(b) spouse, parents or children of the insured person who has evidence certifying the performance as the administrator of the funeral of the insured person;

(c) other person with evidence certifying his or her performance as the administrator of the funeral of the insured person.

(2) Allowance, in the case where an insured person is dead, shall be paid to a person whom the insured person has specified in writing to be the receiver of the allowance. If the insured person has not made any writing, such allowance shall be equally shared among spouse, parents or child of such insured person on the following amount:

(a) If before his or her death, the insured person has paid contributions more than thirty six months but less than ten years, the allowance shall be paid in an amount equal to fifty per cent of monthly wages calculated in accordance with section 57 and multiplied by three;

(b) If before his or her death, the insured person has paid contributions more than ten years, the allowance shall be paid in an amount equal to fifty per cent of monthly wages calculated in accordance with section 57 and multiplied by ten.

Section 73 bis.34 In the case where the insured person who is invalid under section 71, has died, the provisions of section 73 shall apply, mutatis mutandis, and the income replacement received for the last month before the death of such insured person

shall be used as basis for calculation.

34 As added by section 31 of the Social Security Act (No.2), B.E. 2537 (1994)

In the case an insured person who is invalid, is, simultanously entitle to receive funeral expenses and allowance upon his death on the status of his insurance and his invalidity according to paragraph one. The beneficary of such insured person shall have the right to receive either the funeral expenses or the allowance receiving under section 73.

Chapter 6

Child Benefits

Section 74.35 An insured person shall be entitled to child benefits provided that such person has paid contributions for a period of not less than twelve months during the period of thirty months before having such entitlement.

Section 75. Child benefits shall consist of:

(1) children living expenses;

(2) children tuition fees;

(3) hildren medical expenses;

(4) other necessary expenses

The above mentioned expenses shall be in accordance with the rules and rates prescribed in the Ministerial Regulations.

Section 75 bis.36 In the case an insured person who is entitled to

child benefits under section 74, is an invalidated person with entitlement to either invalidity or death benefit, such person or the person specified under section 75 quarter shall also be entitled to child benefit.

35As amended by section 6 of the Social Security Act (No.3), B.E.2542 (1999) 36 As added by section 7,ibid.

Section 75 ter.37 An insured person shall be entitled to child benefits for his or her legitimate child according to the age as prescribed by the Ministerial Regulations, such entitlement shall be terminated when the child is fully fifteen years of age and shall not exceed two children at a time.

In the case both parents are insured persons, only the father or the mother shall be entitled to child benefits except in the case of registrated divorce or separation, an insured persons who provides the child’s maintenance shall be entitled to such benefit.

Child benefits shall be in accordance with rules, procedures and conditions prescribed in the Ministerial Regulations.

Section 75. quarter.38 In the case where an insured person is dead, child benefits shall be paid to the following persons in respective order:

(1) husband or wife of the deceased or the person who cohabits

publicly as husband or wife with the deceased according to the rule as prescribed by the Secretary - General and is exercising the parental power.

(2) in the case the person specified in (1) does not provide maintenance to the child or his or her parental power is cancelled or he or she is dead, the person who provides maintenance to the child shall be entitled to such benefits.

Chapter 7

Old- Age Benefits

Section 76.39 An insured person shall be entitled to old-age benefits provided that such person has paid contributions for a period of not less than one hundred and eighty months irrespective of whether the period of contribution is consecutive or not.

37 As added by section 7 of the Social Security Act (No.3), B.E. 2542 (1999) 38As added by section 7,ibid.

39 As amended be section 8,ibid.

Section 77. 40 Old – age benefits shall consist of :

(1) monthly allowance namely “Superannuation Pension” ; or

(2) lump sum allowance namely “Superannuation Gratuity”

The above mentioned allowance shall be in accordance with the rules, procedure, period and rate prescribed in the Ministerial Regulations.

Section 77 bis. 41 In the case where an insured person has paid contributions for a period of not less than one hundred and eighty months, such person shall be entitled to old – age benefits as from the month following the month which he or she has reached the age of fifty five, except at such time the said person is continually being an insured person under section 38 or section 41, he or she shall be entitled to old-age benefit as from the month following the month his or her insurance is terminated.

In the case the insured person has paid contributions for a period less than one hundred and eighty months and ceased to be an insured person under section 38 or section 41, such person shall be entitled to old-age benefits.

Section 77 ter. 42 In the case where a person entitled to old-age benefits is subsequently become an insured person, the payment of old-age benefits shall be exhausted until the insurance of such person is terminated under section 38 or section 41, as the case may be.

In the case the insurance is terminated under any causes other than death, such person shall be entitled to old-age benefits.

In the case the insurance is terminated upon death, the insured person’s heirs under section 77 quarter shall be entitled to old-age benefits.

40 As amended by section 8 of the Social Security Act (No.3), B.E. 2542 (1999) 41 As added by section 9,ibid.

42 As added by section 9,ibid.

Section 77 quarter. 43 In the case where an insured person who is entitled to old- age benefits under section 77 bis, is dead before receiving such benefits or in the case where a person receiving superannuation pension is dead within sixty months as from the month of his or her entitlement, the heirs of such person shall be entitled to such superannuation pension.

The heirs specified in paragraph one shall be as follows :

(1) legitimate child of the deceased except adopted child or the child adopting to other person, shall be entitled to two portions and in the case the deceased has more than three legitimate children, such heirs shall be entitled to three portions ;

(2) husband or wife shall be entitled to one portion ;

(3) parents or father or mother who is still surviving shall be entitled to one portion.

In the case there are no heirs of any subsection or such heirs is dead before the distribution of benefits, the benefit as prescribed under section 77 (2) shall be distributed among heirs of the same subsection.

Section 77 quinque. 44 In the case where an insured person is simultanously entitled to income replacement under section 71 and to superannuation pension, such person shall, in substitution, be entitled to income replacement under section 71 and superannuation gratuity.

In the case an insured person has already received superannuation pension and subsequently becomes invalidity within the prescribed time under section 38 paragraph two, the payment of superannuation pension shall be terminated and such person shall, in

substitution, receive superannuation gratuity ofwhich the amount of superannuation pension paid before the becoming of invalidity shall be deducted from the amount thereof and remit to the fund.

43 As added by section 9,ibid.

44 As added by section 9 of the Social Security Act (No. 3), B.E. 2542 (1999)

Chapter 8

Unemployment Benefits

Section 78. An employee who is an insured person shall be entitled to unemployment benefits provided that the such employee has paid contributions for a period of not less than six months within a period of fifteen months before becoming unemployment and meets the following conditions :

(1) being able to work, being ready for suitable job as provided, having no objection to job training and having been registered with the Government Employment Service Office at which his or her presentation is frequently required for not less than once a month ;

(2) the unemployment of an insured person is not caused by the termination as the result of malperformance of duty, or intentionally committing a criminal offence against the employer, or intentionally causing damage to the employer, or violating material rules or work regulations or lawful order of the employer, or neglecting duty for seven consecutive days without justifiable reason, or causing serious damage to the employer as the result of negligence or being imprisoned by the final judgement to imprisonment except for an offence committed through negligence or petty offence ;

(3) being untitled to the old-age benefits under chapter 7 of this title.

Section 79. An insured person shall be entitled to unemployment benefits on and after the eighth day as from the date of becoming unemployment with the last employer in accordance with the rules and rates prescribed in the Ministerial Regulations.

TITLE 4

Competent Officials, Inspection and Supervision

Section 80. In the performance of duties, the competent official shall have the following powers :

(1) to enter the establishment or office of an employer, work place of an employee, between sunrise and sunset or during working hours, to inspect or inquire into facts, to inspect properties or other documents, to take photographs, to photocopy documents relating to employment, wages payment, employee records, payment of contributions, or other relevant documents, or to take the relevant documents for examination or for other

appropriate action in order to obtain facts for the execution of this Act.

(2) to search any locations or vehicles when there is a reasonable cause to suspect that there are properties of an employer who does not pay contributions or additional contributions or fails to pay the full amount thereof, during working hours or between sunrise

and sunset except in the case of prolonged searching which has not been completed within the aforesaid period.

(3) to issue letter of inquiry or summon any persons to give information or to produce relevant items or documents or other necessities for examination. In this regard, the provisions of section 30 shall apply mutatis mutandis.

(4) to seize or attach properties of an employer according to the order of the Secretary-General under section 50 in the case where an employer does not pay contributions or additional contributions or fails to pay the full amount thereof.

In the performance of duties under paragraph one, a competent official may bring civil servants or employees of the Office to assist in the performance thereof.

Section 81. In the performance of duties of competent official under section 80, the persons concerned shall provide such competent official with reasonable facilities.

Section 82. In the performance of duties, the competent official must produce his or her identity card.

The identity card of a competent official shall be in a form prescribed by the

Minister.

Section 83. In the performance of duties under this Act, the competent official

shall be official under the Penal Code.

Section 84. For the purpose of inspection and supervision in regard to social security, an employer shall provide a record of insured persons and keep it at the working place of the employer to be ready for inspection by the competent official.

The record of insured persons under paragraph one shall be in a form prescribed by the Secretary-General.

Section 84 bis.45 In the case the person who has responsibility to conform with the provisions of this Act within the prescribed time under the provisions of section 39, section 45, section 47 section 47 bis and section 56, is not in the country, or cannot perform the responsible obligations within the prescribed time thereof according to any inexcused necessary cause and such person has submitted the application, indicating the necessary causes, before the expiry of time for extension or postponing the time. The Secretary-General may, if he or she deems appropriate, extend or postpone such prescribed time, as necessary to the case but, such extension or postponement shall not exceed one time of the period of prescribed time under each section.

The extension as prescribed under section 39 or section 47 shall not result in any reduction on or exemption from additional payments.

TITLE 5 Appeal

Section 85. The employer, the insured person or other person who is dissatisfied

with the order of the Secretary-General or of the competent official under this Act except the order under section 50, shall be entitled to lodge an appeal in writing to the Appeal Committee within thirty days from the date of receiving such order. 46

45 As added by section 32 of the Social Security Act (No. 2), B.E. 2537 (1994) As amended by section 33, ibid.

46The rule and procedure of submittion the appeal shall be as prescribed in the Ministerial Regulations.

Section 86. There shall be an Appeal Committee appointed by the Minister consisting of a chairman and other qualified members in legal affairs, medical affairs, social security system and Labour affairs, three representatives of employers and three representatives of employees, and representatives of the Office shall be a member and secretary, the total number of whom shall not be more than thirteen persons.

Section 87. The Appeal Committee shall have powers and duties to examine and decide on appeals submitted under section 85.

After having considered the appeal, the Appeal Committee shall inform the decision in writing to the appellant.

If the appellant is dissatisfied with the decision of the Appeal Committee, such person shall have the right to bring the case to the Labour Court within thirty days as from the date of notification of decision. If the case is not brought to the Labour Court within the said period, the decision of the Appeal Committee shall be final.

Section 88. The Appeal shall not imply any abatement of the order of the Secretary-General or a competent official under this Act, except the appellant has made a request to the Secretary-General for the abatement of the execution of such order. The Secretary-General may, if he or she deems appropriate, allow an abatement for the execution of the order pending the decision of the Appeal Committee.

Section 89. The Appeal Committee has the power to appoint sub-committee to assist in carrying out the assigned duties. After the sub-committee has performed the assigned duties, it shall make the proposals or report to the Appeal Committee.

The provisions of section 13 shall apply mutatis mutandis to the meetings of the sub-committee.

Section 90. A member of the Appeal Committee shall hold office for a term of two years.

A member who vacates office may be reappointed but not more than two consecutive terms.

Section 91. The provisions of section 11, section 12, section 13 and section 17 shall apply mutatis mutandis to the Appeal Committee

TITLE 6 Penalties

Section 92. Any person who fails to provide information or submit documents, or any data required by the order of the Committee, the Medical Committee, the Appeal Committee, sub-committees or competent officials, shall be liable to imprisonment for a term not exceeding one month or to a fine not exceeding ten thousand Baht or to both.

Section 93. Any person who intentionally does not fill out the form or survey or fills out such form incompletely or does not return such form within the prescribed time shall be liable to a fine not exceeding five thousand Baht.

Section 94. Any person who knowfully fills out false information or figures in the form of survey shall be liable to imprisonment for a term not exceeding six months or to a fine not exceeding twenty thousand Baht or to both.

Section 95. Any person who violates section 32 shall be liable to imprisonment for a term not exceeding six months or to a fine not exceeding twenty thousand Baht or to both.

Section 96. Any employer who intentionally does not submit the form to the Office within the time prescribed under section 34 or does not declare in writing to the Office any changes or additional modifications of the records within the time prescribed under section 44 shall be liable to imprisonment for a term not exceeding six months or to a fine not exceeding twenty thousand Baht or to both.47

47 As amended by section 34 of the Social Security Act (No.2), B.E. 2537 (1994)

If an offence under paragraph one is committed continually, the offender shall be liable to an additional fine not exceeding five thousand Baht per day throughout the period of violation or non- compliance.

Section 97 48. Any employer who submits the form prescribed under section 34 or a written request for modifications or amendments to the form prescribed under section 44 by intentionally filing out false statements in such form or substituting false statements for modifications or amendments in such written request shall be liable to imprisonment for a term not exceeding six months or to a fine not exceeding twenty thousand Baht or to both.

Section 98. Any person who obstructs or does not provide reasonable facilities to the competent official who is performing the duties under section 80 shall be liable to imprisonment for a term not exceeding one month or to a fine not exceeding

ten thousand Baht or to both.

Section 99. Any employer who fails to comply with section 84 shall be liable to imprisonment for a term not exceeding one month or to a fine not exceeding ten thousand Baht or to both.

Section 100. Any person who has or acquires knowledge of any fact through performing the duty under this Act, discloses any fact concerning the affairs of an employer which normally would be kept confidential by an employer, shall be liable to imprisonment for a term not exceeding one month or to a fine not exceeding three thousand Bahts, or to both, unless such disclosure is for the purpose of official performance under this Act, or for labour protection, investigation or adjudication.

Section 101. In the case where a juristic person is an offender and is liable to punishment under this Act, a representative of such juristic person, every associated member and the person responsible for the operation of such juristic person shall be liable to the same punishment as imposed thereof, unless they can prove that they had no part in the commission of such offence or had made a reasonable effort to prevent such offence.

48 As amended by section 35, ibid.

Section 102. In the case of offences imposing punishment to a fine or to imprisonment for a term not exceeding six moths except an offence under section 95, the following competent official shall have the power to settle such offences if he or she considers that an offender does not deserve penalty of imprisonment or prosecution for such offence:

(1) The Secretary-General or the authorized person, for the offence committed in the Great Bangkok Metropolitan.

(2) Provincial Governor or a person authorized by the provincial governor, for the offence committed in other provinces.

In holding an inquiry, if an inquiry official is of the opinion that any person who has committed an offence under this Act at a level where the punishment can be settled, has agreed to have the case settled, the inquiry official shall submit the case to the Secretary-General or the Provincial Governor, as the case may be, within seven days as from the date such person agreed to have the case settled.

When the offender has paid the fine so fixed within thirty days, the case shall be deemed to be settled according to the Penal Procedure Code.

If the offender does not agree to have the case settled or after having agreed to have the case settled, failes to pay the fine within the prescribed time under paragraph three, the case shall be further proceeded.

Transitory Provisions49

Section 103. This Act shall be enforced for an undertaking which employs twenty employees or more as from the date this Act comes into force.

This Act shall be enforced for an undertaking which employs ten employees or more after a period of three years from the date of its coming into force.

In addition to those transitory provisions, section 38, section 39, section 40 and section 41 ofthe Social Security Act (No.2), B.E. 2537 (1994) has added the following transitory provisions:

“Section 38. Any person who is entitled to any benefit from the Fund before or at the date of this Act comes into force, shall be further entitled to such benefit until his entitlement is terminated.

Section 39. The temporary employees of the Central Administration, Provincial Administration and Local Administration, who ceased to be the insured person under this Act, whether such person has paid any mount of contribution. Such person shall be further entitled to benefit under the provisions of chapter 2, chapter3, chapter 4 and chapter 5 of title 3 of the Social Security Act, B.E. 2533 (1990) for a period of six months from the date this Act comes into force.

The provisions of section 39 of the Social Security Act, B.E. 2533, as amended by this Act, shall enforce to the temporary employee ceasing to be the insured person under paragraph one, mutatis mutandis.

Section 40. For the benefit of calculating the period of time for paying contributions

under this Act, contributions of each month which, either having a total of days or being deducted and paid per month, was paid or deemed to have been paid before the date this Act comes into force, shall be considered that the period ofpayment equals to one month.

Section 41. All money which an employer or an insured person is entitled to refund before the date this Act comes into force and having no application to the Office for refunding within one year from the date this Act comes into force, shall belong to the Fund.”

This Act shall apply to the employer having employees less than ten persons in locality and time as prescribed in the Royal Decree.50

Section 104. The collection of contributions shall be carried out for the purpose of providing injury or sickness benefits, invalidity benefits, death benefit not relating to work and maternity benefits as form the date the provisions of chapter 2 of title 2 comes into force.

The collection of contributions for child benefits and old-age benefits shall be prescribed in the Royal Decree, which shall not be in force later than 31 st December B.E.2541.51

The commencement for collection of contributions for unemployment benefits shall be prescribed in the Royal Decree.

Countersigned by:

Major General Chatchai Choonhavan Prime Minister

50 As added by section 36 of the Social Security Act (No.2), B.E. 2537 (1994)

51 As amended by section 37, ibid

Rates of fees

(1) Substitute for social security 50 Baht each

certificate of registration

(2) Substitute for social security card 10 Baht eact

The Rate of Contributions Appended to the Act

|

|

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

【全网最全】31个省市!残保金政策汇编及申

【全网最全】31个省市!残保金政策汇编及申

全网最全|2022年失业保险稳岗补贴政策汇总

全网最全|2022年失业保险稳岗补贴政策汇总

2021年个税汇算容易出现哪些错误?税务总局

2021年个税汇算容易出现哪些错误?税务总局

【全网最全】历史上最高规模退税减税!2022

【全网最全】历史上最高规模退税减税!2022