|

|

宁波市电子税务局

非居民跨境办税场景

操作指引

尊敬的非居民纳税人:

4月6日起,宁波市电子税务局新增双语“非居民跨境办税”场景,该场景适用于在中国境内未设立机构场所的非居民企业,取得来源于非上市公司(不含限售股)的股权转让所得,无扣缴义务人,需按次自行申报企业所得税、印花税的情形。宁波市电子税务局提供的注册赋码、合同采集、税款智能计算、一键式多税种综合申报、跨境税费缴纳等服务,助您实现全程境外办税缴税。具体操作流程如下:

Dear Non-resident Taxpayers,

According to the unified plan of the State Tax Administration, a “Tax Service Scenario for Overseas Non-resident Enterprises” has been added to the E-tax China, provides you with a simple and smooth bilingual overseas tax service. This scenario is applicable to non-resident enterprises without institutions in China which obtain equity transfer income from non-listed companies (not including restricted shares), without withholding agents and need to file enterprise income tax and stamp tax per occurrence. The E-tax China provides services such as registration and ID code generation, contract collection, intelligent calculation of taxes, one-click comprehensive declaration of taxes (income tax, stamp tax, etc.), and overseas tax payment, which would help you enjoy the whole course overseas tax service. Operational processes are as follows.

具体操作步骤

Specific Operations

第一步

用户注册

Registration

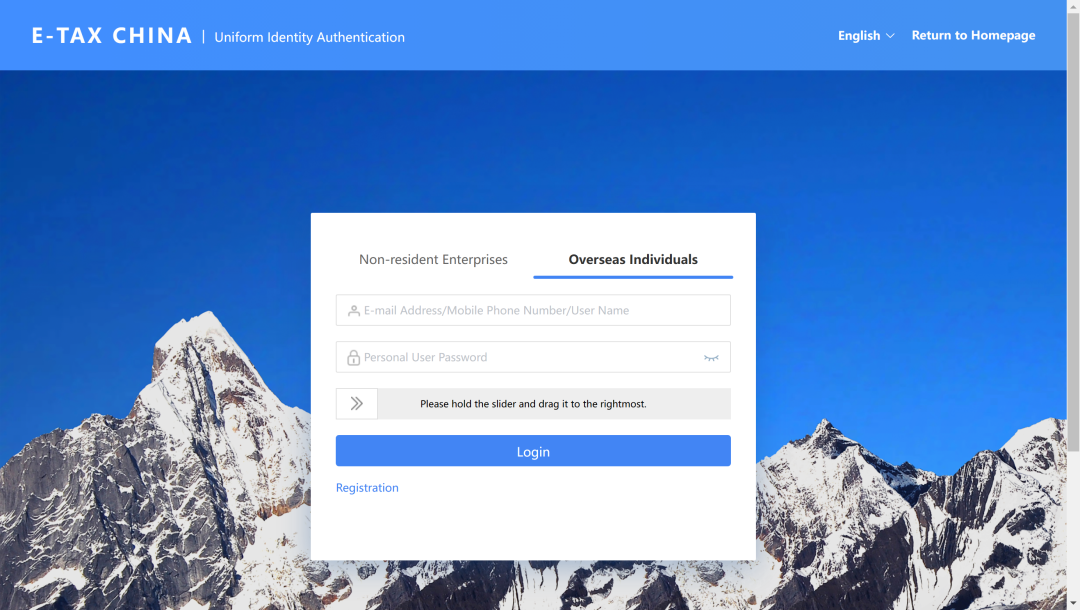

(1)打开电子税务局,可以点击右上方按钮切换成英文语言;

Open E-tax China, and click on the top right button to switch to English;

(2)切换成英文语言模式;

Switch to English;

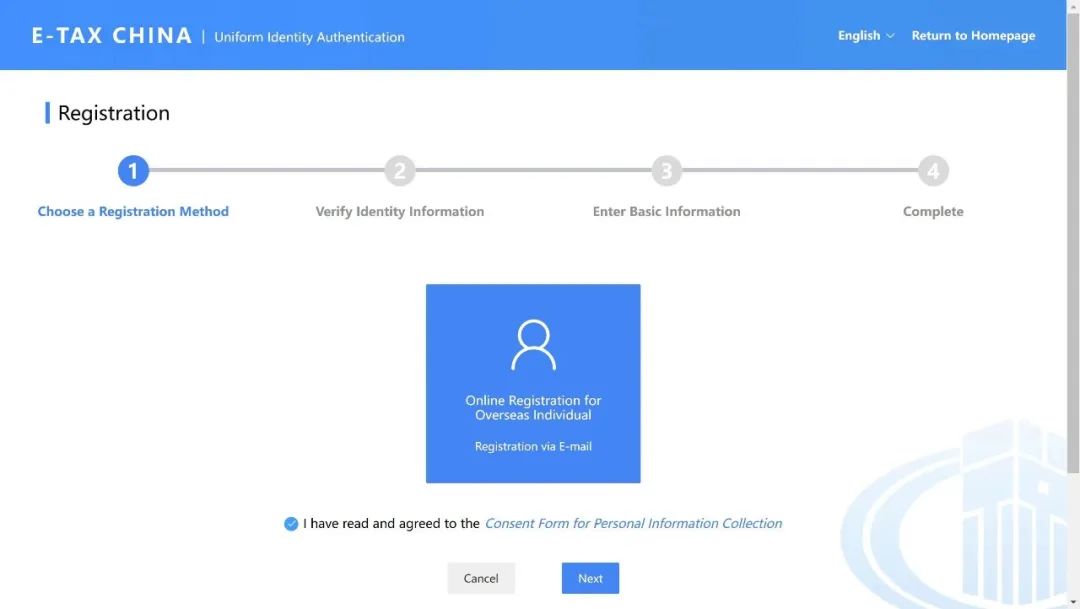

(3)点击切换到“境外自然人”,可查看到“用户注册”入口;

Click on "Overseas Individuals " to see the "Registration" portal;

(4)点击【用户注册】,进入注册页面;

Click on “Registration” to enter the registration page.

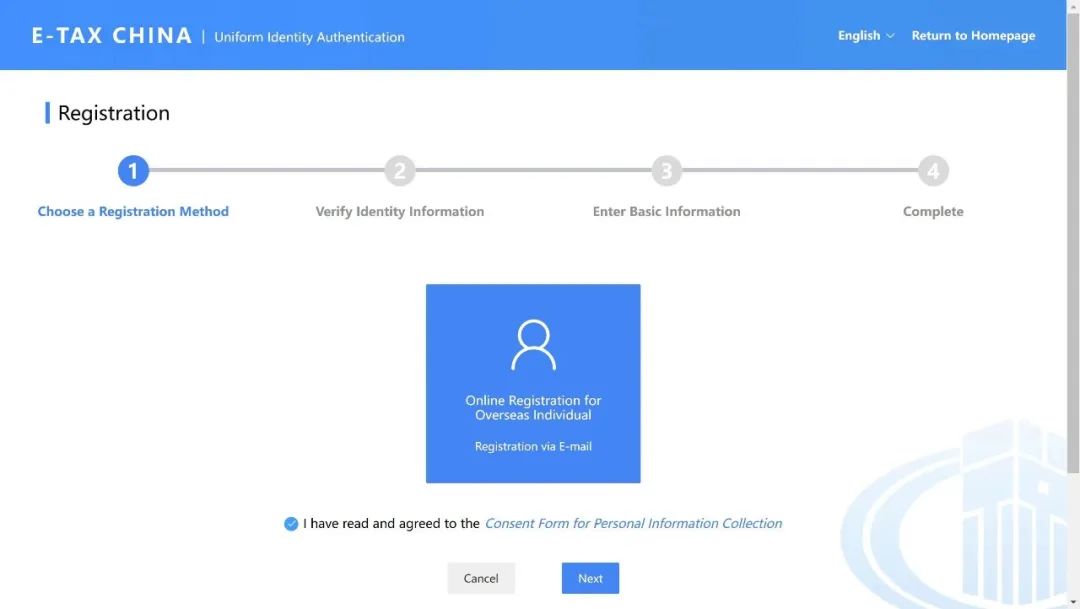

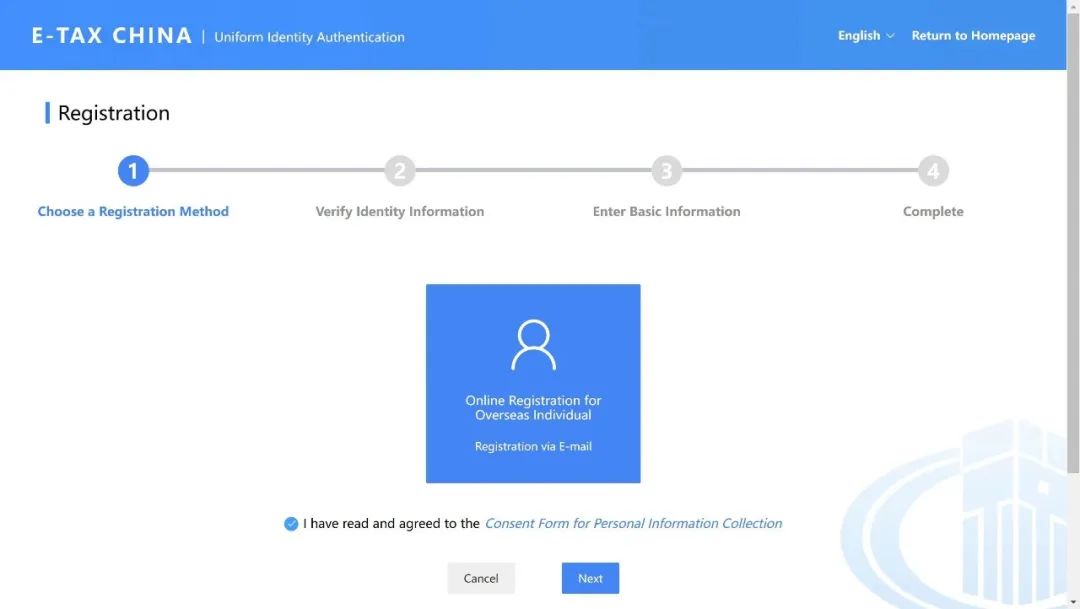

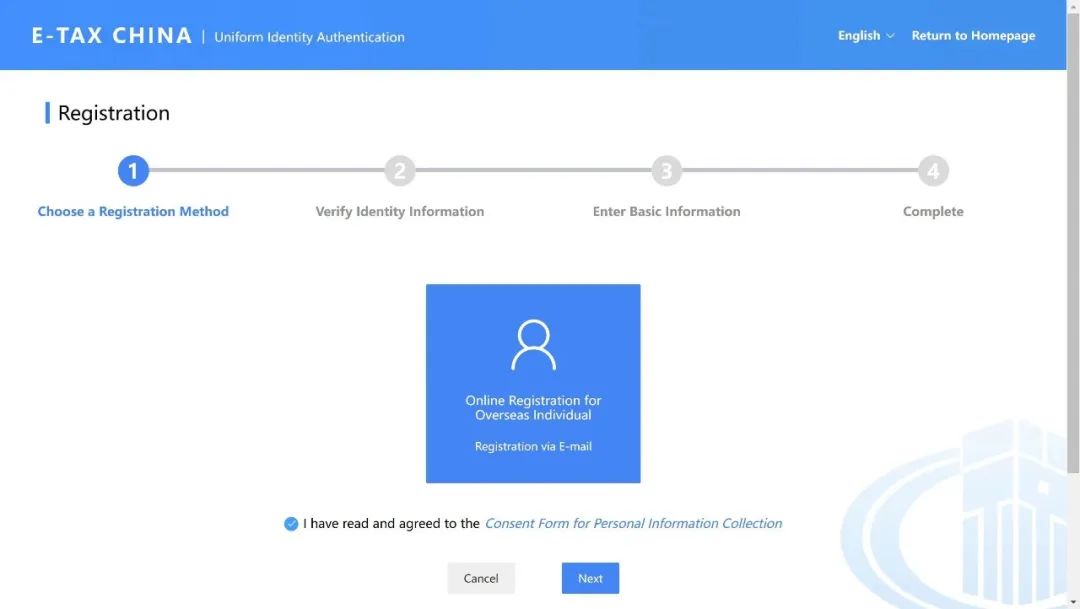

(5)勾选“我已阅读并同意《个人信息保护告知同意书》”,点击【下一步】,进入校验身份信息填写页面;

Check "I have read and agree to the Consent Form for Personal Information Collection", and click on “Next” to enter the identity information verification page;

(6)输入姓名、证件类型、证件号码、性别、国籍(地区),点击【下一步】进行基本信息填写;

Enter your name, type of ID Document, ID number, gender, country (region), and click on “Next” to fill in the basic information;

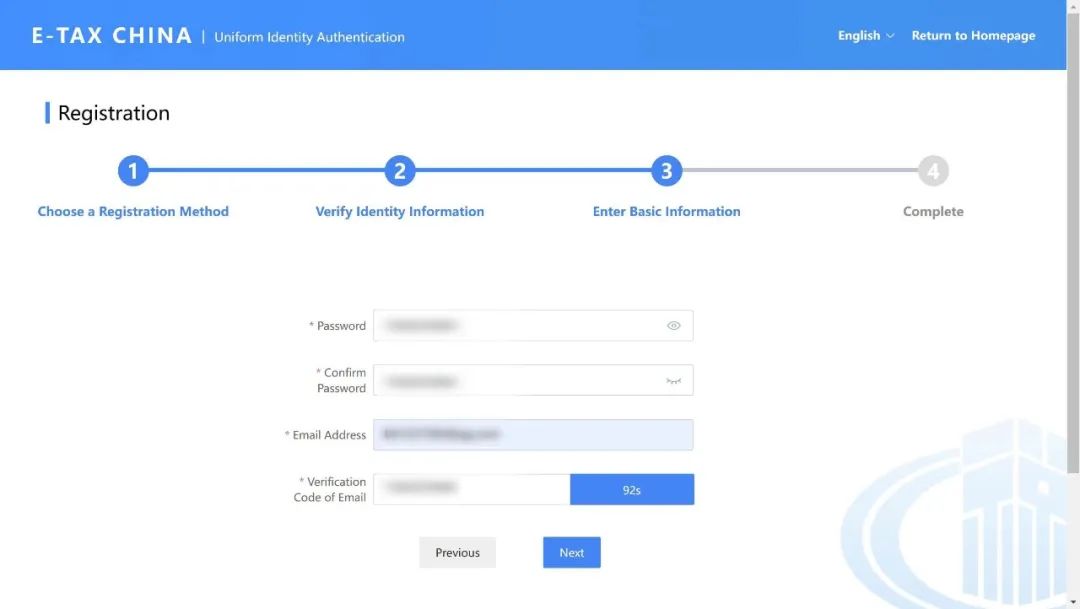

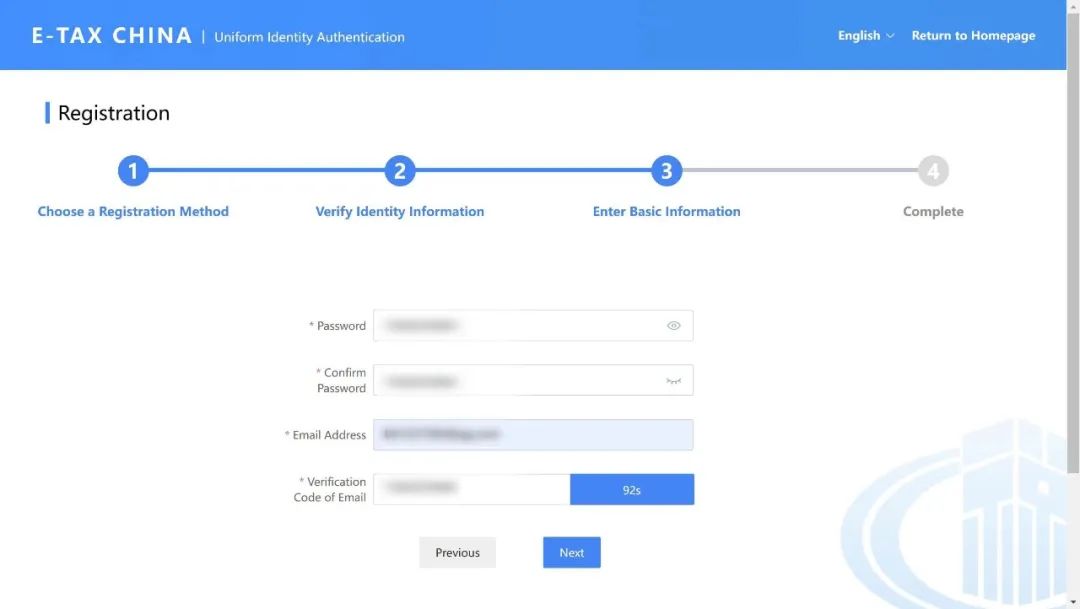

(7)输入密码、确认密码、邮箱、点击【获取验证码】进行验证码获取;

Enter the password, confirm the password, the email address, and click on “Get a verification code” to obtain the verification code;

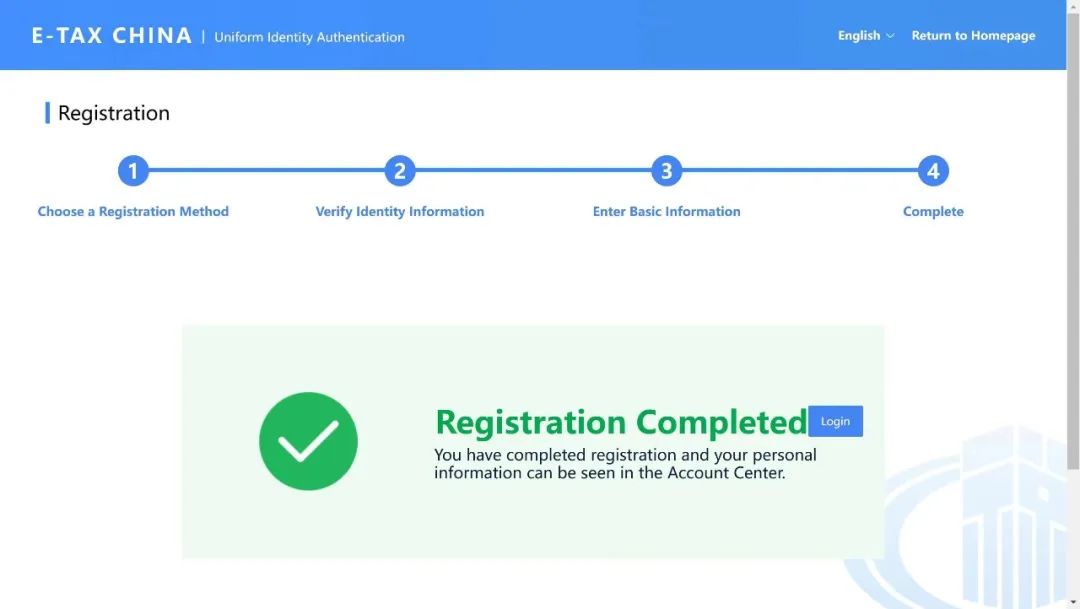

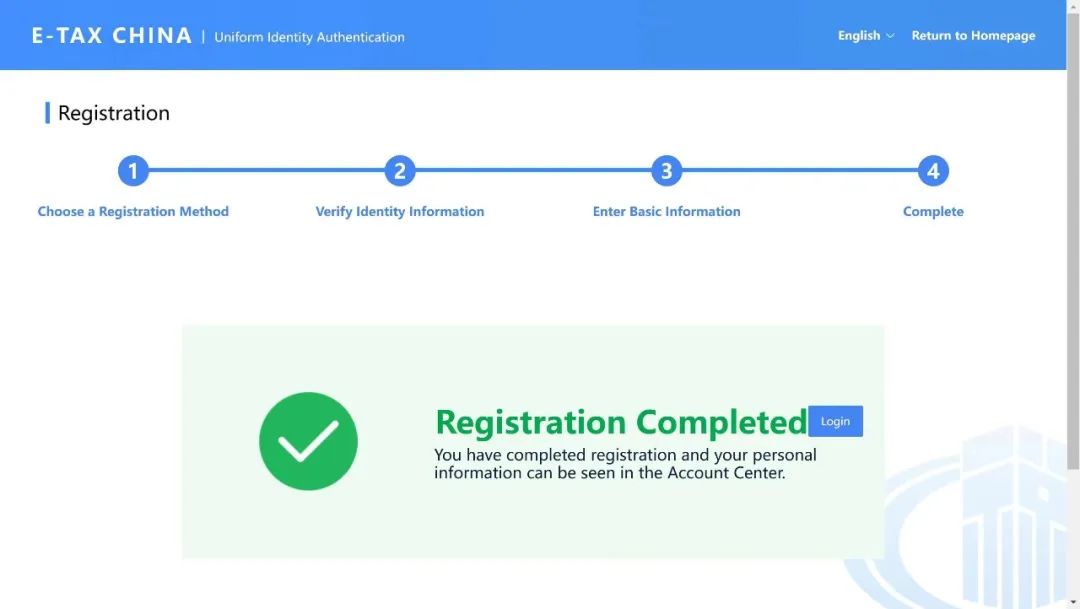

(8)输入邮箱验证码、点击【下一步】,完成用户注册。

Enter the verification code of email and click on “Next” to complete registration;

操作指引

第二步

用户登录

Login

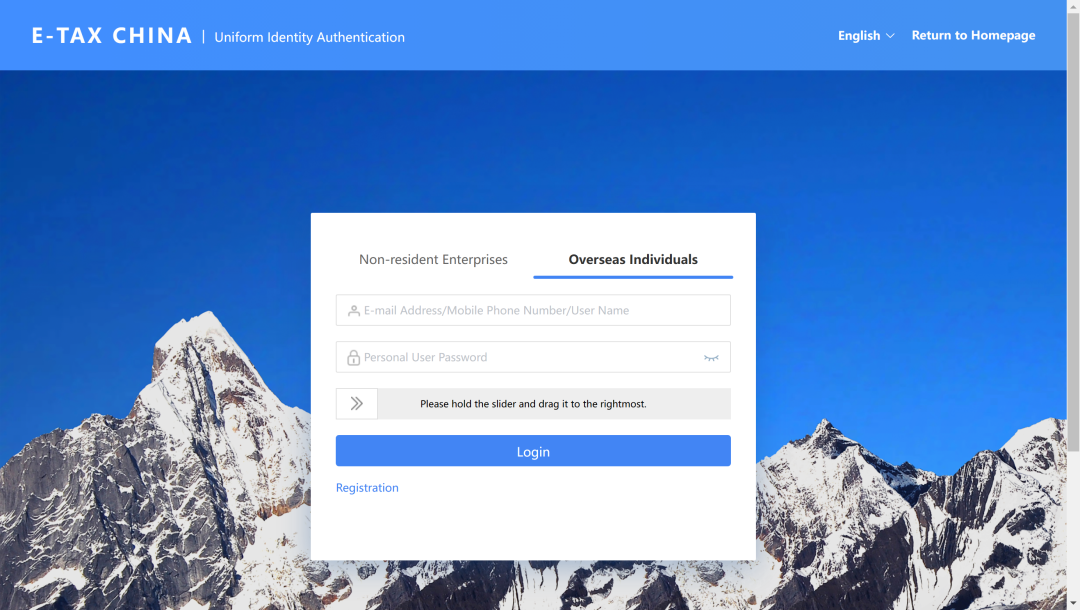

(1)境外自然人登录

Overseas Individuals Login

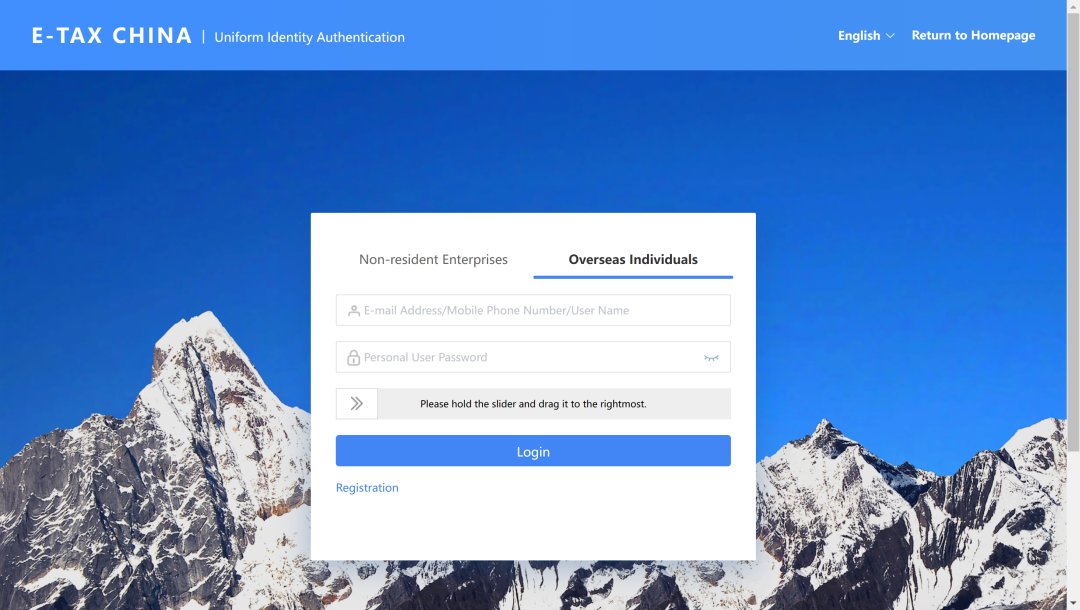

①打开电子税务局,点击右上方按钮切换成英文语言;

Open E-tax China, and click on the top right button to switch to English;

②切换成英文语言模式:

Switch to English;

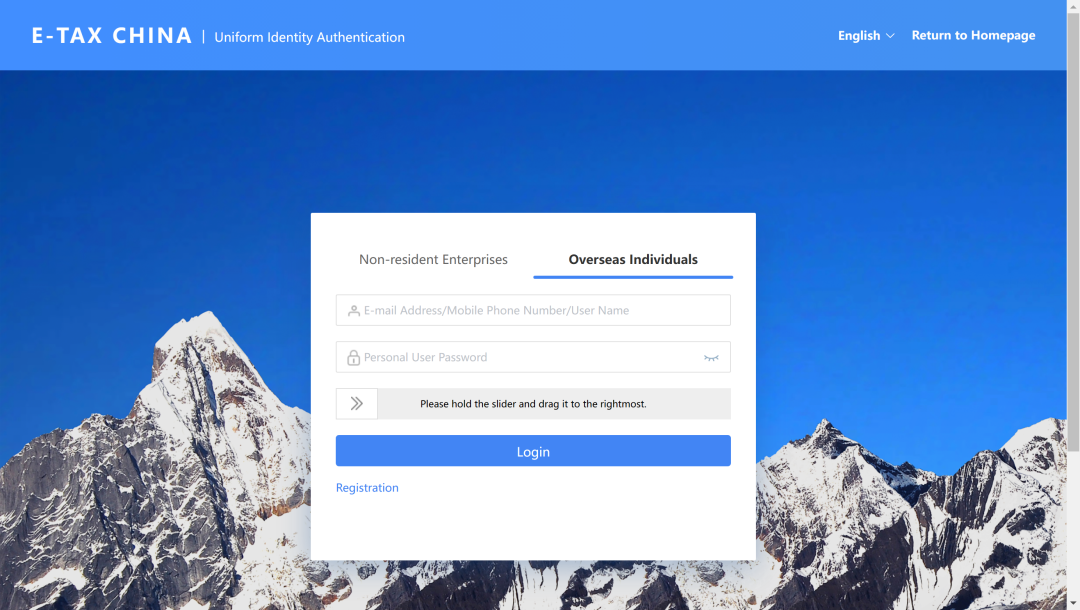

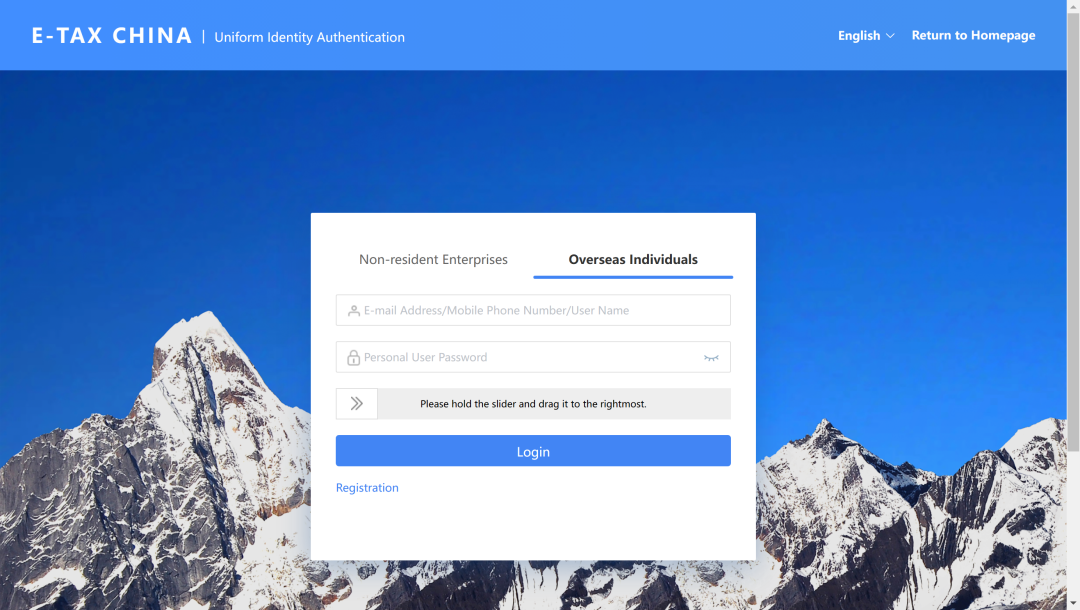

③点击【境外自然人登录】,切换境外自然人登录入口;

Click on "Overseas Individuals " and switch to "Login";

④用户输入邮箱地址、个人用户密码,完成滑块验证,点击【登录】,完成境外自然人登录。

Enter the email address and Password, complete the slider verification, and click on “Login” to complete login.

(2) 非居民企业登录

Non-resident Enterprise Login

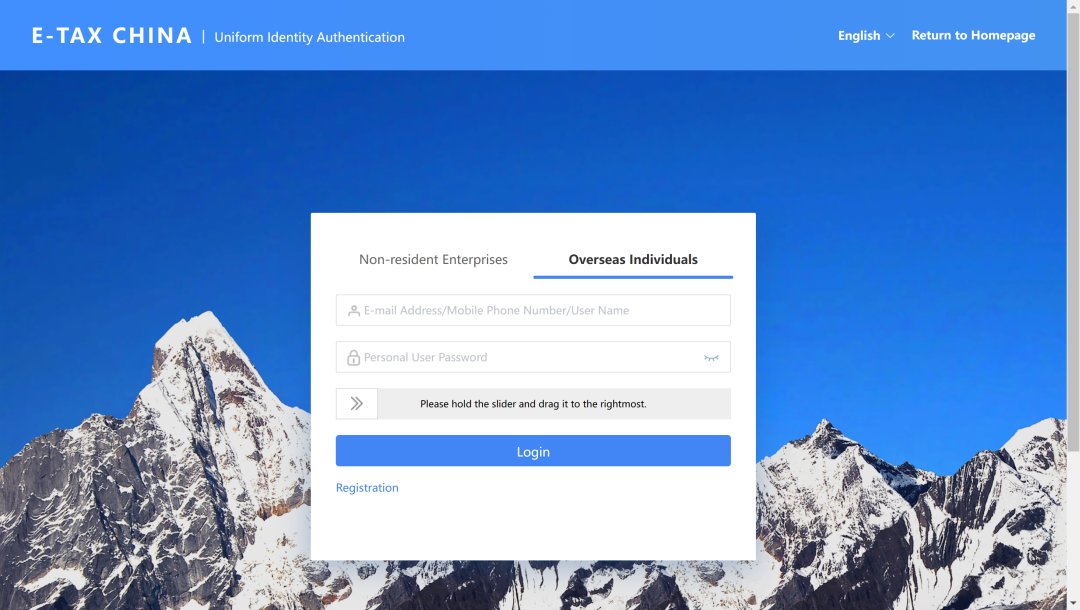

①打开电子税务局登录页面,点击右上方按钮切换成英文语言;

Open E-tax China, and click on the top right button to switch to English;

②点击【非居民企业】,切换非居民企业登录入口;

Click on "Non-resident Enterprise" to see the "Login" portal.

③用户输入非居民企业身份码、邮箱地址/手机号码/用户名和个人用户密码,完成滑块验证,点击【登录】,完成非居民企业登录。

Enter the Non-resident Enterprises Identification Number, Email address/Mobile phone number/User name and Password to complete the slider verification, and click on “Login” to complete login.

操作指引

第三步

非居民企业身份信息采集

Non-resident Enterprise

Information Collection

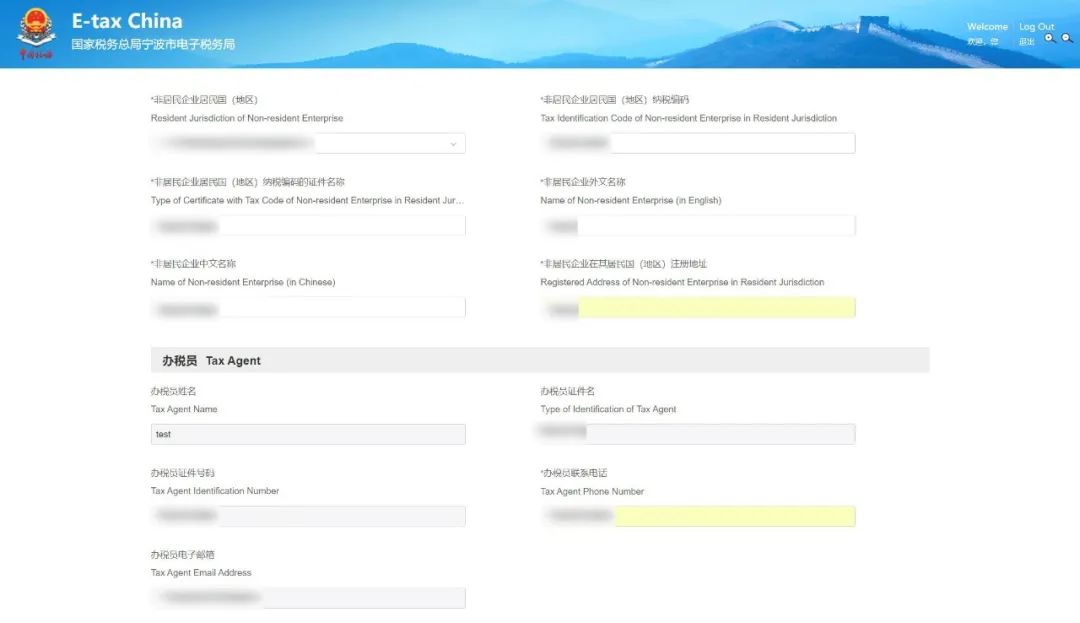

(1)进行自然人身份登录,详细操作详见本文档为“第二步:境外自然人登录”章节。

Complete Overseas Individuals login first. For detailed operations, see "step 2 Overseas Individuals Login".

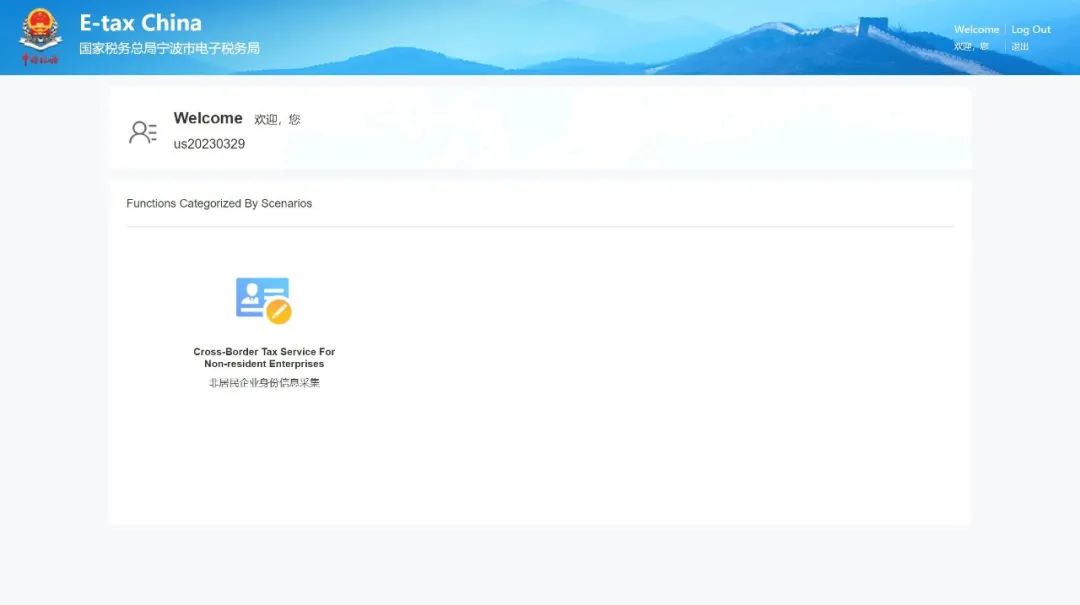

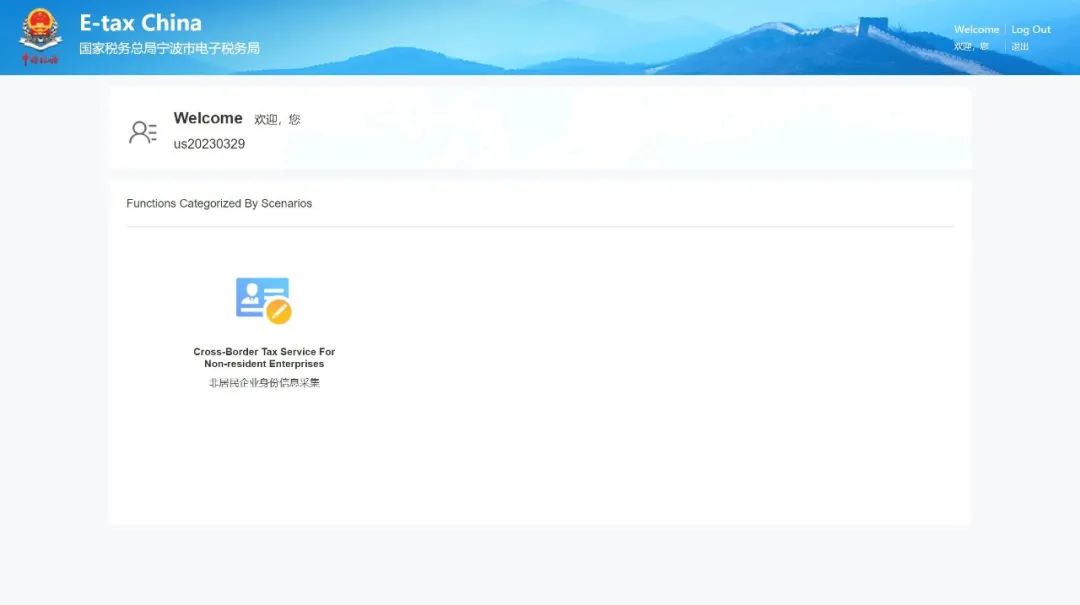

(2)登录后,在首页点击【非居民企业身份信息采集】功能菜单。

After logging in, click on the “Non-resident Enterprise Information Collection” menu on the home page.

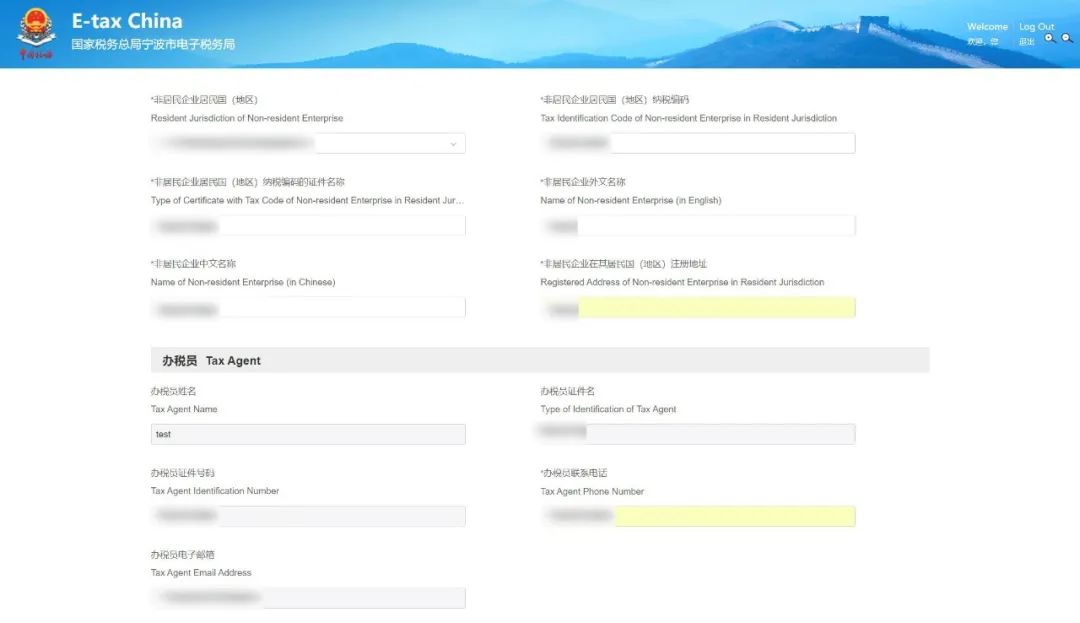

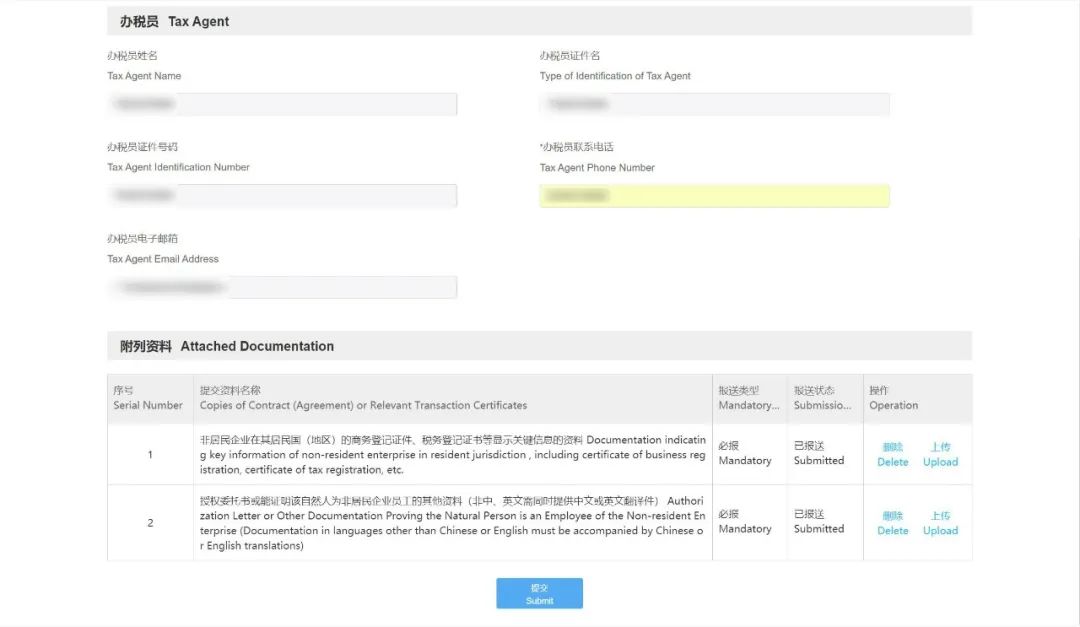

(3) 系统跳转至非居民企业信息采集界面,手动录入相关信息,若缺少“办税员联系电话”或“办税员电子邮箱”信息需进行手动补录。

Enter relevant information on the page of Non-resident Enterprise Information Collection. If the "Tax Agent Phone Number" or "Tax Agent Email Address" is missing, please manually enter it/them.

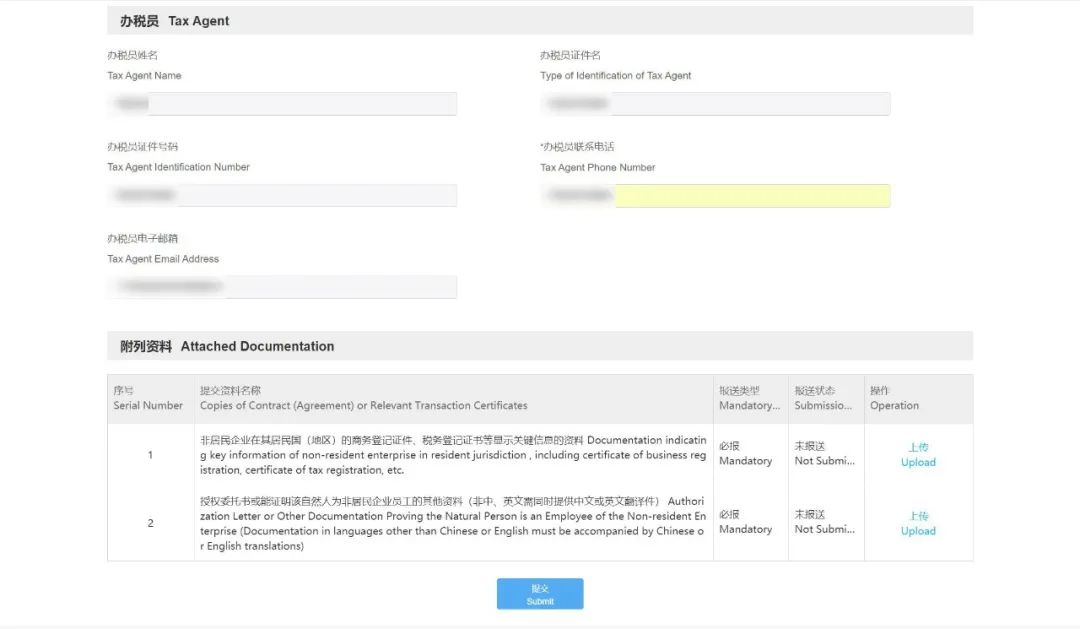

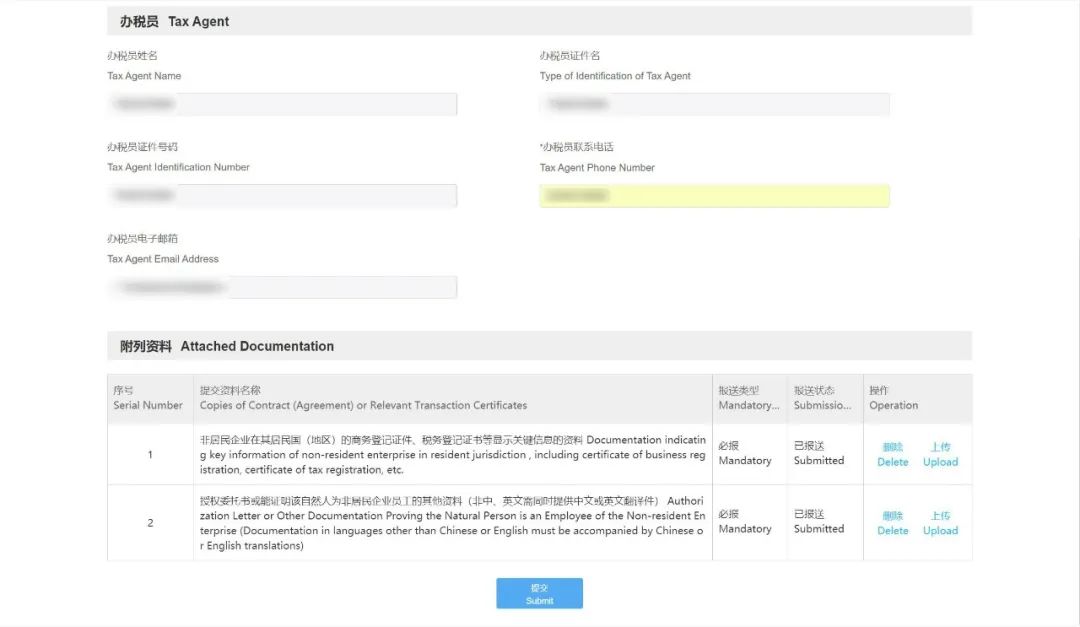

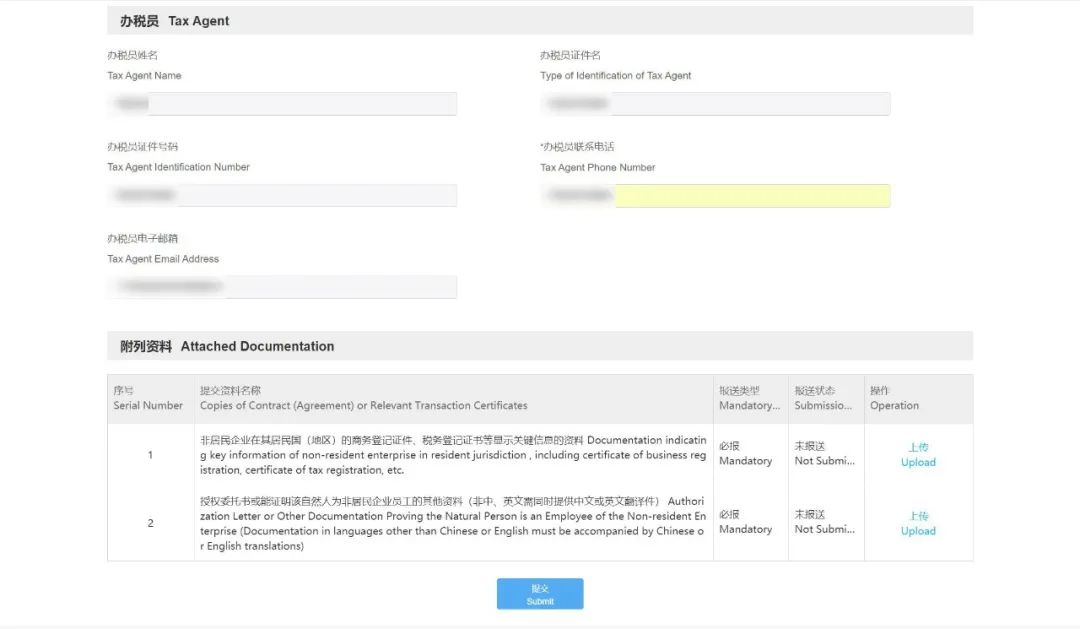

(4)点击【上传】进行对应附列资料的上传。

Click on “Upload” to upload Attached Documentation.

(5) 填写完成后,点击【提交】按钮。

Click on “Submit” after completing the filling.

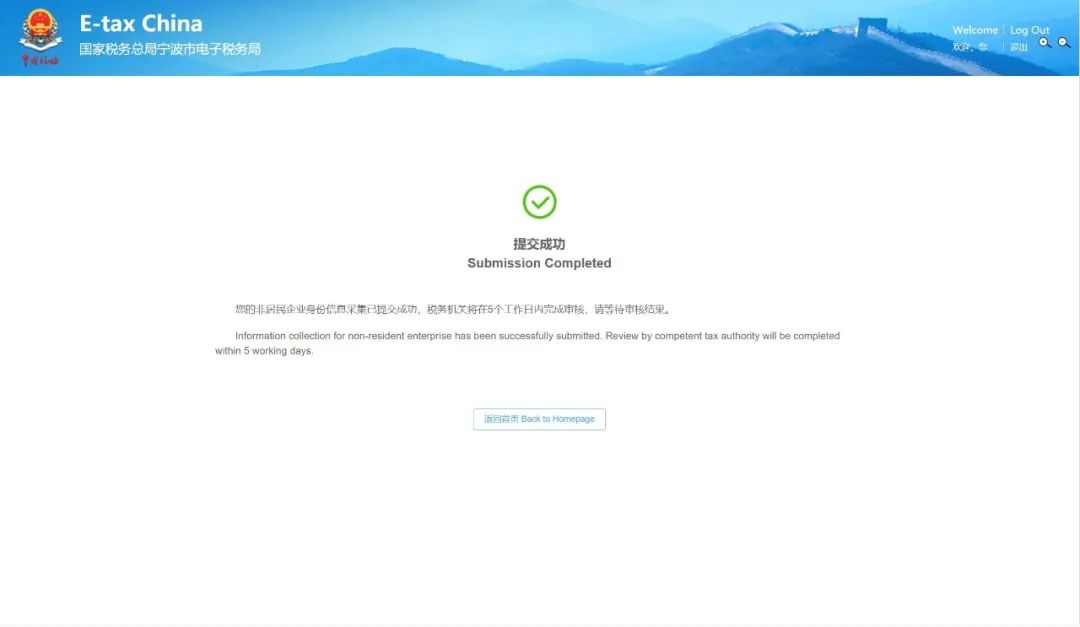

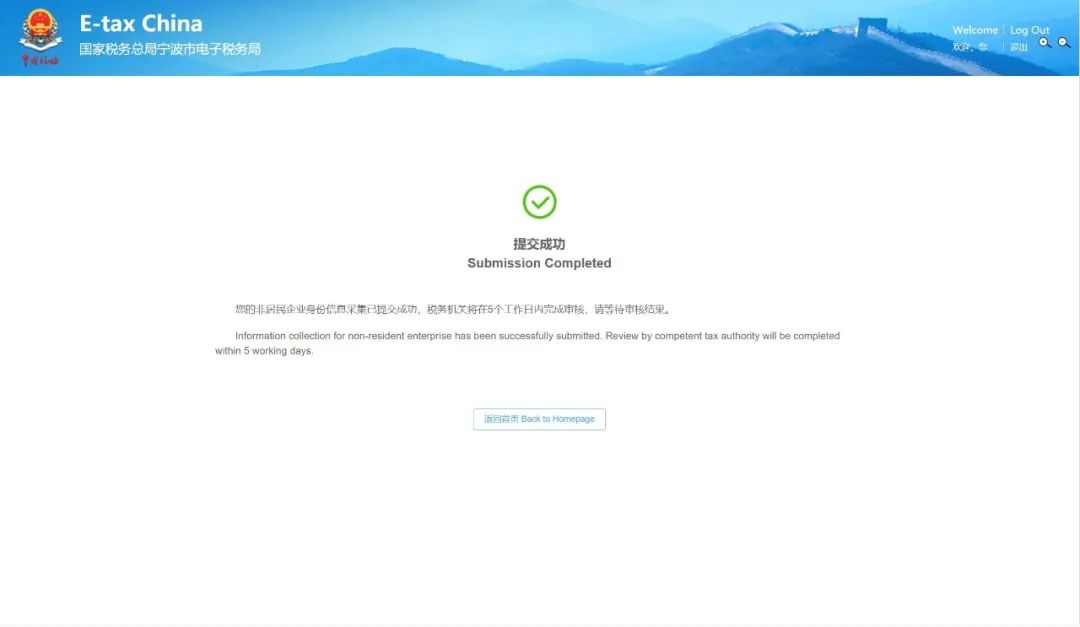

(6)提交成功,系统提示“您的非居民企业身份信息采集已提交成功,税务机关将在1个工作日内完成审核,请等待税务机关审核结果”。

If the submission is successful, the system will prompt “Information for non-resident enterprise has been successfully submitted. Review by the tax authority in charge will be completed within 1 working day.”

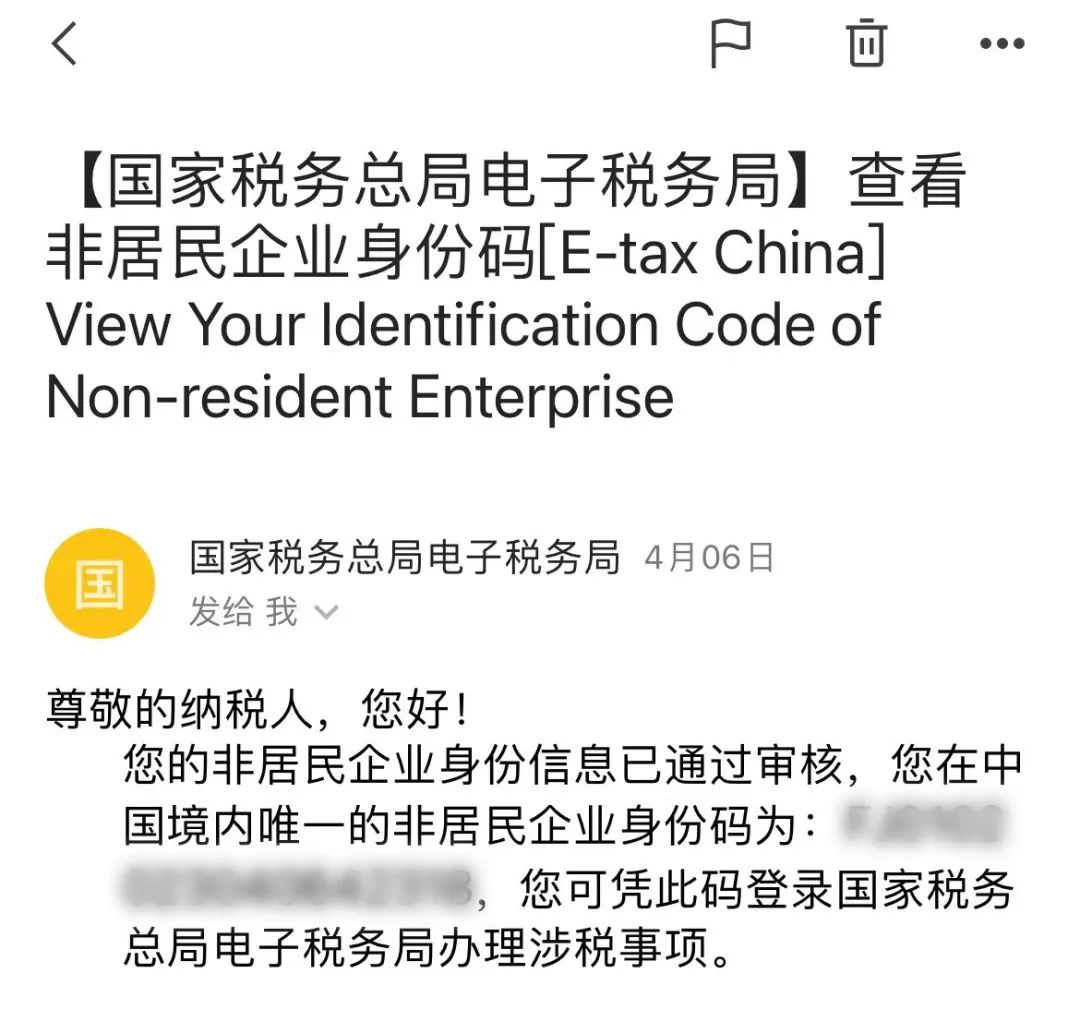

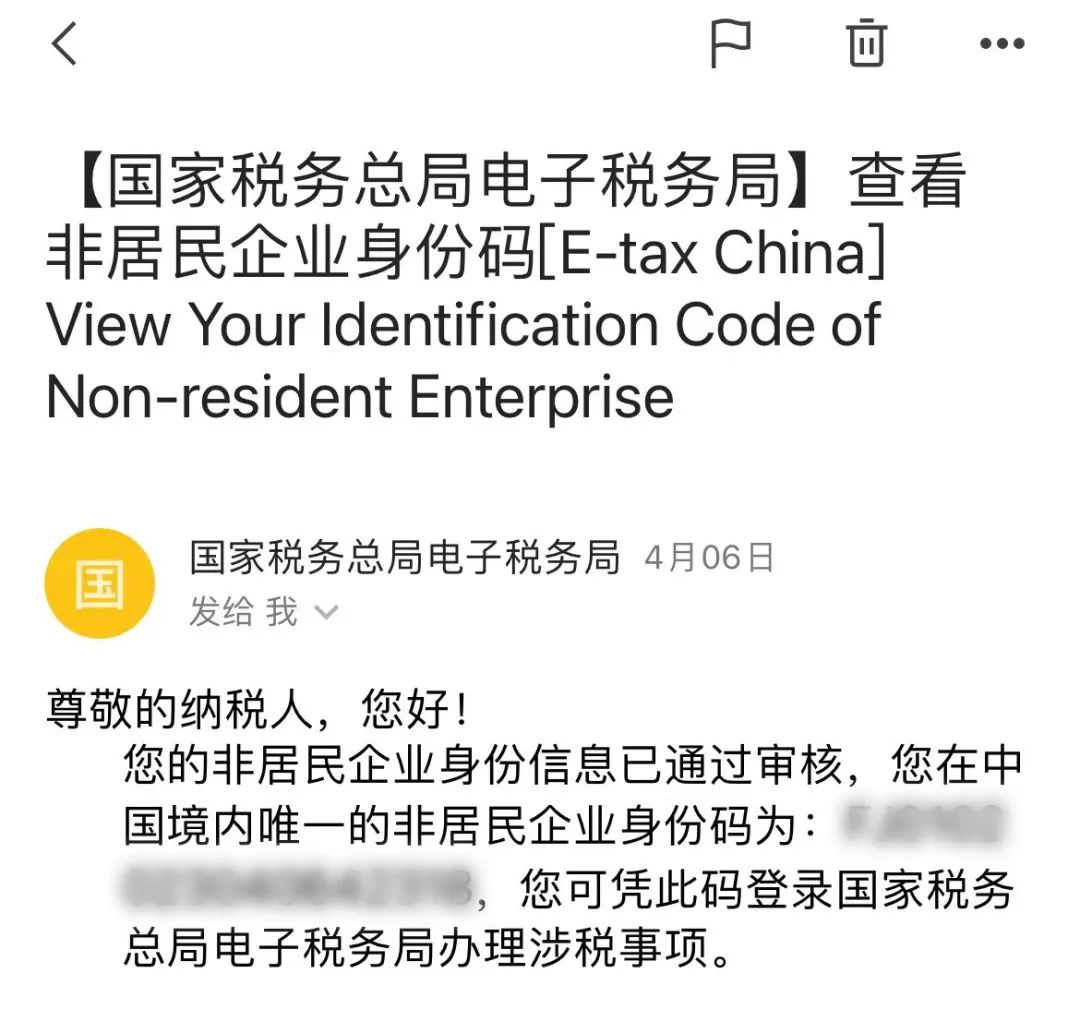

(7)当审核通过后,可通过邮箱或电子税务局站内信查看结果并获取到“非居民企业身份码”。

Check the result and get the Identification Code of Non-resident Enterprise through Email or internal mail of E-Tax China after the review is completed.

操作指引

第四步

非居民企业跨境办税

Cross-border Tax Service for

Non-resident Enterprises

(1)通过“非居民企业身份码”进行非居民企业登录,详细操作详见本文档 “第二步:非居民企业登录”章节。

Enter the “Identification Code of Non-resident Enterprise” to log in Non-resident Enterprise account, see step 2 Registration of Non-resident Enterprises for details on instructions.

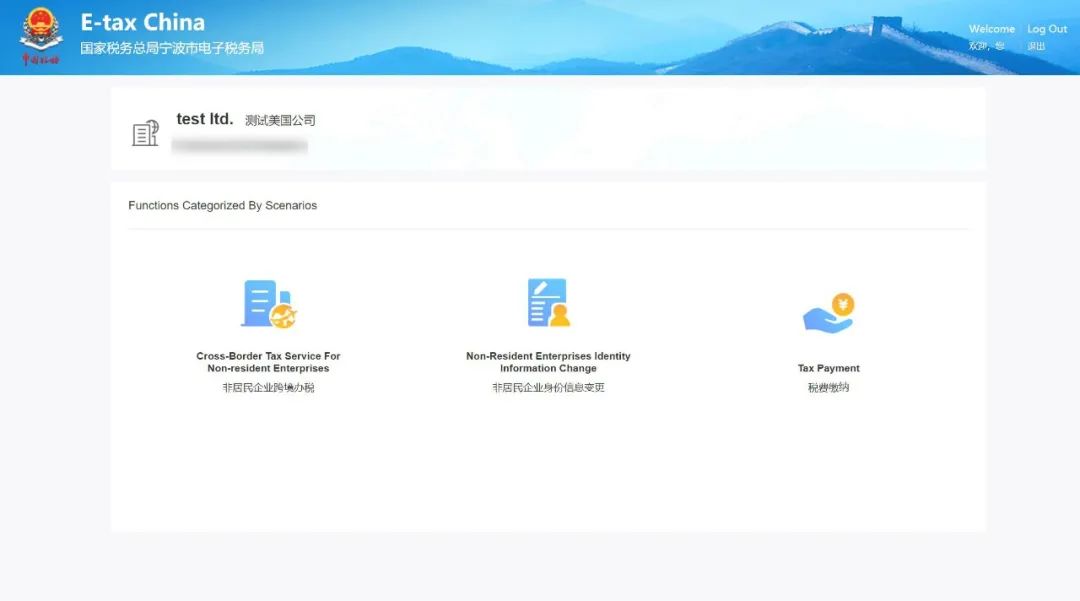

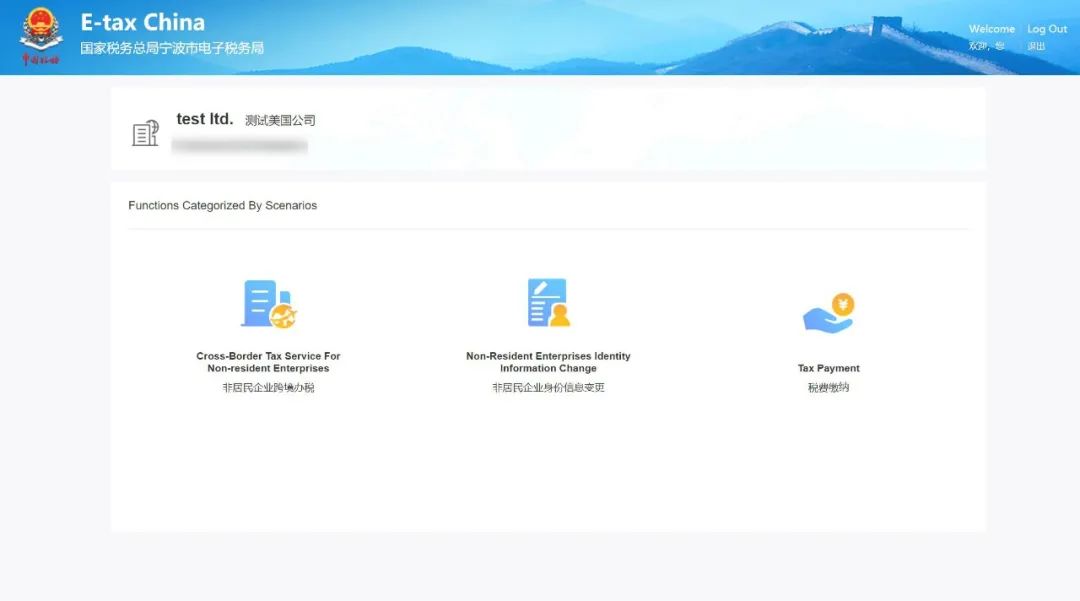

(2)登录后进入首页,点击“非居民企业跨境办税”。

After logging in, please click on “Cross-border Tax Service for Non-resident Enterprises” on the homepage.

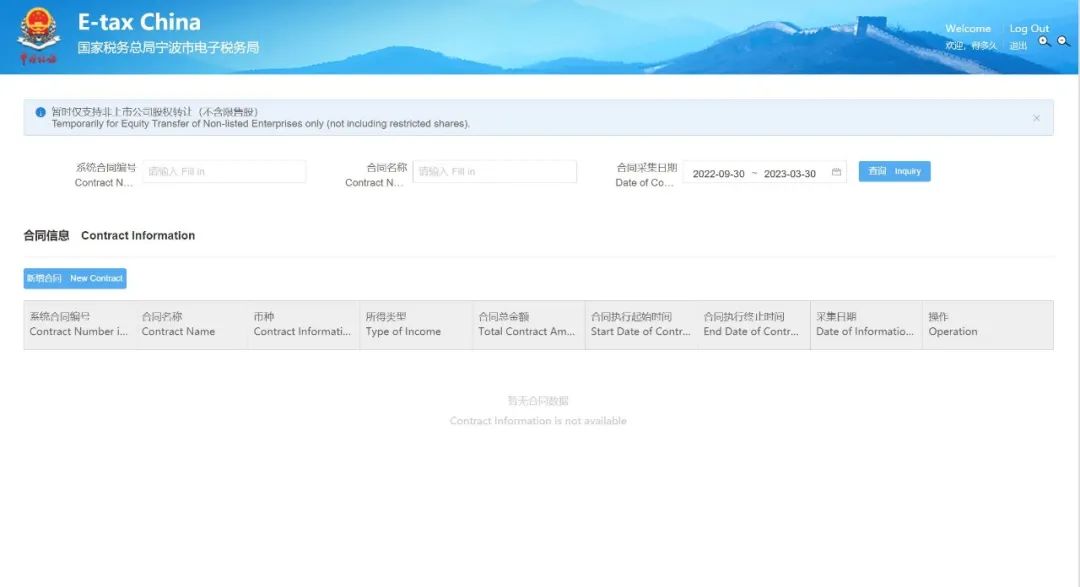

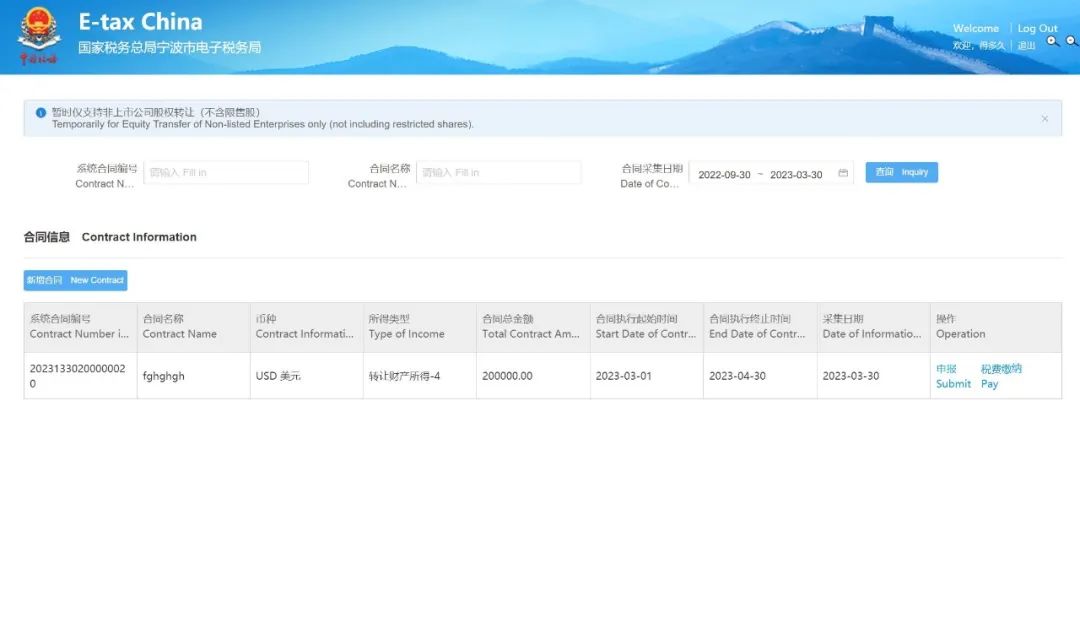

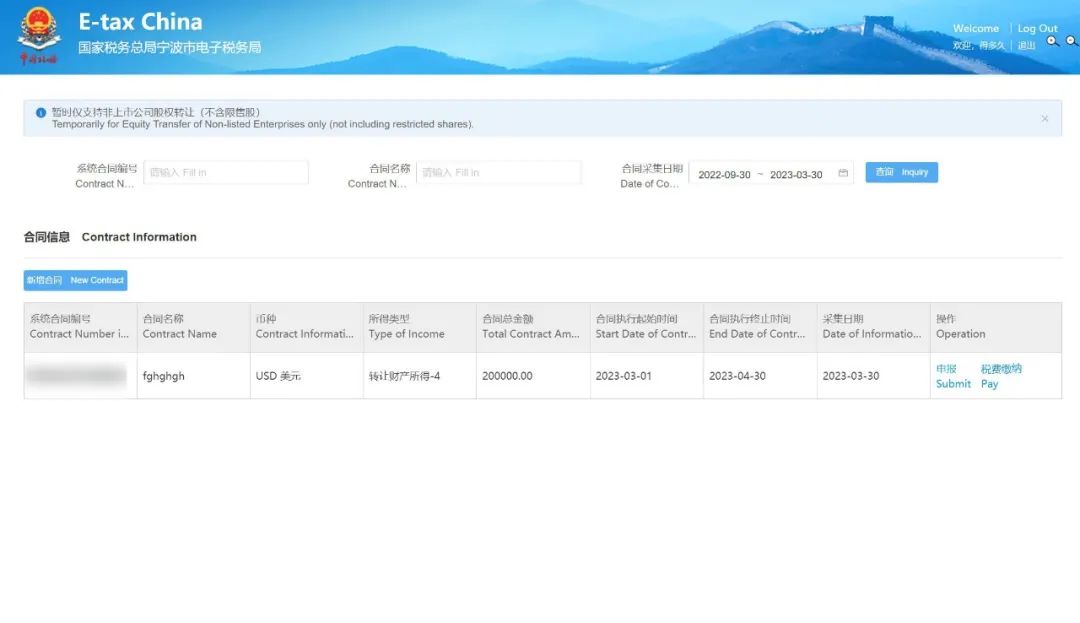

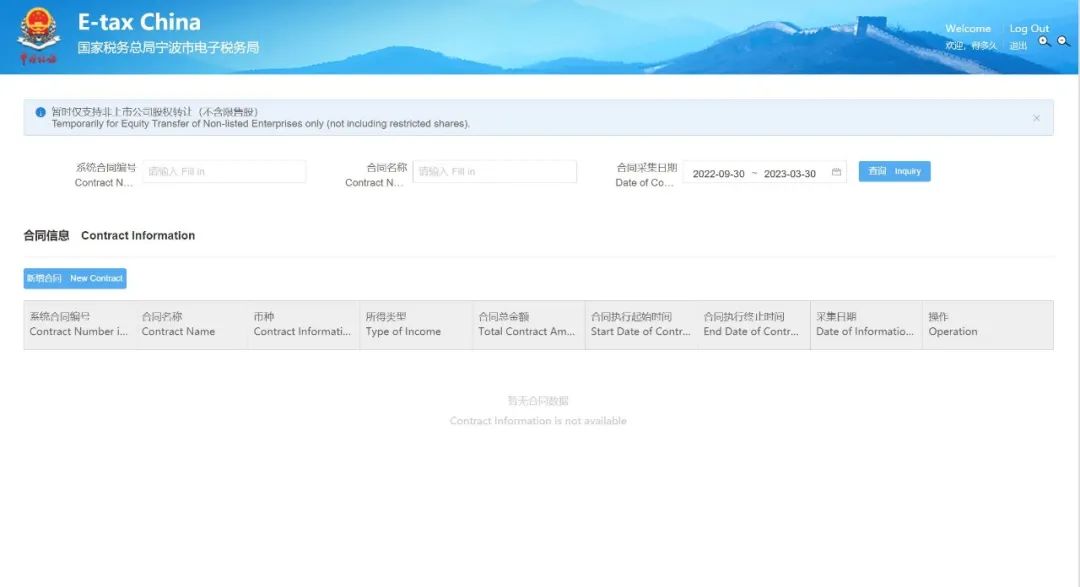

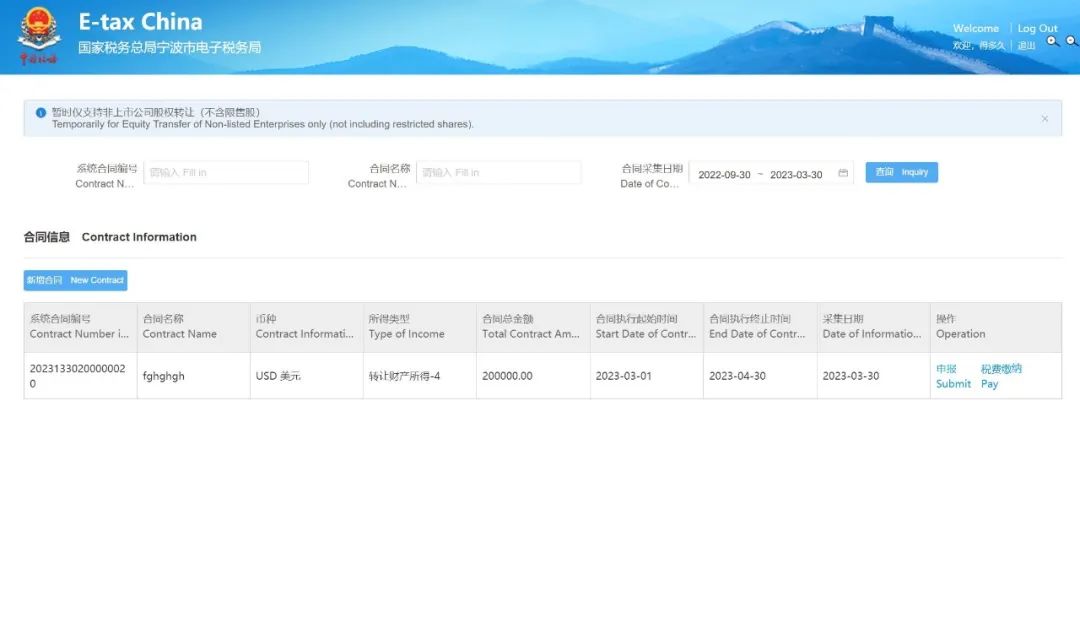

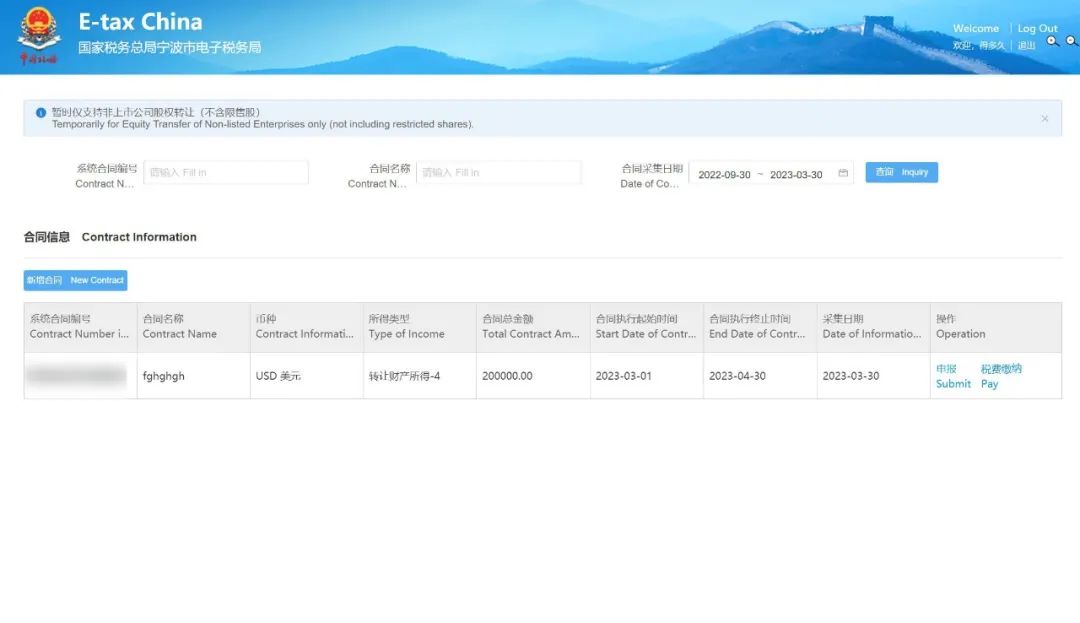

(3)进入“非居民企业跨境办税”页面;当存在合同时,会自动带出合同列表;当无合同时,可点击新增合同。

Enter the page of “Cross-border Tax Service for Non-resident Enterprises”. If contracts exist, the contract list will be automatically displayed. Otherwise, click on "Add New Contract".

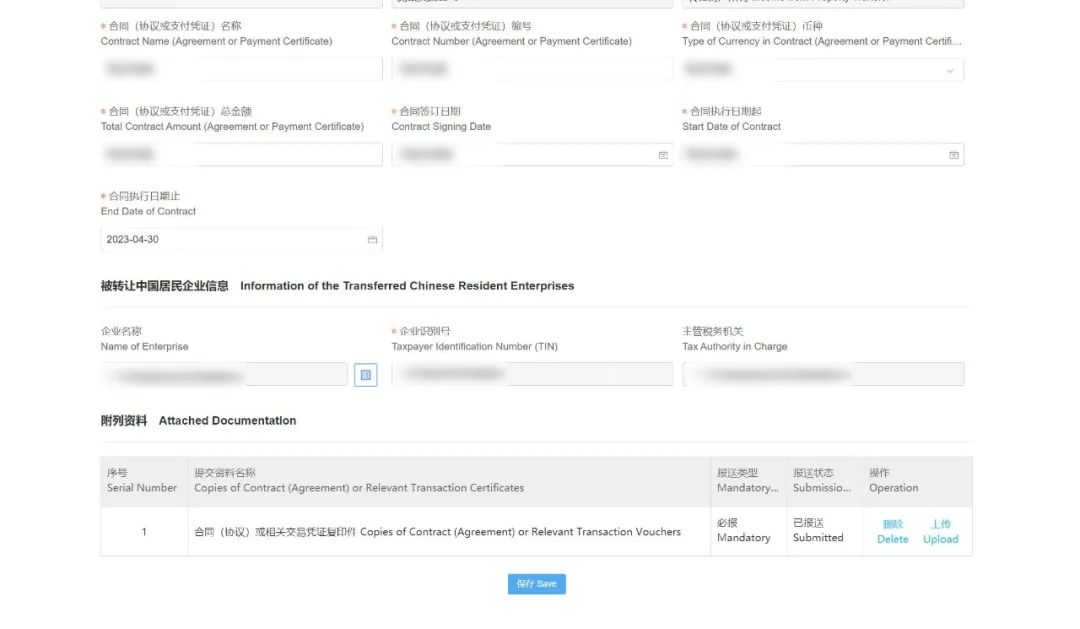

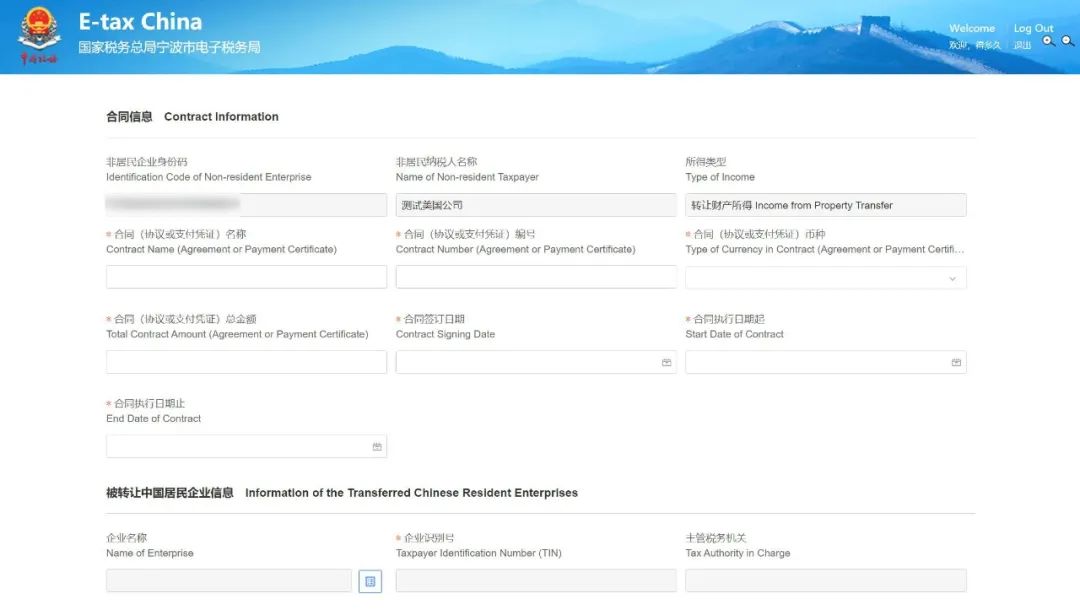

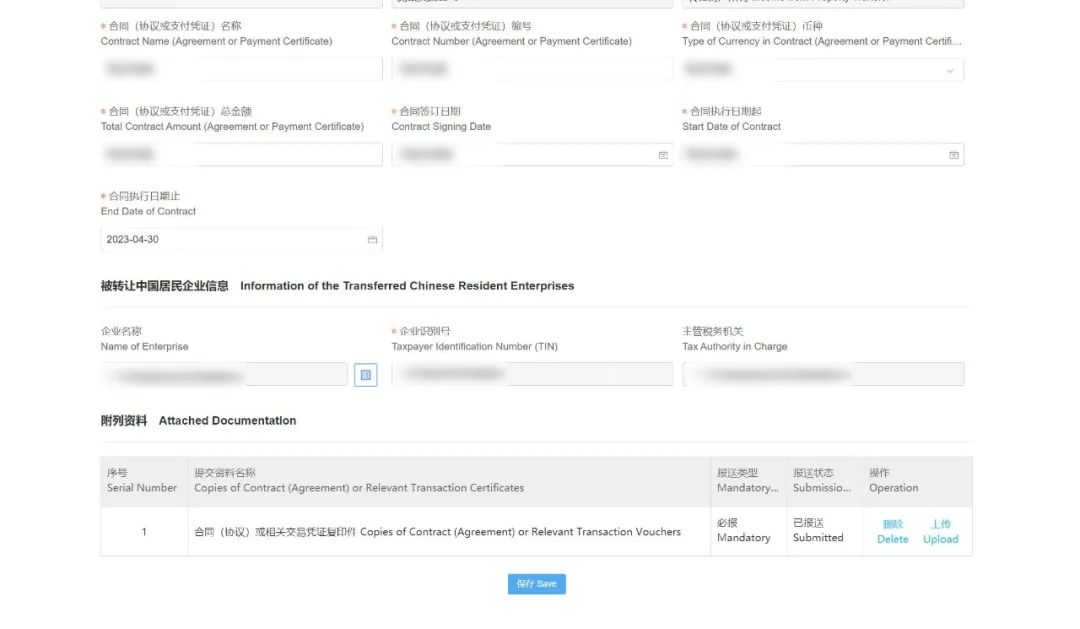

(4)点击【新增合同】或【去新增】按钮,进入合同采集页面,录入合同相关信息、选择被转让的中国居民企业信息、上传附送资料等。具体操作如下:

Click on “New Contract” or “Add new contract” to enter the page of “Contract Information Collection”. Enter the Contract Information, select the Information of the Transferred Chinese Resident Enterprises and upload the Attached Documentation, etc. The detailed operating steps are as follows:

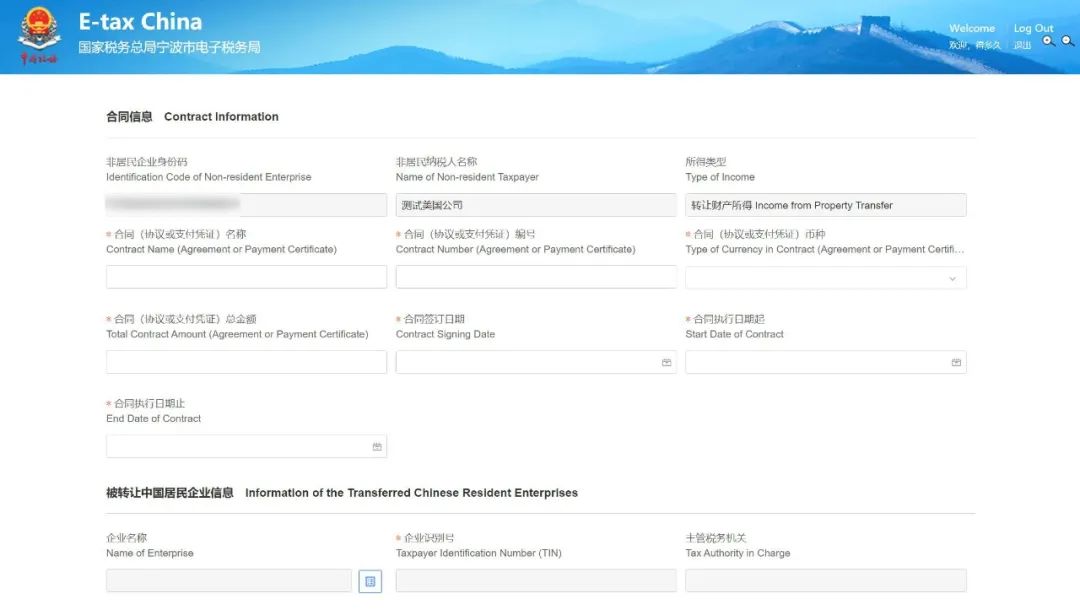

①录入合同相关信息;

Enter the contract information;

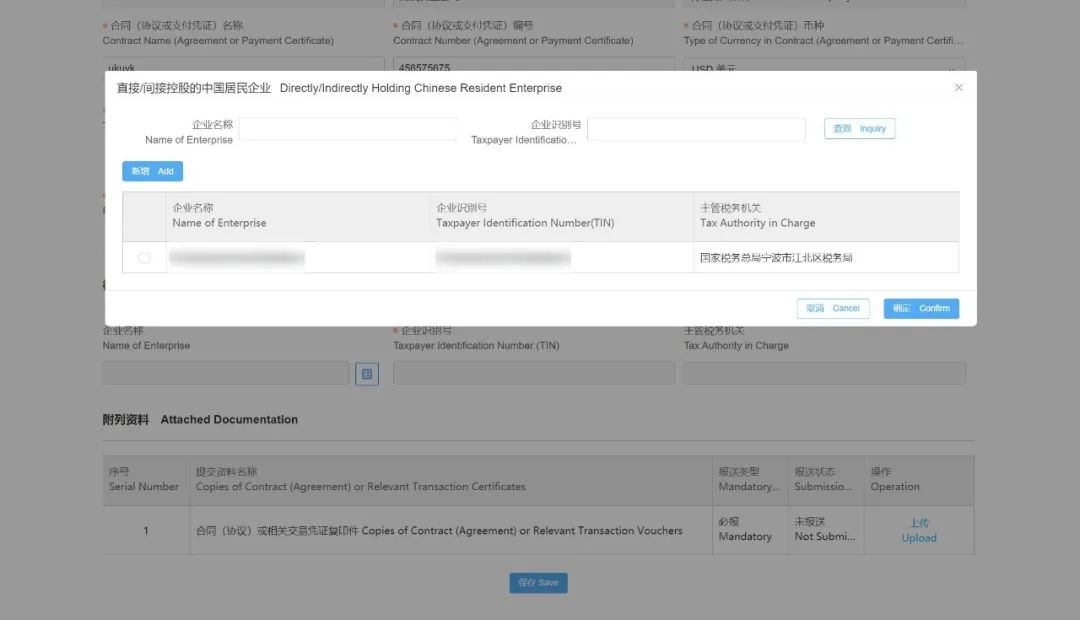

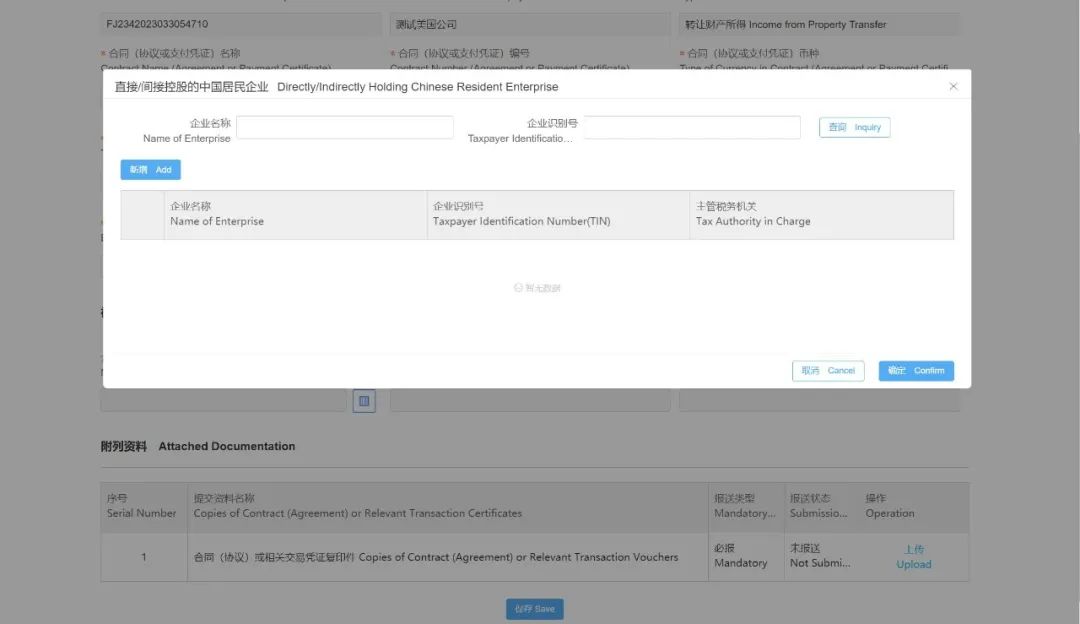

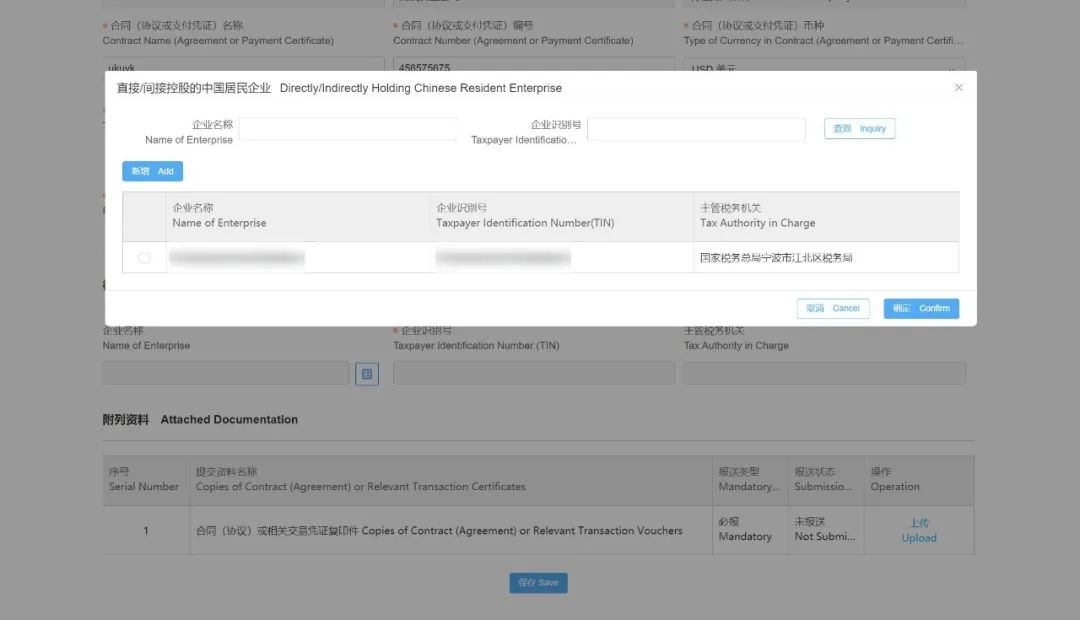

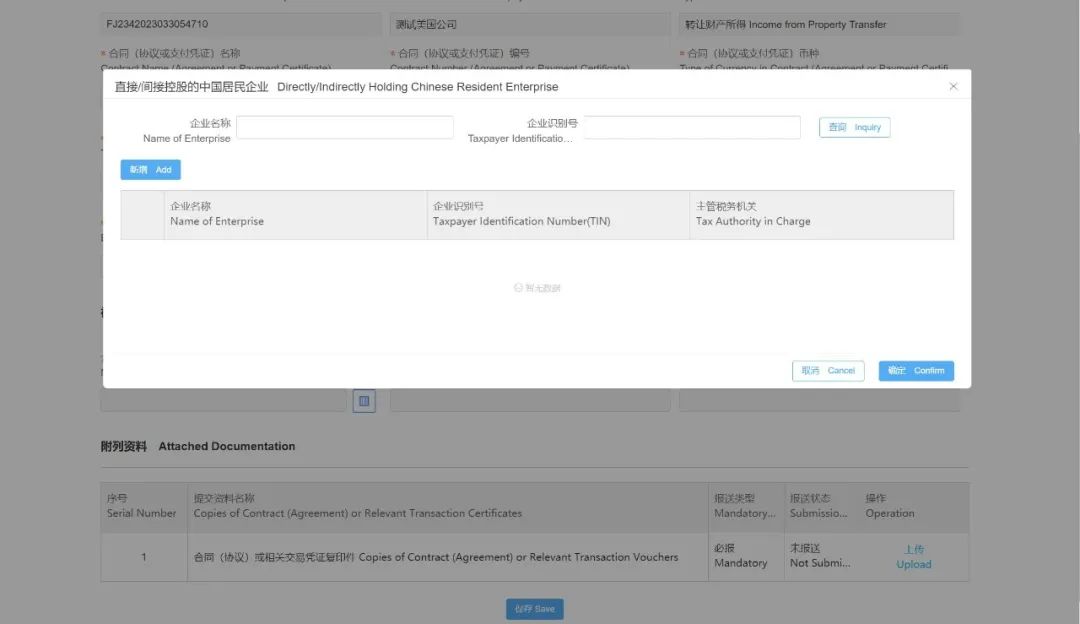

②选择“被转让的中国居民企业信息”,在弹窗页面显示了已有的直接/间接控股的中国居民企业,可以直接勾选,点击【确定】按钮;

Select the “Information of the Transferred Chinese Resident Enterprises”, the pop-up will display the Directly/Indirectly Holding Chinese Resident Enterprise. You can check directly and click on “Confirm”;

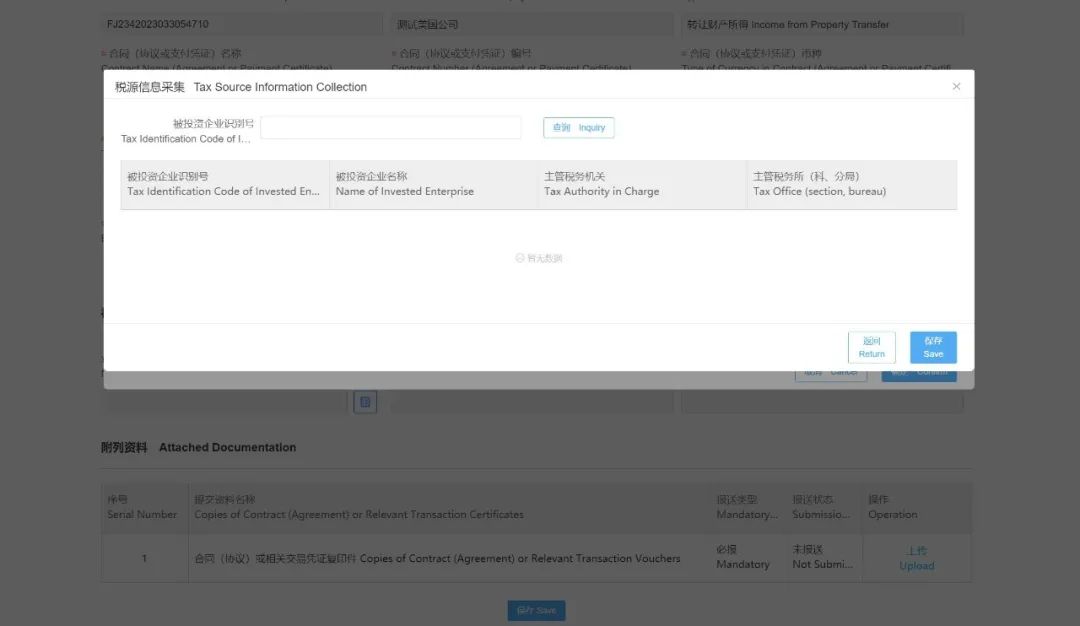

如果没有“直接/间接控股的中国居民企业”信息,可点击【新增】,跳转至“税源信息采集”页面,新增税源后再重新新增合同。

If there is no information of the “Directly/Indirectly Holding Chinese Resident Enterprise”, you can click on “Add”, then the page will turn to “Tax Source Information Collection”. After adding tax source, you can add a new contract.

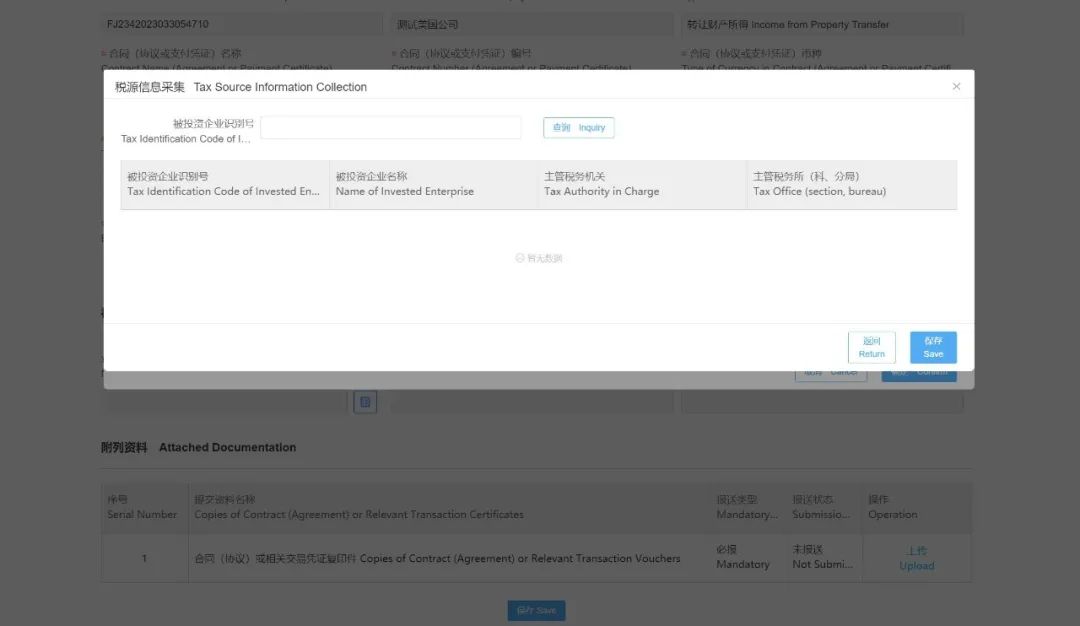

③在“税源信息采集”页面,点击【新增】按钮录入“被投资企业识别号“即可自动带出相关信息,点击【保存】按钮即可完成新增。

On the page of “Tax Source Information Collection”, click on “Add” and enter the “Tax Identification Number of Invested Enterprise”, the relevant information will be automatically displayed. Please click on “Save” to complete the addition.

(5)在附送资料列表,需要上传“合同(协议)或相关交易凭证复印件”,点击【上传】按钮,选择文件即可。

In the list of attached documentation, you need to upload Copies of Contract (Agreement) or Relevant Transaction Certificate. Click on “Upload” and select the file.

(6)当完成合同采集后,点击【申报】,则跳转至税费智能计算页面。

After completing contract information collection, click on“Submit” to enter the page of intelligent tax calculation.

(7)也可以点击【保存】,跳转至合同信息列表页面。

Or click on “Save” to enter the contract information list page.

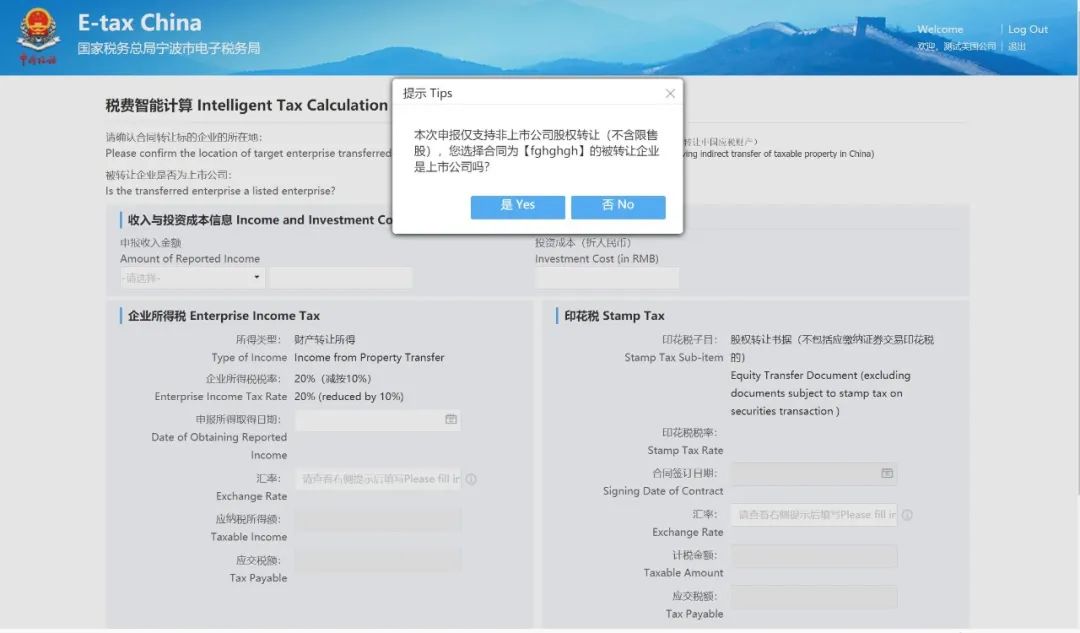

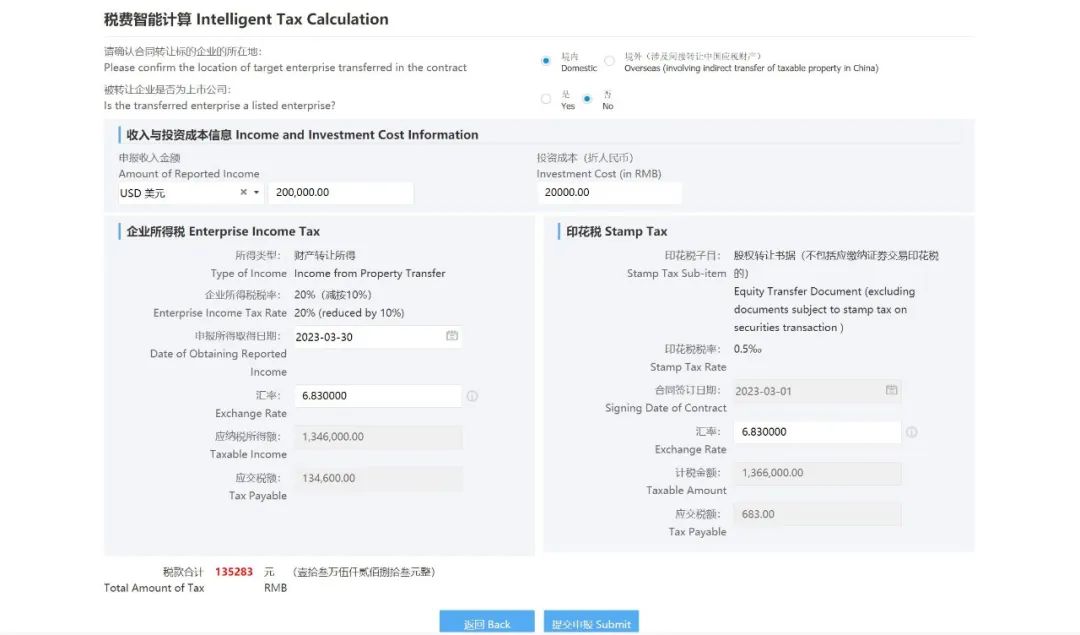

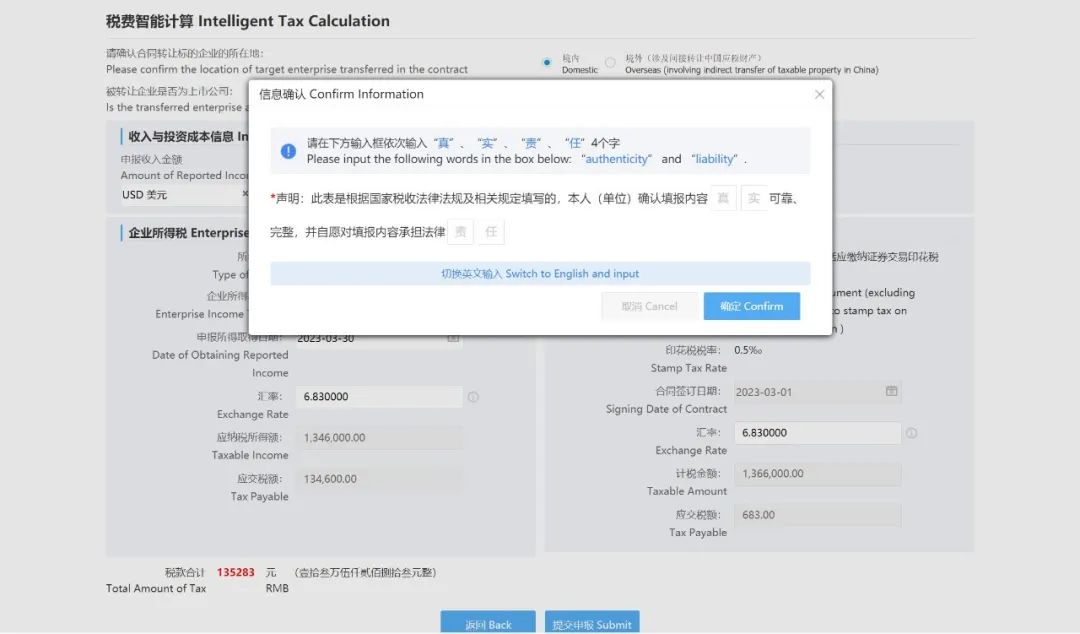

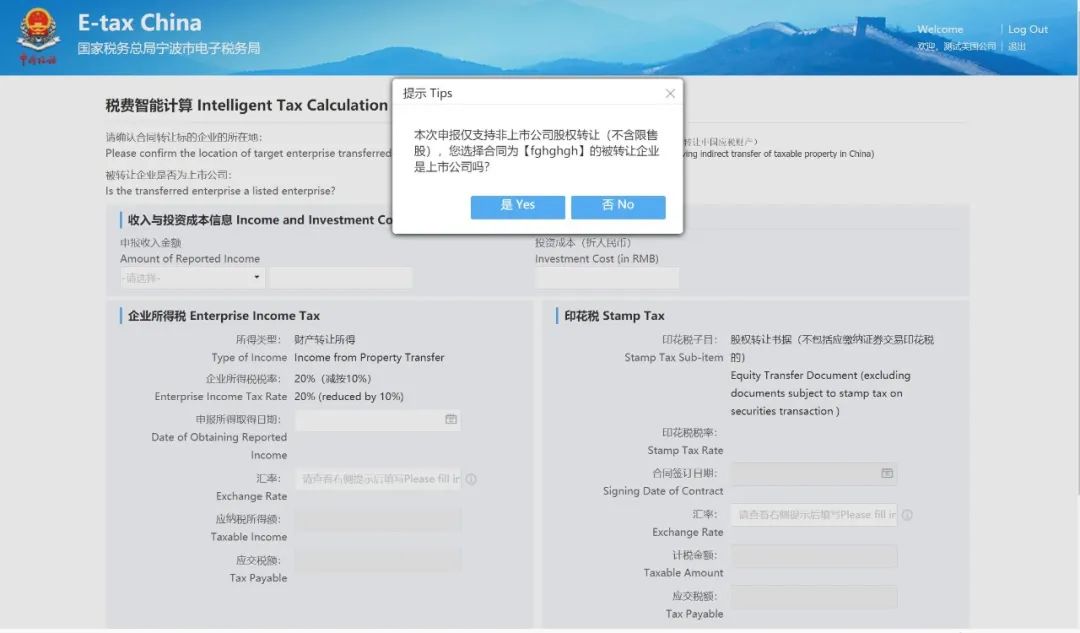

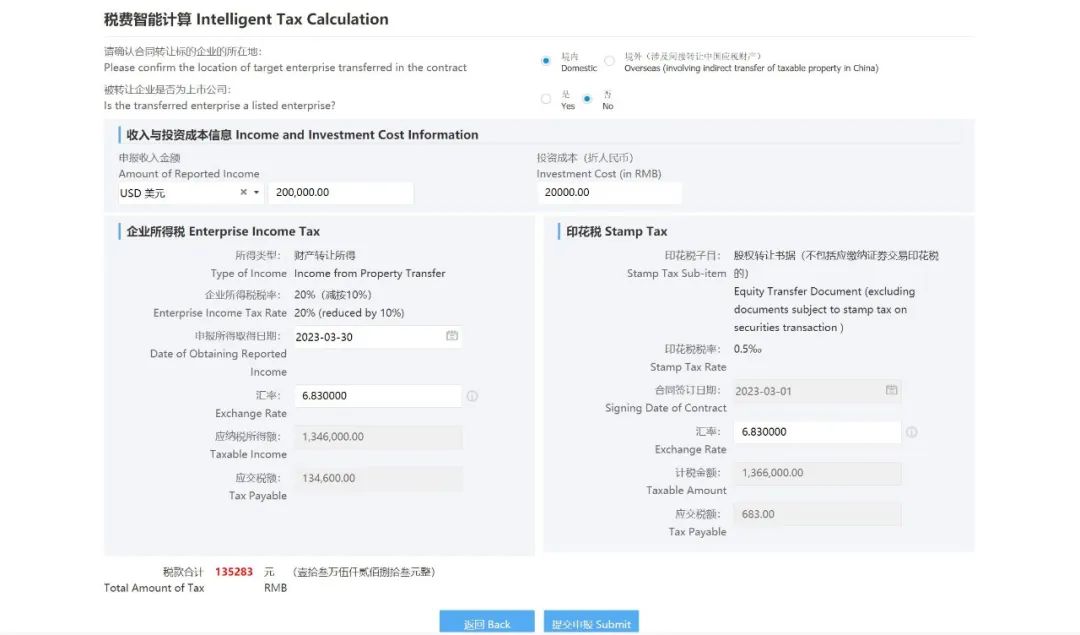

(8)税费智能计算页面,录入相关信息,点击【计算】按钮。

Enter relevant information on the intelligent tax calculation page and click on “Calculate”.

(9)确认计算结果无误后,点击【提交申报】;若录入有误,则可点击【重新计算】重新录入相关信息。

After confirming the calculation results, click on “Submit”. If there is an error(s), click on“Recalculate” to reenter relevant information.

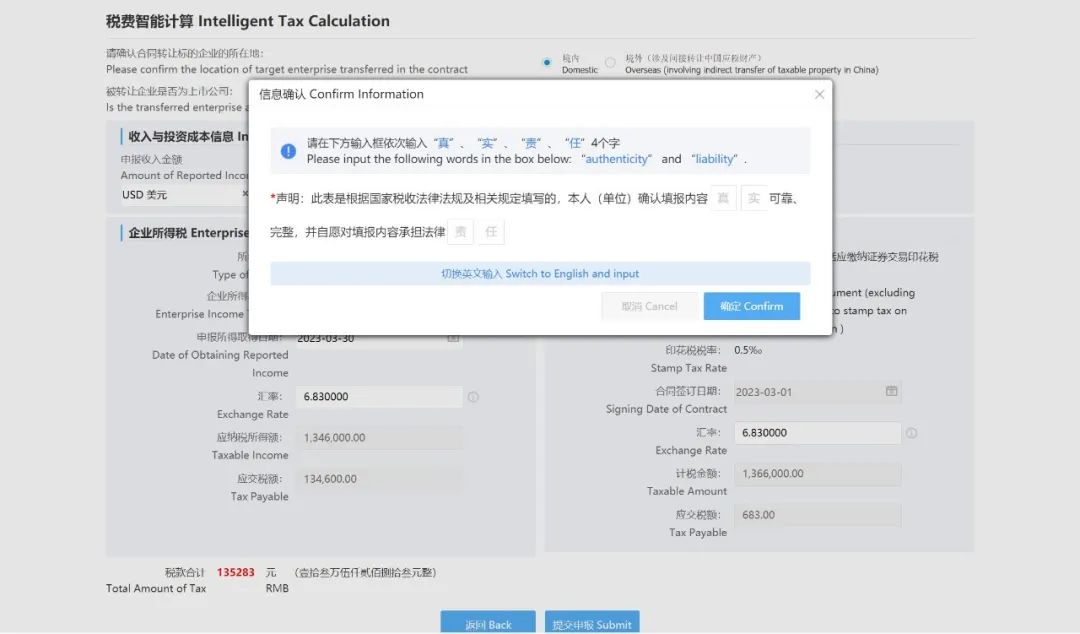

(10)点击【提交申报】后,弹窗显示信息确认声明页面,需要按要求录入信息,并点击【确定】按钮;可切换中文/英文输入;

After clicking on “Submit”, there is a pop-up to confirm information. You must enter the required information and click on“Confirm”. The input language is switchable between Chinese and English.

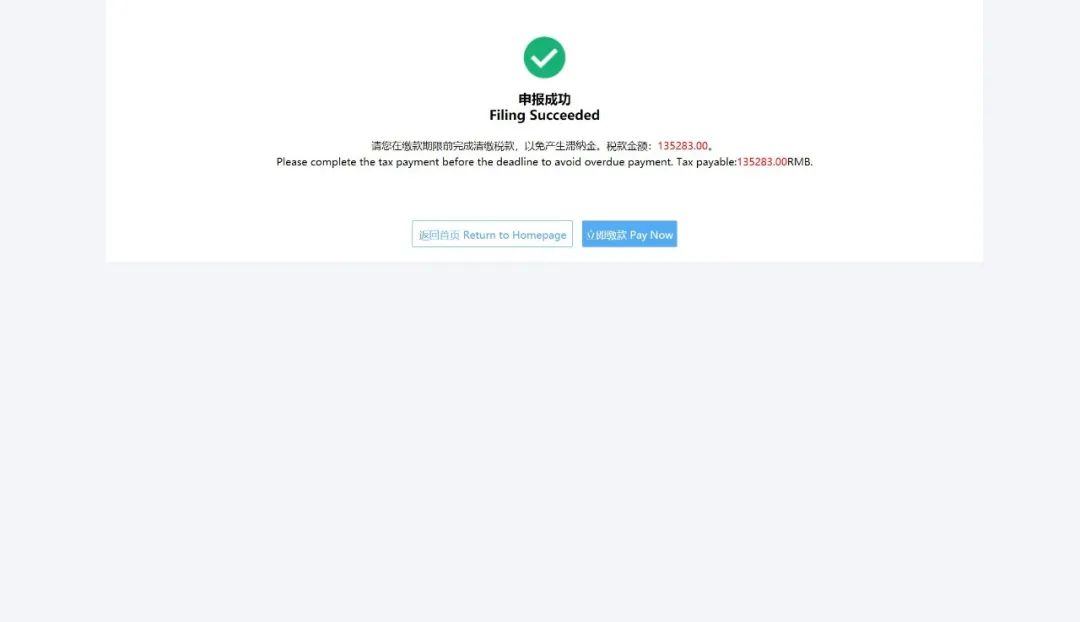

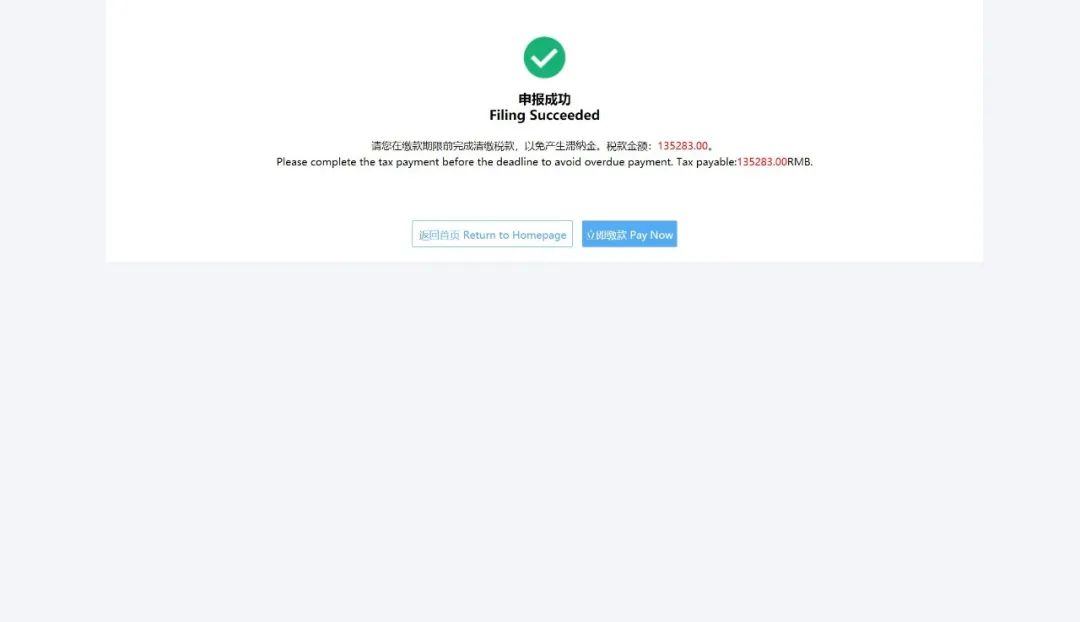

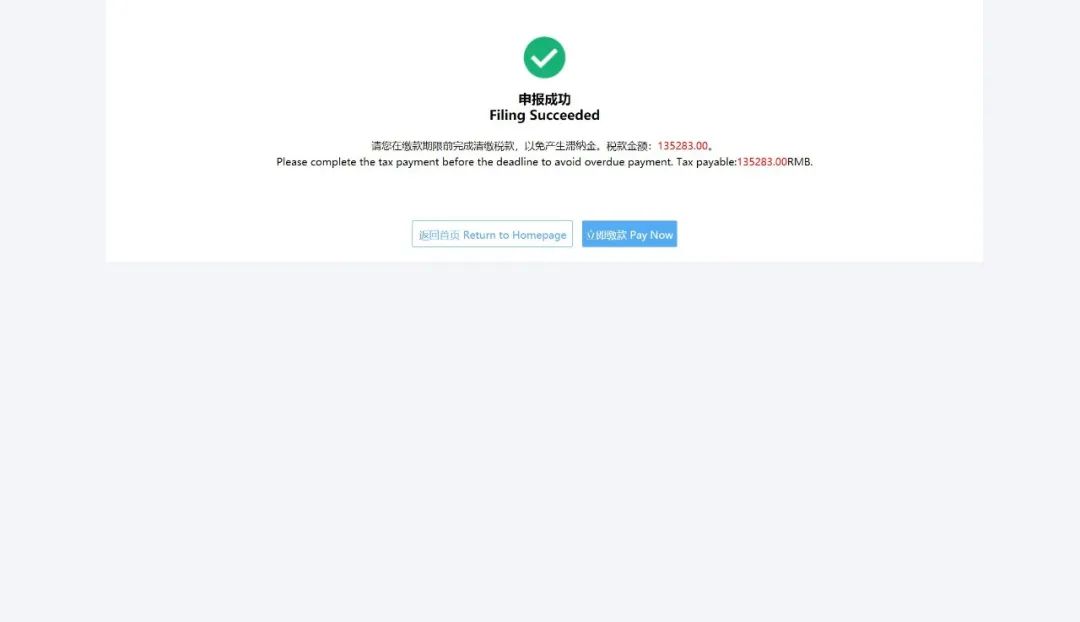

(11)申报成功,点击【立即缴款】即可跳转至缴款页面。

After filling succeeded, click on“Pay Now” to enter the payment page.

操作指引

第五步

跨境缴款

Cross-Border Payment

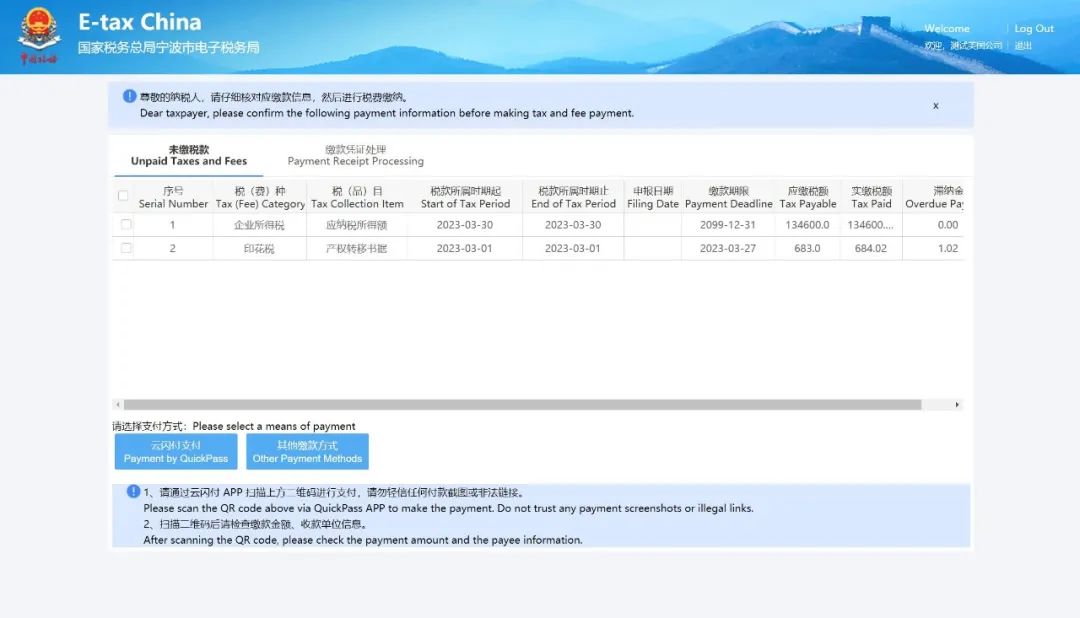

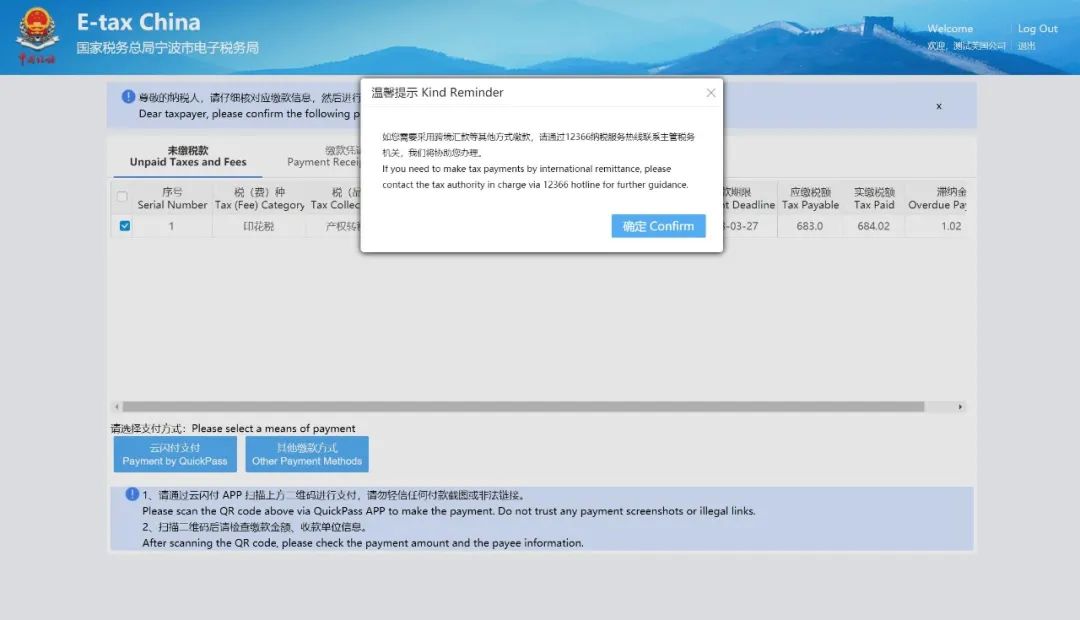

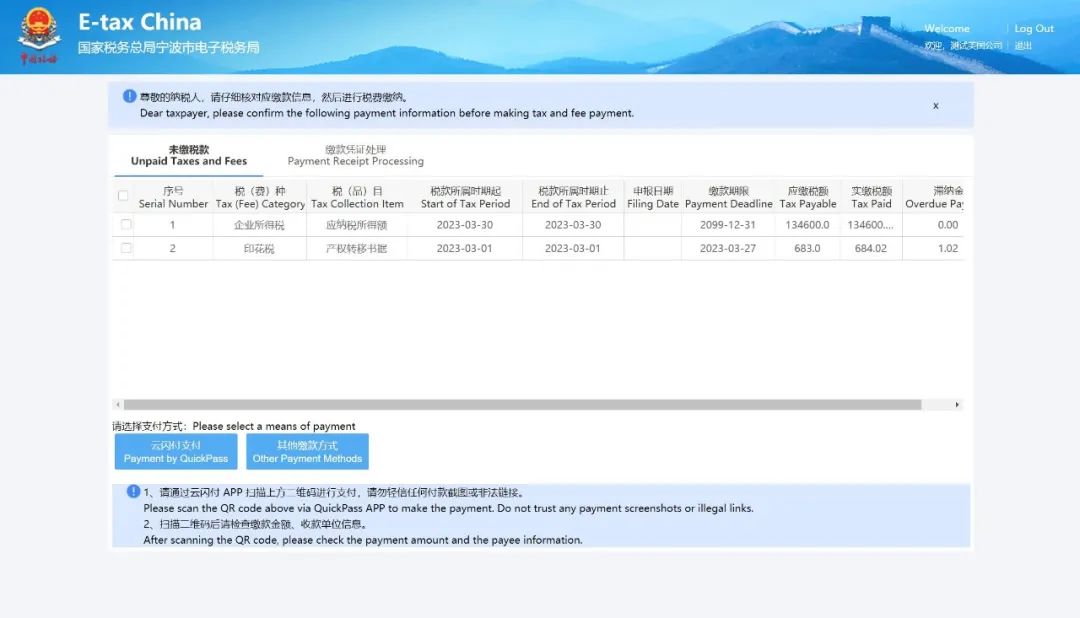

(1)点击【立即缴款】,进入税费缴纳界面。

Click on “Pay Now”, and enter the “Tax payment” page.

(2)勾选需要缴款的记录,系统默认为全勾选。

Check the records to be paid. All records are checked by default.

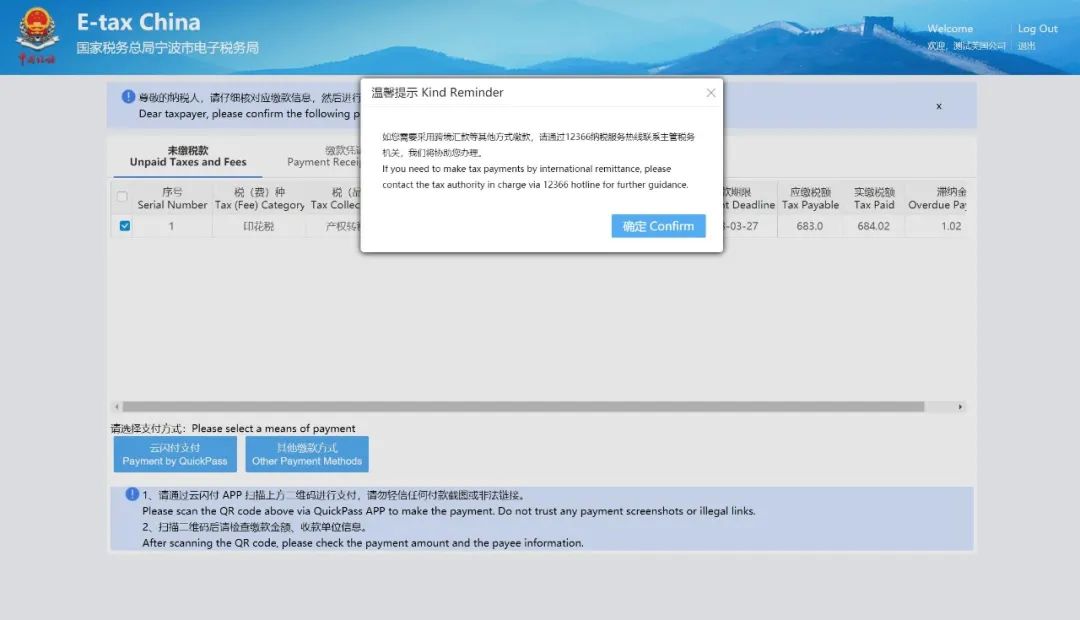

(3)选择支付方式,支持云闪付等方式。

Select the means of payment. QuickPass and Other Payment Methods are available.

(4)点击【立即缴款】

Click on “Pay Now”.

如选择“云闪付”方式,弹出云闪付确认界面,显示对应的缴款信息,核对确认无误后点击【扣款】。

If you choose “Payment by QuickPass”,“Payment by QuickPass” confirmation page will pop up, displaying the corresponding payment information. Click on “Payment” after confirmation.

系统弹出扫描支付缴税界面,请通过云闪付APP扫描二维码进行支付。

Then it will pop up the Scanning for payment page, please scan the QR code via QuickPass App to complete tax payment.

(5)缴款成功。

The payment is completed successfully.

操作指引

如有问题请联系纳税服务热线12366,非常感谢您对我们工作的信任与支持。

If you have any questions, Please contact taxation service hotline 12366.Thanks for your trust and support of our work.

来源:镇海税务、江北税务

一审:骆冰,杨涛 二审:金鑫,竺继荣

三审:钱正平 四审:周承颖

|

-

|

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

【全网最全】31个省市!残保金政策汇编及申

【全网最全】31个省市!残保金政策汇编及申

全网最全|2022年失业保险稳岗补贴政策汇总

全网最全|2022年失业保险稳岗补贴政策汇总

2021年个税汇算容易出现哪些错误?税务总局

2021年个税汇算容易出现哪些错误?税务总局

【全网最全】历史上最高规模退税减税!2022

【全网最全】历史上最高规模退税减税!2022