|

|

政策文件

| 政策原文链接: |

- |

| 发文单位: |

|

| 文件编号: |

- |

| 文件名: |

个人所得税 |

| 发文日期: |

|

| 政策解读: |

- |

| 备注: |

- |

| 纵横四海点评: |

- |

Personal Income Tax (PIT)

Personal Income Tax (PIT) is a direct tax levied on income of a person. A person means an individual, an ordinary partnership, a non-juristic body of person and an undivided estate. In general, a person liable to PIT has to compute his tax liability, file tax return and pay tax, if any, accordingly on a calendar year basis.

1.Taxable Person

Taxpayers are classified into “resident” and “non-resident”. “Resident” means any person residing in Thailand for a period or periods aggregating more than 180 days in any tax (calendar) year. A resident of Thailand is liable to pay tax on income from sources in Thailand as well as on the portion of income from foreign sources that is brought into Thailand. A non-resident is, however, subject to tax only on income from sources in Thailand.

2.TAX BASE

2.1 Assessable Income

Income chargeable to the PIT is called “assessable income”. The term covers income both in cash and in kind. Therefore, any benefits provided by an employer or other persons, such as a rent-free house or the amount of tax paid by the employer on behalf of the employee, is also treated as assessable income of the employee for the purpose of PIT. Assessable income is divided into 8 categories as follows :

income from personal services rendered to employers;

income by virtue of jobs, positions or services rendered;

income from goodwill, copyright, franchise, other rights, annuity or income in the nature of yearly payments derived from a will or any other juristic Act or judgment of the Court;

income in the nature of dividends, interest on deposits with banks in Thailand, shares of profits or other benefits from a juristic company, juristic partnership, or mutual fund, payments received as a result of the reduction of capital, a bonus, an increased capital holdings, gains from amalgamation, acquisition or dissolution of juristic companies or partnerships, and gains from transferring of shares or partnership holdings;

income from letting of property and from breaches of contracts, installment sales or hire-purchase contracts;

income from liberal professions;

income from construction and other contracts of work;

income from business, commerce, agriculture, industry, transport or any other activity not specified earlier.

2.2 Deductions and Allowances

Certain deductions and allowances are allowed in the calculation of the taxable income. Taxpayer shall make deductions from assessable income before the allowances are granted. Therefore, taxable income is calculated by :

TAXABLE INCOME = Assessable Income - deductions - allowances

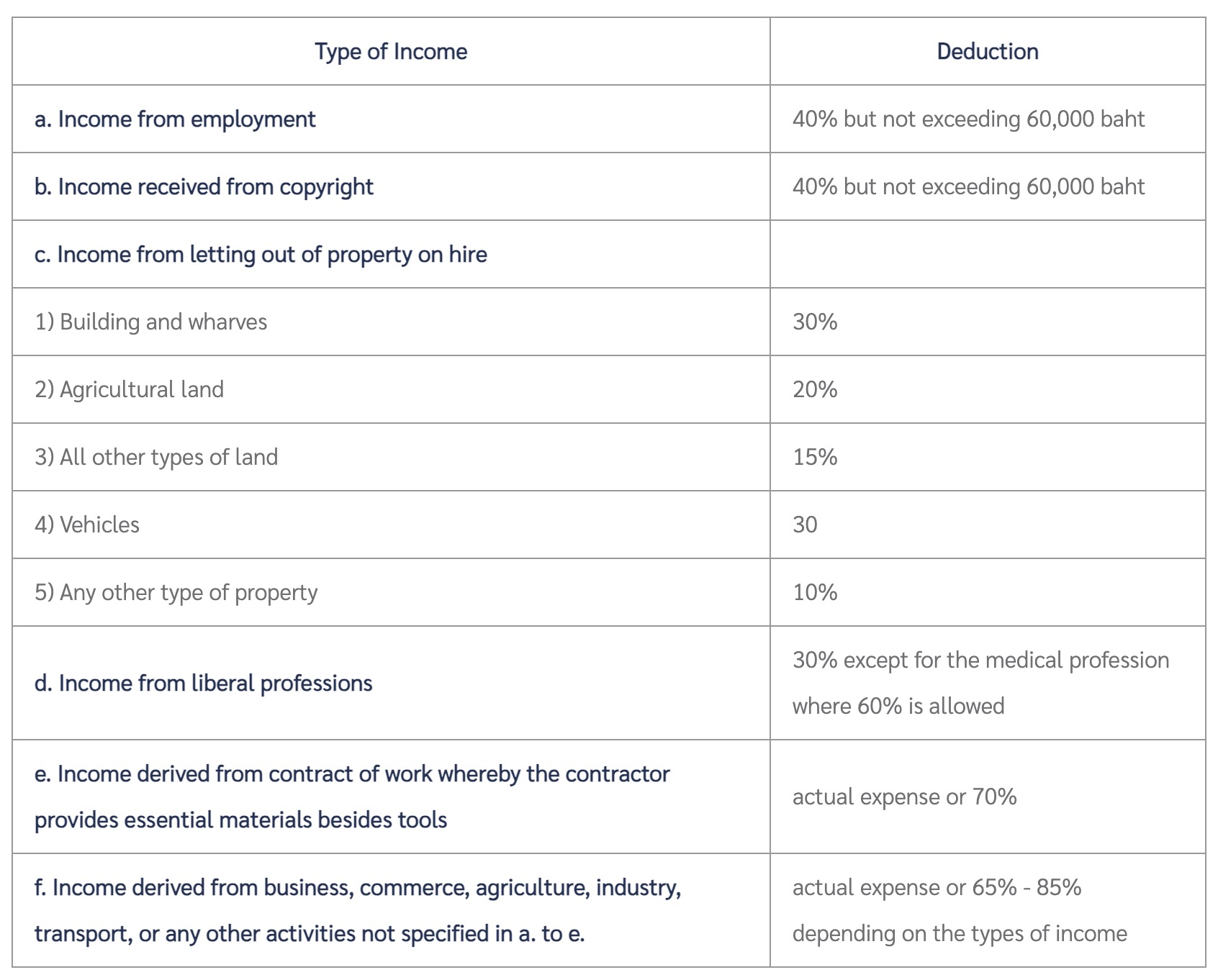

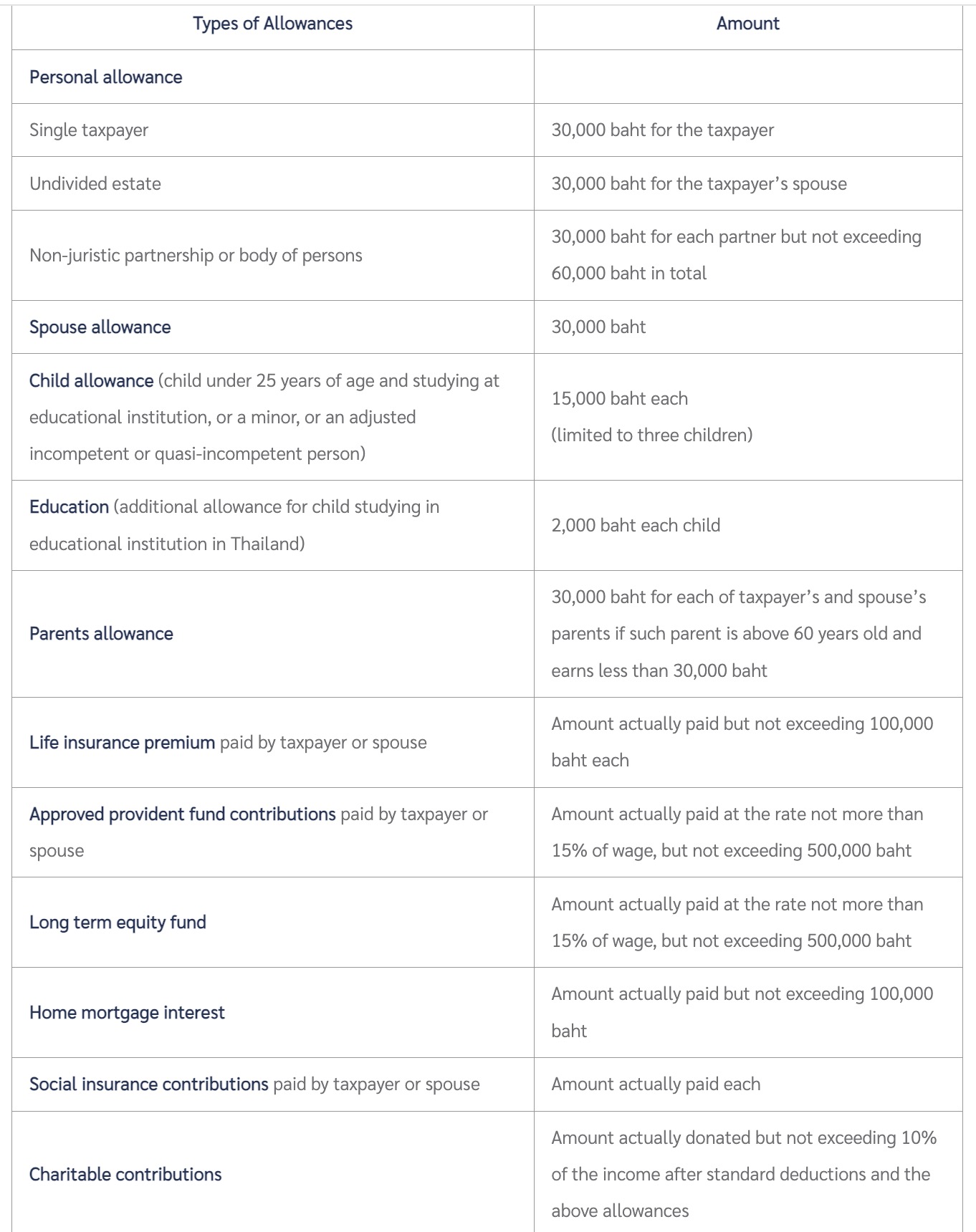

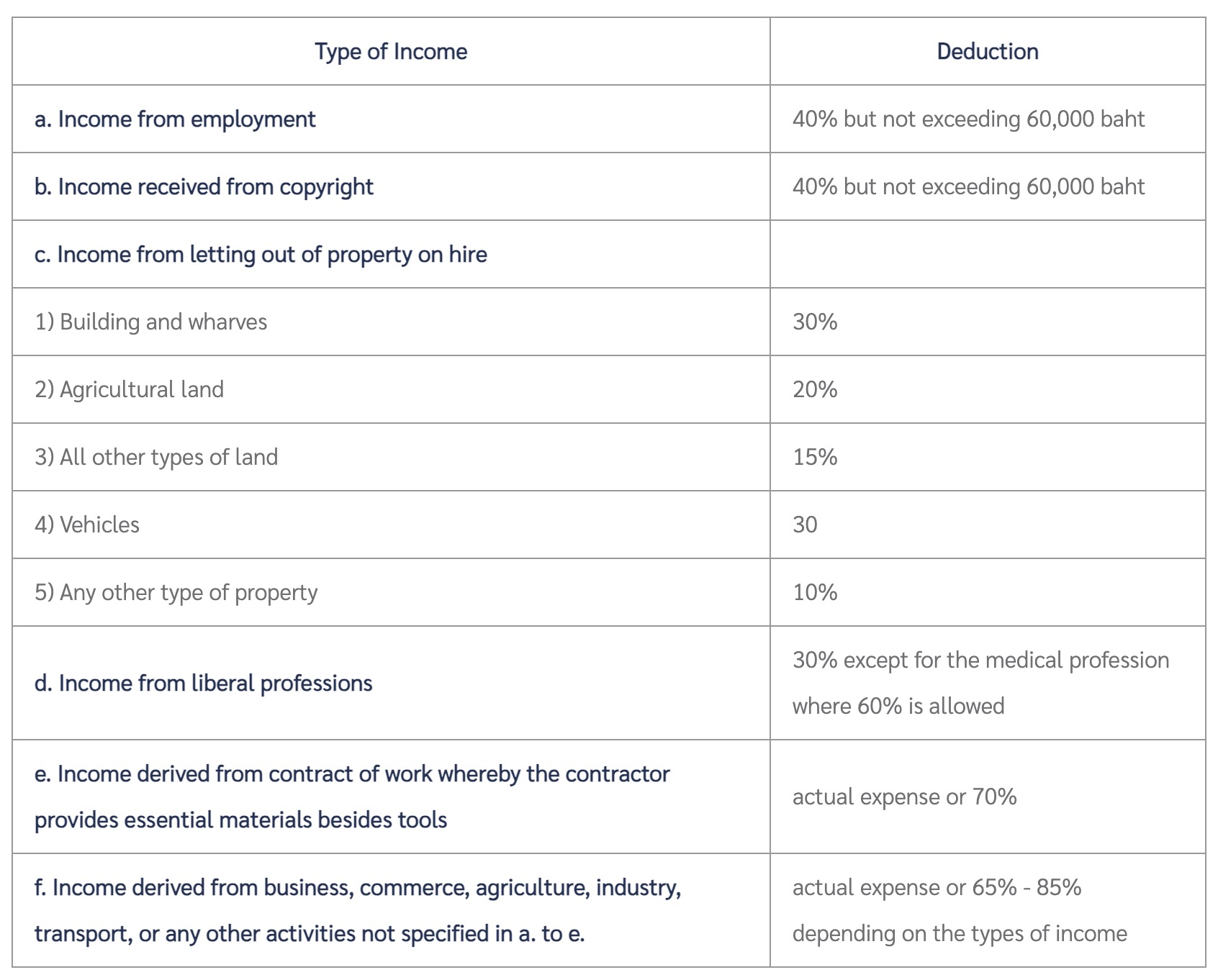

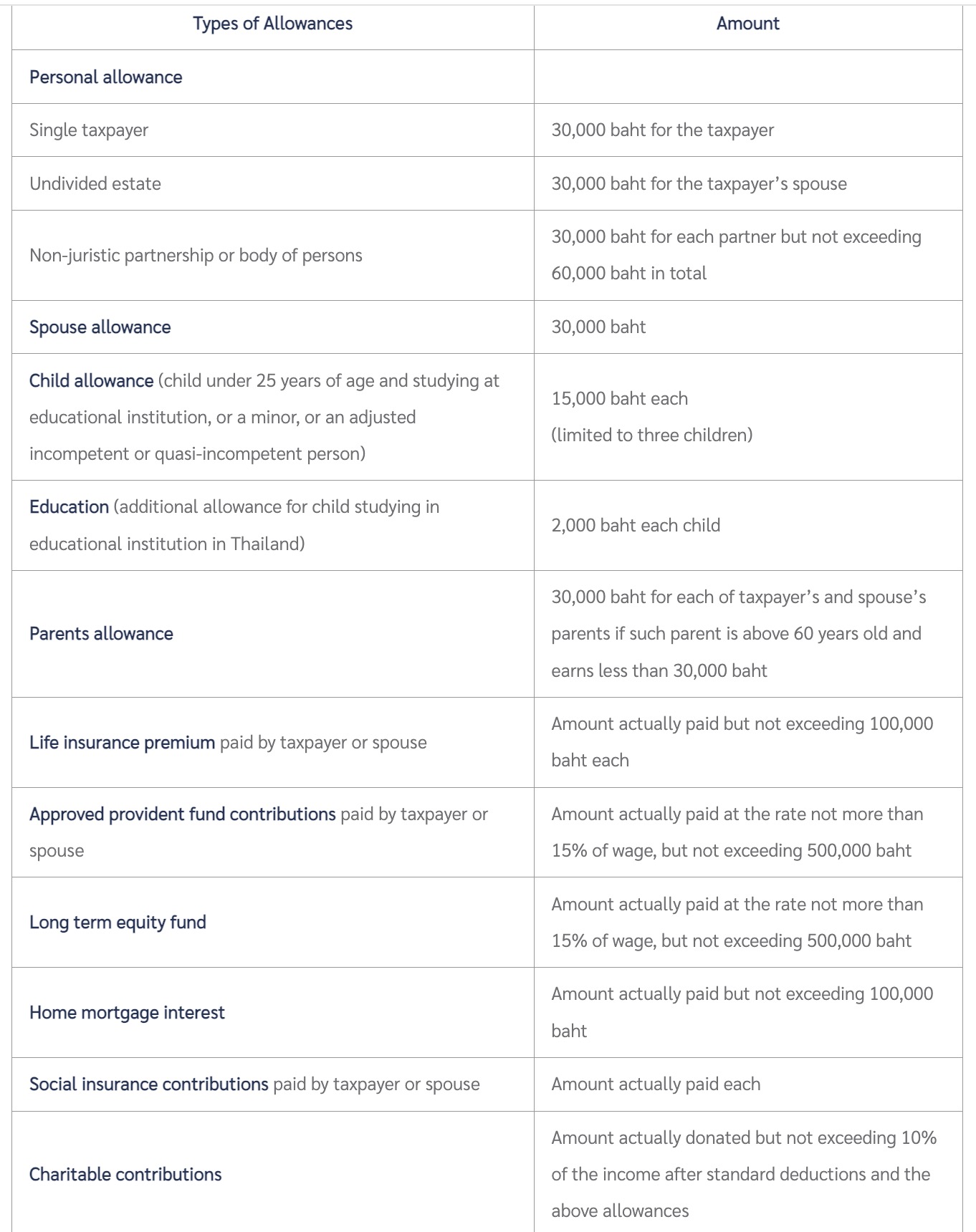

Deductions allowed for the calculation of PIT

Allowances (Exemptions) allowed for the calculation of PIT

2.3 Tax Credit for dividends

Any taxpayer who domiciles in Thailand and receives dividends from a juristic company or partnership incorporated in Thailand is entitled to a tax credit of 3/7 of the amount of dividends received. In computing assessable income, taxpayer shall gross up his dividends by the amount of the tax credit received. The amount of tax credit is creditable against his tax liability.

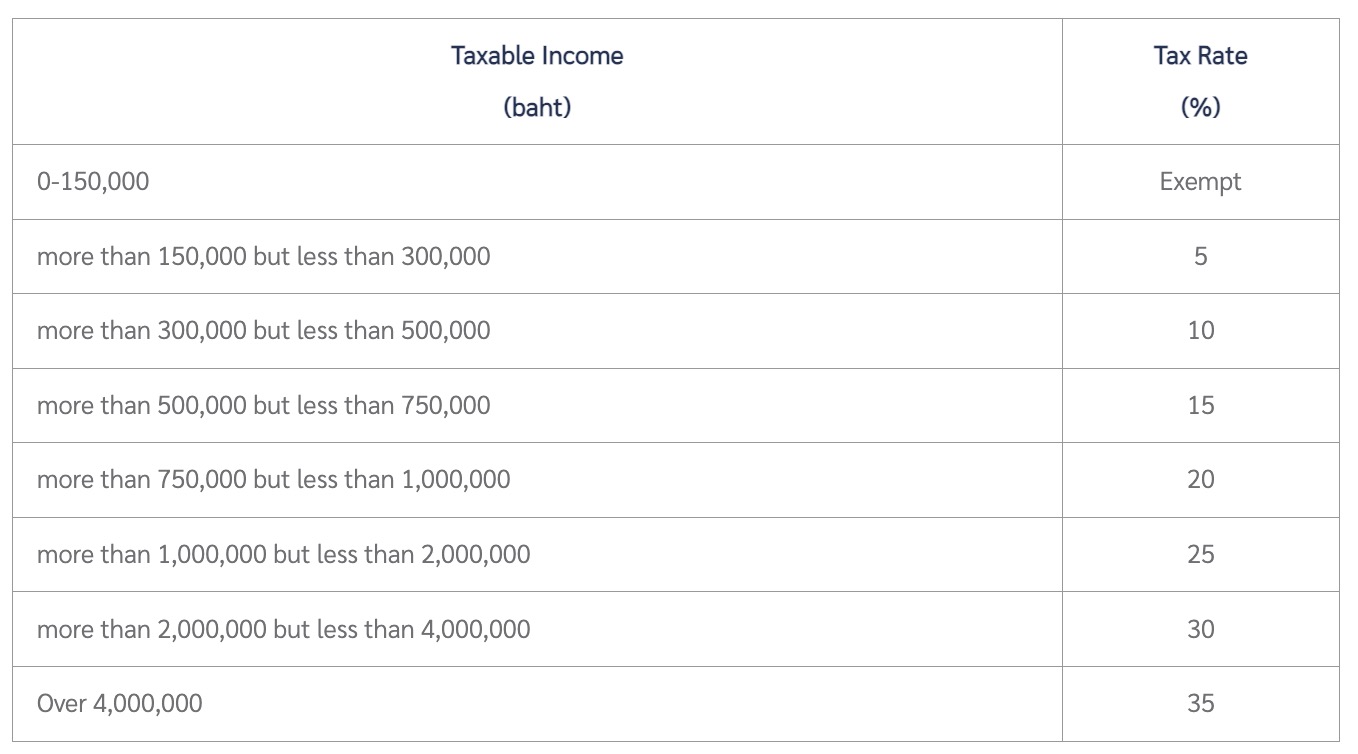

3. Progressive Tax Rates

3.1 Progressive Tax Rates

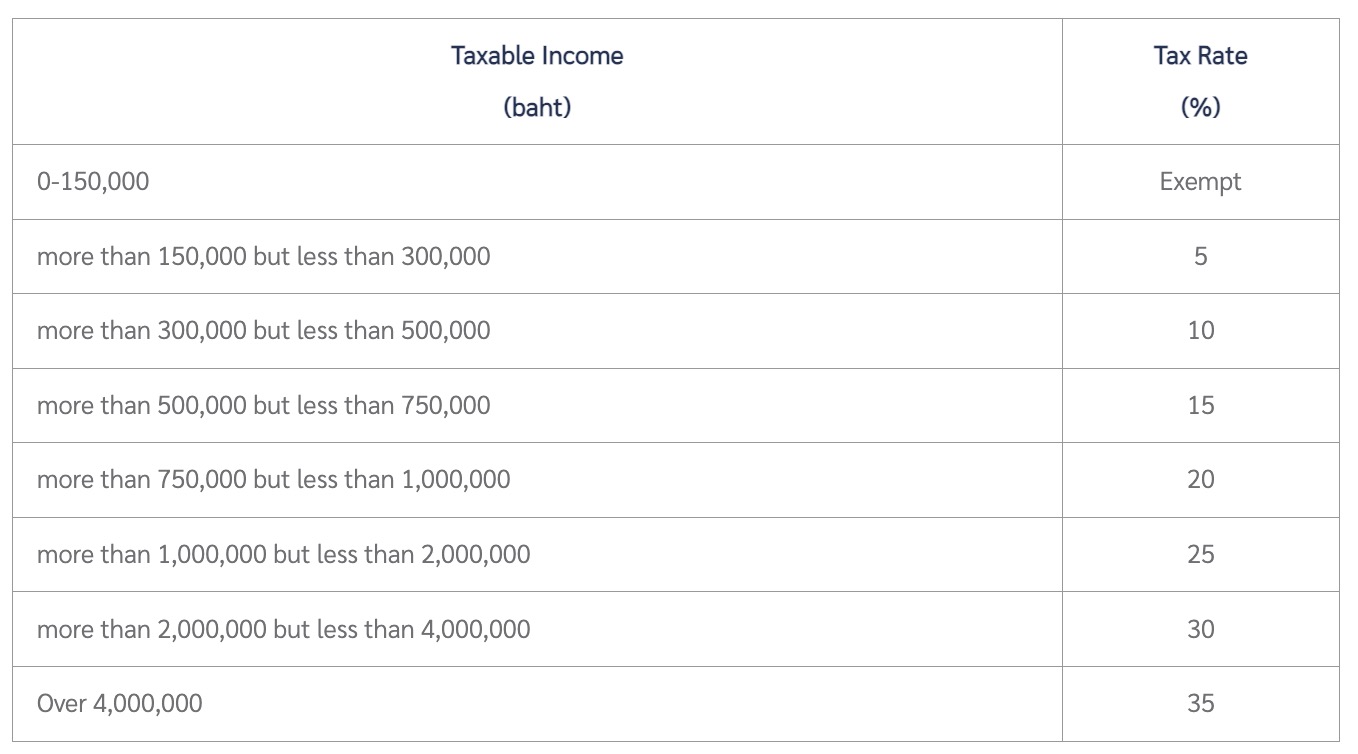

Personal income tax rates applicable to taxable income are as follows

Tax rates of the Personal Income Tax

To be implemented for the 2013 and 2014 tax years.

In the case where income categories (2) - (8) mentioned in 2.1 are earned more than 60,000 Baht per annum, taxpayer has to calculate the amount of tax by multiplying 0.5% to the assessable income and compare with the amount of tax calculated by progressive tax rates. Taxpayer is liable to pay tax at the amount whichever is greater.

3.2 Separate Taxation

There are several types of income that the taxpayer shall not include or may not choose to include such income to the assessable income in calculating the tax liability.

Income from sale of immovable property

Taxpayer shall not include income from sales of immovable property acquired by bequest or by way of gift to the assessable income when calculating PIT. However, if the sale is made for a commercial purpose, it is essential that such income must be included as the assessable income and be subject to PIT.

Interest

The following forms of interest income may, at the taxpayer’s selection, be excluded from the computation of PIT provided that a tax of 15 per cent is withheld at source:

interest on bonds or debentures issued by a government organization;

interest on saving deposits in commercial banks if the aggregate amount of interest received is not more than 20,000 baht during a taxable year;

interest on loans paid by a finance company;

interest received from any financial institution organized by a specific law of Thailand for the purpose of lending money to promote agriculture, commerce or industry.

Dividends

Taxpayer who resides in Thailand and receives dividends or shares of profits from a registered company or a mutual fund which tax has been withheld at source at the rate of 10 per cent, may opt to exclude such dividend from the assessable income when calculating PIT. However, in doing so, taxpayer will be unable to claim any refund or credit as mentioned in 2.4.

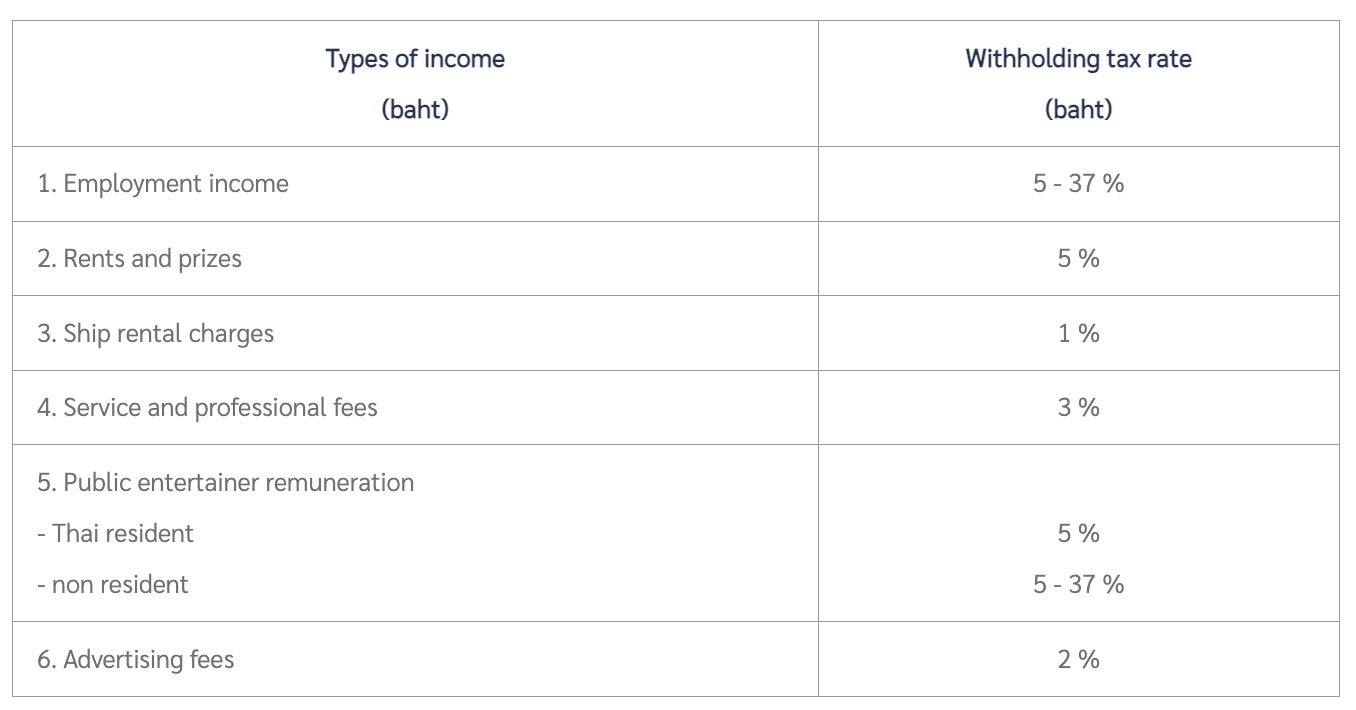

4. Withholding Tax

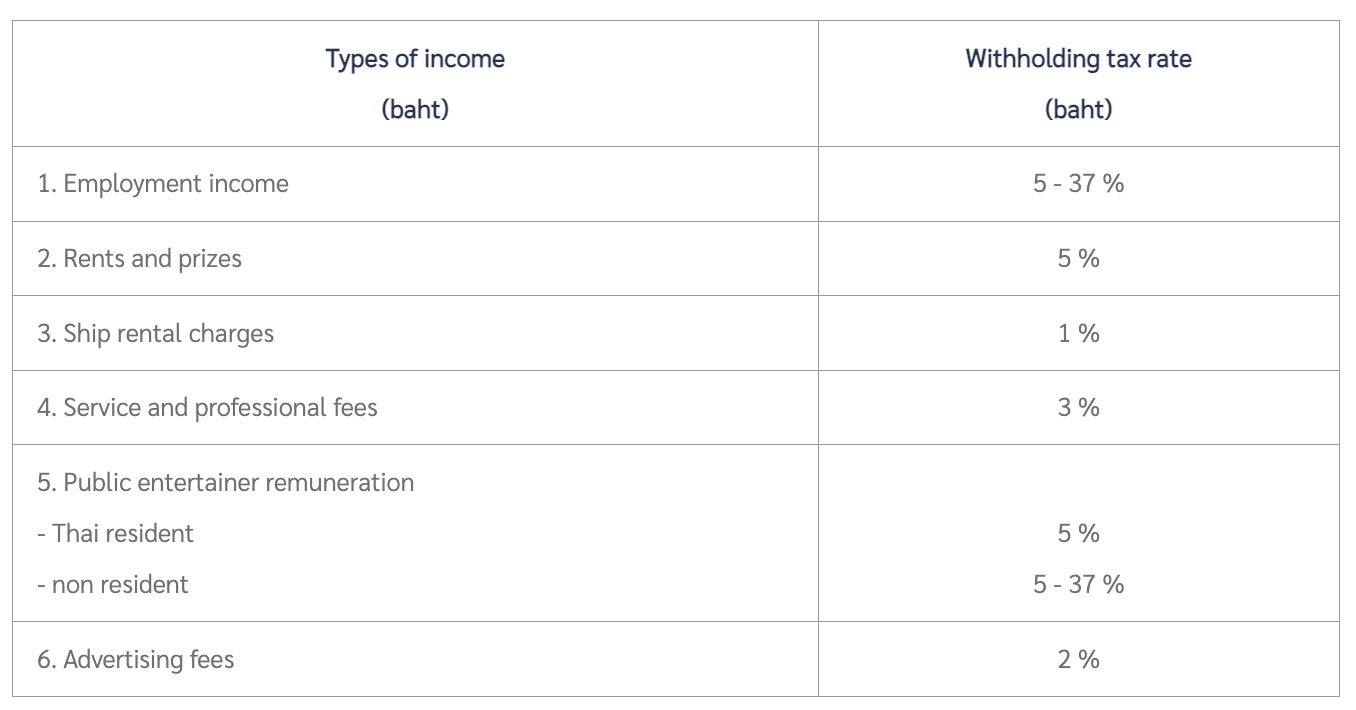

For certain categories of income, the payer of income has to withhold tax at source, file tax return (Form PIT 1, 2 or 3 as the case may be) and submit the amount of tax withheld to the District Revenue Office. The tax withheld shall then be credited against tax liability of a taxpayer at the time of filing PIT return. The following are the withholding tax rates on some categories of income.

5. Tax Payment

Taxpayer is liable to file Personal Income Tax return and make a payment to the Revenue Department within the last day of March following the taxable year. Taxpayer, who derives income specified in c, d or f in 2.3 during the first six months of the taxable year is also required to file half - yearly return and make a payment to the Revenue Department within the last day of September of that taxable year. Any withholding tax or half-yearly tax which has been paid to the Revenue Department can be used as a credit against the tax liability at the end of the year.

|

|

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

【答疑】外单位员工的差旅费,我公司可否税

【答疑】外单位员工的差旅费,我公司可否税

【全网最全】《互联网平台企业涉税信息报送

【全网最全】《互联网平台企业涉税信息报送

【全网最全】国家税务总局黑龙江省税务局党

【全网最全】国家税务总局黑龙江省税务局党

《育儿补贴制度实施方案》公布!每孩每年36

《育儿补贴制度实施方案》公布!每孩每年36