|

|

Income Tax Guide for Foreign Company

In Thailand, there are many kinds of business identities. The type of business you chose will affect your tax rates and tax benefits.

In general, the most common types of business are:

Thai company

- A company registered under Thai law.

Foreign company

- A company carrying on business in Thailand but registered under foreign law.

- A company not carrying on business in Thailand but deriving income from Thailand.

Thai Company

A Thai company generally pays tax at 20% (until 2015) of net profit. However, some types of company are entitled to a rate reduction.

- Small business with paid-up capital less than 5 million baht

- 20% of net profit > 1million baht, 15% of net profit between 300,000 - 1 million baht, Exempt for net profit < 300,000 baht

- Company registered in the Stock Exchange of Thailand (SET)

- 20% of net profit < 300 million baht for 5 consecutive accounting periods starting from 6th September B.E.2545.

- Newly registerd company in the Stock Exchange of Thailand (SET) and Market for Alternative Investment (MAI) within 3 years starting from 6th September B.E.2545

- 20% of net profit for newly registered company in SET for 5 consecutive accounting periods.

- 20% of net profit for newly registered company in MAI for 5 consecutive accounting periods.

- Bangkok International Banking Facility and Regional Operating Headquarters

- 10% of net profit from qualified income

- Association and foundation

- 2% or 10% on gross receipts

Foreign Company

A foreign company carrying on business in Thailand, whether it has a branch, an office, an employee or an agent in Thailand shall pay 30% tax (reduced to 20% until 2015) only on profit deriving from business in Thailand. However, international transportation company shall pay tax at the rate of 3% on gross receipts.

Foreign Company Abroad

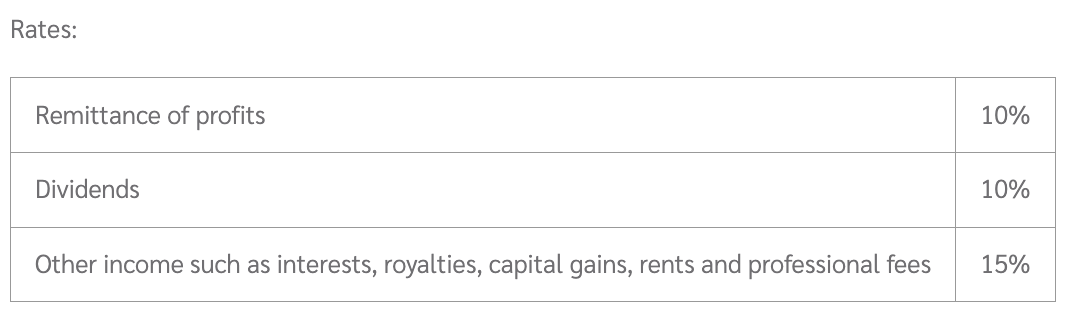

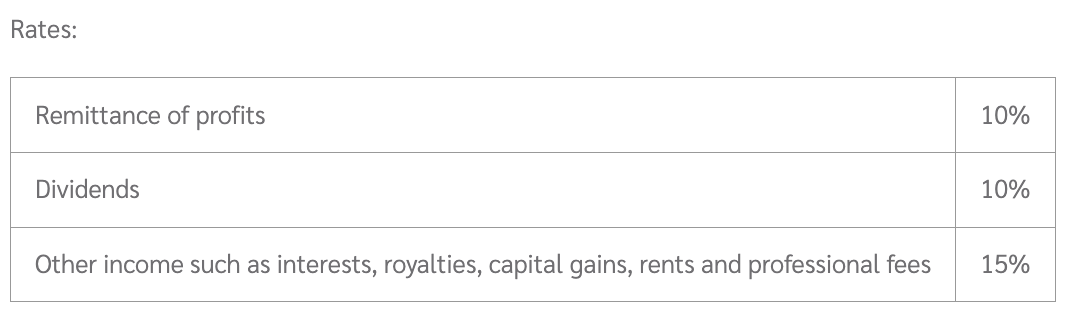

A foreign company that does not carry on business in Thailand will be subject to withholding tax on certain categories of income derived from Thailand. The withholding tax rates may be further reduced or exempted depending on types of income under the provision of Double Taxation Agreement.

Tax Registration

A foreign company carrying on business in Thailand, whether setting up a branch or an office must apply for tax identification number from the RevenueDepartment. An application form (Lor Por 10.3) together with other relevent documents i.e. a copy of a company’s registration license, house registration, etc. shall be submitted to the Area Revenue Office within 60 days for the date of registration or operation.

Tax Treaties to Avoid Double Taxation

Currently, Thailand has concluded 57 tax treaty agreements : : Armenia, Australia, Austria, Bangladesh, Bahrain, Belgium, Bulgaria, Canada, China P.R., Cyprus, Czech Republic, Denmark, Finland, France, Germany, Hong Kong, Hungary, India, Indonesia, Israel, Italy, Japan, Korea, Laos, Luxembourg, Malaysia, Mauritius, Nepal, the Netherlands, New Zealand, Norway, Oman, Pakistan, the Philippines, Poland, Romania, Seychelles, Singapore, Slovenia, South Africa, Spain, Srilanka, Sweden, Switzerland, Turkey, Ukraine, United Arab Emirates, United Kingdom of Great Britain and Northern Ireland, United States of America, Uzbekistan, Vietnam, Kuwait, Russia, Chile, Burma, Taiwan, and Estonia .

Tax Filing and Payments

Thai & Foreign Company Carrying on Business in Thailand

Any Thai or foreign company carrying on business in Thailand must submit their tax returns and payments twice a year.

- The semi-annual tax return must be submitted (CIT 51 form) within two months after the end of the first six months, the amount of tax due shall be half of the entire year projection of the company’s annual net profit.

- The annual tax returns (CIT 50 form) must be submitted within 150 days after the closing date of its accounting period.

International Transportation Business

A company shall submit tax return (CIT 52 form) and payment within 150 days after the closing date of its accounting period.

Foreign Company Not Carrying on Business in Thailand

A taxpayer in Thailand shall withhold tax at source at the time of payment and submit it together with CIT 54 form to the Area Revenue Office within 7 days of the following month after the payment is made.

Electronic Filing and Payments

A company can easily submit income tax return (CIT 50, 51, 52, 54) and make tax payment via internet at http://www.rd.go.th The service opens daily form 6 am. – 10 pm.

Tax Benefits

A company that chooses to register under Thai law shall enjoy various tax benefit schemes such as;

- Income tax holiday from 3 to 8 years for business with Investment Promotion Privileges.

- Reduction or exemption of import duties on raw material and imported machinery for business with Investment Promotion Privileges or industries setting up in Export Processing Zone and Free Trade Zone.

- Double deduction for the cost of transportation, electricity and water supply for industries with Investment Promotion Priviledges.

- 200% deduction for the cost of hiring qualified researchers doing research and development project.

- 150% deduction for the cost of employee’s training in order to improve human capital.

- Small and medium size company can choose to deduct special initial allowance on the date of acquisition for computer (40%), plant (25%) and machinery (40%).

|

|

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

【全网最全】31个省市!残保金政策汇编及申

【全网最全】31个省市!残保金政策汇编及申

全网最全|2022年失业保险稳岗补贴政策汇总

全网最全|2022年失业保险稳岗补贴政策汇总

2021年个税汇算容易出现哪些错误?税务总局

2021年个税汇算容易出现哪些错误?税务总局

【全网最全】历史上最高规模退税减税!2022

【全网最全】历史上最高规模退税减税!2022