|

|

点击蓝字

关注我们

来源:中国香港税务局官网

编译:思迈特财税国际税收服务团队

Key Features (Other than Economic Substance Requirement) 主要特征(经济实质要求除外)

Example 1-Whether an entity is an MNE entity

示例1:一个实体是否是MNE实体

Company-HK, a company incorporated in Hong Kong, carried on a business in Hong Kong. It was a member of Group-HK which has operations in various jurisdictions in Asia and Europe. It held 100% of the ownership interest in Subsidiary-F, which is a resident of Jurisdiction F. It received dividends from Subsidiary-F in Hong Kong.

公司-HK,是一家在香港注册成立的公司,在香港经营一项业务,其是Group-HK的成员,Group-HK在亚洲和欧洲的多个辖区都有业务。其持有子公司-F100%的所有权权益,而子公司-F是F辖区的居民,其在香港从子公司-F收取股息。

As Company-HK was an entity included in a multinational enterprise (“MNE”) group, it was an MNE entity. The dividends from Subsidiary-F were specified foreign-sourced income received in Hong Kong. Under the new foreign-sourced income exemption (“FSIE”) regime, such dividends could be exempt from profits tax provided that the economic substance requirement was met or the participation exemption applied.

由于公司-HK是一个包含在MNE集团中的实体,它是一个MNE实体。来自子公司-F的股息是在香港收取的指明外地收入。在新外地收入豁免(FSIE)制度下,只要符合经济实质要求或适用参股豁免,这些股息就可以豁免利得税。

Example 2-Whether an entity is an MNE entity

示例2 :一个实体是否是MNE实体

Fund F was an investment fund established in Jurisdiction F. It had an office in Hong Kong and carried out in Hong Kong various transactions in shares of companies in Jurisdiction G. It received in Hong Kong dividends and disposal gains from Jurisdiction G. Following the accounting standards of Jurisdiction F, Fund F did not consolidate with its investee companies in preparing its financial statements.

F基金是一个在F辖区成立的投资基金,它在香港设有办公室,并在香港从事辖区G公司股票的各种交易,它在香港收取来自G辖区的股息和处置收益。按照F辖区的会计准则,F基金在编制财务报表时没有与其被投资公司进行合并。

Since Fund F and its investee companies were not included in any consolidated financial statements, they did not form part of a group or MNE group. Thus, Fund F was not an MNE entity and its foreign-sourced dividends and disposal gains received in Hong Kong would continue to be exempt from profits tax under the new FSIE regime.

由于F基金和它的被投资公司没有包括在任何合并财务报表中,它们不构成一个集团或MNE集团的一部分。因此,F基金不是一个MNE实体,其在香港收取的外地股息和处置收益在新FSIE制度下将继续被豁免利得税。

Example 3-Accrual and receipt of specified foreign-sourced income

示例3:应计和收取指明外地收入

Company-HK was an MNE entity carrying on a business in Hong Kong. Its wholly-owned subsidiary in Jurisdiction-F, Subsidiary-F, declared dividends of F$1 million for each of the years ended 30 June 2022 and 30 June 2023 in November 2022 and December 2023 respectively. The 2022 and 2023 dividends were received in Hong Kong in February 2023 and March 2024 respectively.

公司-HK是一个在香港经营业务的MNE实体,其在F辖区的全资子公司,即子公司-F,在截至2022年6月30日和2023年6月30日的每个年度,分别宣布了100万斐济元的股息。2022年和2023年的股息分别于2023年2月和2024年3月在香港收取。

As the new FSIE regime only applied in relation to specified foreign-sourced income accrued and received from 1 January 2023, it would not affect the 2022 dividend which accrued before 1 January 2023. The regime would only apply to the 2023 dividend which accrued and was received after 1 January 2023.

由于新FSIE制度只适用于从2023年1月1日起应计和收取的指明外地收入,它不会影响2023年1月1日前应计的2022年股息。该制度只适用于2023年1月1日之后产生并收取的2023年的股息。

Example 4-Whether a specified foreign-sourced income is received in Hong Kong

示例4:指明外地收入是否在香港收取

Company-HK was an MNE entity carrying on a business in Hong Kong. Its wholly-owned subsidiary in Jurisdiction-F, Subsidiary-F, declared dividends of F$2 million. It maintained a bank account in Jurisdiction F to receive the dividends. The funds in the bank account were not remitted to Hong Kong. They were wholly used to acquire an immoveable property in Jurisdiction F.

公司-HK是一个在香港经营业务的MNE实体,其在F辖区的全资子公司,即子公司-F,宣布派发200万斐济元的股息。该公司在F辖区开设了一个银行账户来收取股息。该银行账户中的资金没有汇入香港。这些资金全部用于购买F辖区的一处不动产。

The dividends were received in Jurisdiction F and never remitted back to Hong Kong. They would not be regarded as received in Hong Kong and thus not be chargeable to profits tax under the new FSIE regime.

股息是在F辖区收取的,从未汇入香港,它们不会被视为在香港收取,因此在新FSIE制度下不需要缴纳利得税。

Example 5-Whether a specified foreign-sourced income is received in Hong Kong

示例5:指明外地收入是否在香港收取

Company-HK was an MNE entity carrying on a business in Hong Kong. Its wholly-owned subsidiary in Jurisdiction-F, Subsidiary-F, declared dividends of F$2 million. It received the dividends through a bank account in Hong Kong.

公司-HK是一个在香港经营业务的MNE实体。其在F辖区的全资子公司,即子公司-F,宣布派发200万斐济元的股息。它通过香港的一个银行账户收取股息。

Since the dividends were received in Hong Kong, the new FSIE regime would apply to the dividends.

由于股息是在香港收取的,因此新FSIE制度将适用于这些股息。

Example 6-Preferential tax regime

示例6-优惠税制

Ship Lessor-HK, an MNE entity and a qualifying ship lessor resident in Hong Kong, carried out qualifying ship leasing activities in relation to an operating lease. It received the lease payments through a bank account in Jurisdiction F and bank interest thereon. The funds (i.e. lease payments and interest) were remitted to Hong Kong.

船舶出租人-HK是一家MNE实体,也是居住在香港的合格船舶出租人,从事了与经营性租赁有关的合格船舶租赁活动。它通过在F辖区的一个银行账户收取租赁款和相关的银行利息。这些资金(即租赁付款和利息)被汇入香港。

Since the net lease payments derived by Ship Lessor-HK from carrying out qualifying ship leasing activities were charged at a concessionary rate under div 14P(1) of the Inland Revenue Ordinance (Cap. 112) (“IRO”), the new FSIE regime would not apply to the interest received from the bank account in Jurisdiction F.

由于船舶出租人-HK从进行合格船舶租赁活动中获得的净租赁付款是按《税务条例(IRO)》(第112章)第14P(1)节规定的优惠税率缴纳的,因此,新FSIE制度将不适用于从F辖区银行账户中收取的利息。

Example 7-Preferential tax regime

示例7:优惠税制

Ship Lessor-HK was an MNE entity carrying out non-qualifying ship leasing activities in relation to operating leases both in and outside Hong Kong. It maintained a bank account for collecting lease payments in Jurisdiction F and received interest arising from that account. The funds (i.e. lease payments and interest) were remitted to Hong Kong.

船舶出租人-HK是一家MNE实体,在香港和香港以外的地方从事与经营性租赁有关的非合格船舶租赁活动。其在F辖区开设了一个银行账户,用于收取租赁付款,并收取该账户的利息,这些资金(即租赁付款和利息)被汇入香港。

As Ship Lessor-HK was not entitled to the profits tax concession under div 14P(1) of the IRO, the new FSIE regime would apply to the interest received from the bank account in Jurisdiction F.

由于船舶出租人-HK无权享受IRO第14P(1)节规定的利得税优惠,因此,新FSIE制度将适用于从F辖区银行账户中收取的利息。

Example 8-Preferential tax regime

示例8:优惠税制

Company-HK was an MNE entity carrying out qualifying aircraft leasing activities in Hong Kong. It lent its idle cash to its holding company, a resident in Jurisdiction F, and received interest through a bank account in Hong Kong.

公司-HK是一家MNE实体,在香港从事合格飞机租赁活动。该公司将其闲置现金借给其控股公司(F辖区的居民),并通过在香港的银行账户收取利息。

Since Company-HK was an entity the assessable profits of which were chargeable to profits tax at a concessionary rate under div 14H(1) of the IRO, the new FSIE regime would not apply to the interest received from its holding company in Jurisdiction F.

由于公司-HK是一个实体,其应评税利润根据IRO第14H(1)节的规定应按优惠税率缴纳利得税,因此,新FSIE制度不适用于从其在F辖区控股公司收取的利息。

Example 9-Whether an entity is a pure equity-holding entity

示例9:一个实体是否为纯股权持有实体

Company-HK was an MNE entity carrying on a business in Hong Kong. It held 100% of the shares in two other companies in Jurisdiction F and received dividends, which were paid into a bank account in that jurisdiction. The bank account was used for the purpose of receiving the dividends and to pay the company’s expenses. Holding equity investments was the only business activity of Company-HK.

公司-HK是一个在香港经营业务的MNE实体。其持有F辖区的另外两家公司100%的股份,并获得股息,这些股息被支付到该辖区的一个银行账户。该银行账户被用于收取股息和支付公司的费用。持有股权投资是公司-HK的唯一业务活动。

Company-HK was a pure equity-holding entity. The receipt of incidental interest income from the bank account would not affect the company’s status as a pure equity-holding entity.

公司-HK是一个纯股权持有实体。从银行账户获得附带利息收入不会影响该公司作为纯股权持有实体的身份。

Example 10-Whether an entity is a pure equity-holding entity

示例10:一个实体是否为纯股权持有实体

Company-HK was an MNE entity carrying on a shipping business in Hong Kong. It also acquired all the shares in another company in Jurisdiction F.

公司-HK是一家在香港经营航运业务的MNE实体。它还收购了F辖区的另一家公司的所有股份。

Company-HK was not a pure equity-holding entity as it carried on a shipping business, which was clearly not an activity that was incidental to the holding of equity participations.

公司-HK不是一个纯股权持有实体,因为它从事的是航运业务,而航运业务显然不是持有股权参与的附带活动。

Example 11-Whether the subject to tax condition is met

示例11:是否满足应税条件

Holding Company-HK was a company incorporated in Hong Kong and closed its accounts on 31 December. Company-F, a private company resident in Jurisdiction-F, was wholly-owned by Holding Company-HK. Company-F operated as a regional investment platform through which an investment return was generated for Holding Company-HK from investee private companies located in the Asia-Pacific region other than Hong Kong.

控股公司-HK是一家在香港注册的公司,在12月31日结账。公司-F是一家居住在F辖区的私人公司,由控股公司-HK全资拥有。公司-F作为一个区域性投资平台运作,通过该平台,位于香港以外的亚太地区的被投资私人公司为控股公司-HK带来投资回报。

Company-F held:

公司-F持有:

100% of the share capital in Investee Private Company1-A in Jurisdiction-A;

在辖区A的被投资私人公司1-A的100%的股本。

70% of the share capital in Investee Private Company2-B in Jurisdiction-B; and

在辖区B的被投资私营公司2-B的70%的股本;和

50% of the share capital in Investee Private Company3-C in Jurisdiction-C.

在辖区-C的被投资私营公司3-C的50%的股本。

Investee Private Company1-A, Investee Private Company2-B and Investee Private Company3-C were investee private companies carrying on retailing business in Jurisdiction-A, Jurisdiction-B and Jurisdiction-C respectively.

被投资的私营公司1-A、被投资的私营公司2-B和被投资的私营公司3-C分别是在辖区A、辖区B和辖区C从事零售业务的被投资私营公司。

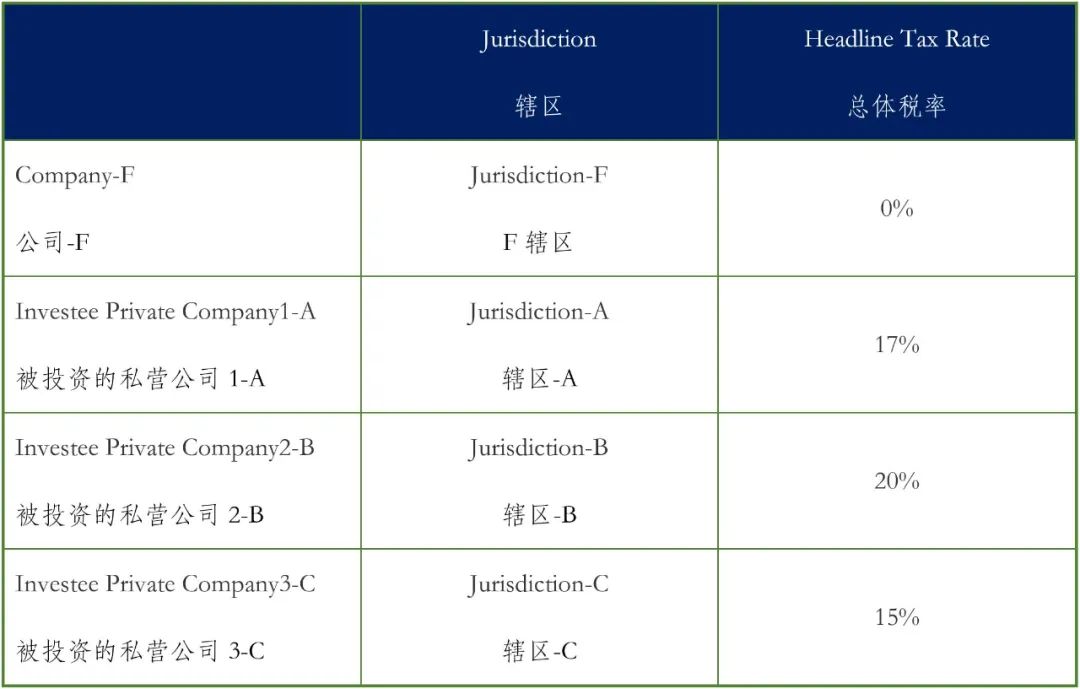

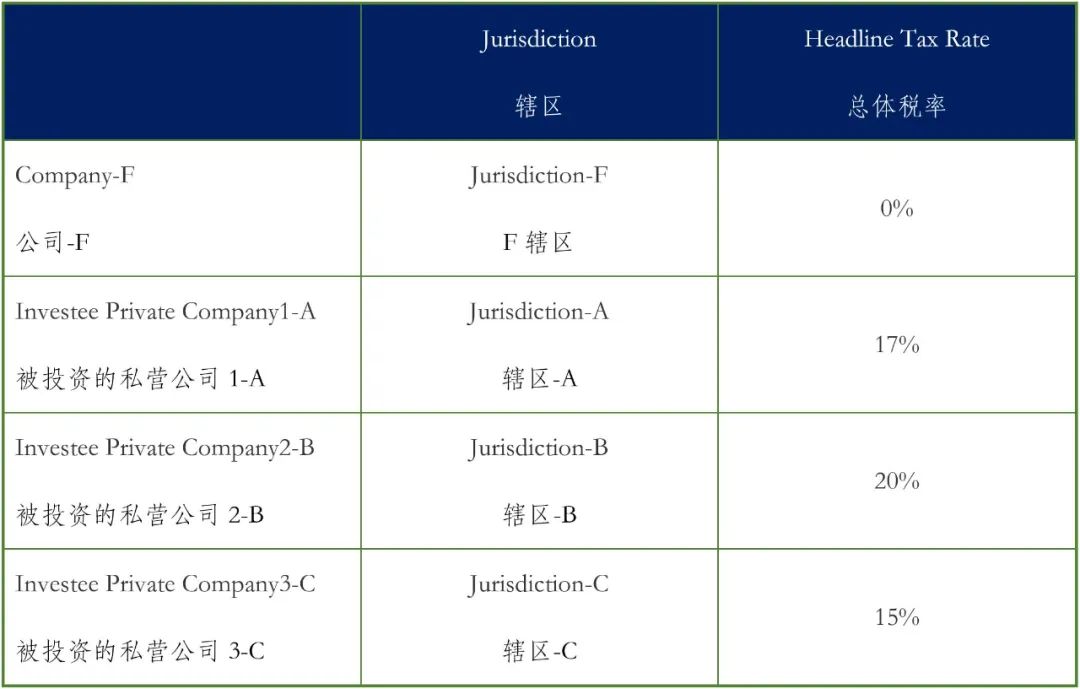

During the year ended 31 December 2023, Investee Private Company1-A, Investee Private Company2-B and Investee Private Company3-C paid dividends of $100 million, $70 million and $50 million to Company-F which in turn paid dividends of $200 million (“the subject income”) to Holding Company-HK. Holding Company-HK deposited the subject income into its bank account in Hong Kong. The headline tax rates of Jurisdiction-A, Jurisdiction-B and Jurisdiction-C for the year of 2023 were as follows:

在截至2023年12月31日的年度内,被投资的私营公司1-A、被投资的私营公司2-B和被投资的私营公司3-C分别向公司-F支付了1亿美元、7000万美元和5000万美元的股息,公司-F又向控股公司-HK支付了2亿美元的股息(“标的收入”)。控股公司-HK将标的收入存入其在香港的银行账户。2023年辖区A、辖区B和辖区C的总体税率如下。

The underlying profits of the subject income consisted wholly of dividends. As such, the headline tax rates in Jurisdiction-A, Jurisdiction-B and Jurisdiction-C at which the related downstream income of such underlying profits was chargeable would be relevant when considering the “subject to tax” condition. Since the aggregate amount of the related downstream income ($100 + $70 + $50 = $220) was greater than that of the subject income (i.e. $200) and the headline tax rates in Jurisdiction-A, Jurisdiction-B and Jurisdiction-C were equal to or higher than 15%, Holding Company-HK satisfied the “subject to tax” condition even though the subject income was subject to zero tax rate in Jurisdiction-F.

标的收入的基础利润完全由股息组成。因此,在考虑“应税”条件时,这些应征税基础利润的相关下游收入与辖区-A、辖区-B和辖区-C的总体税率将是相关的。由于相关下游收入的总额(100美元+70美元+50美元=220美元)大于标的收入的总额(即200美元),而辖区-A、辖区-B和辖区-C的总体税率等于或高于15%,因此,即使标的收入在F辖区的税率为零,控股公司-HK仍符合“应税”条件。

Example 12-Whether the subject to tax condition is met

示例12:是否满足应税条件

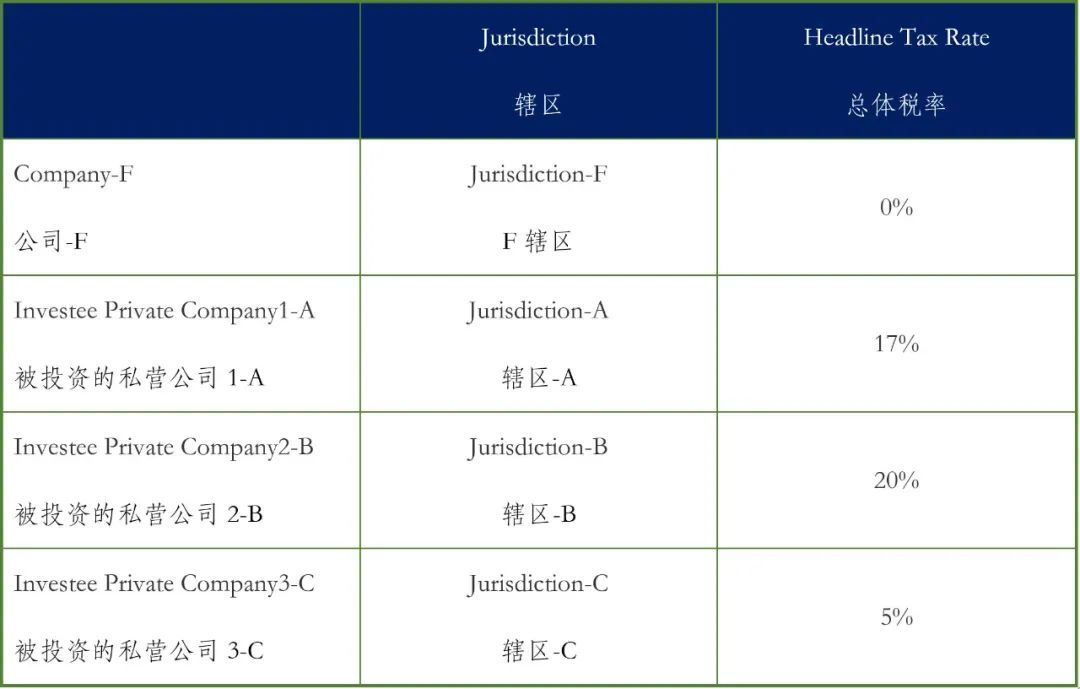

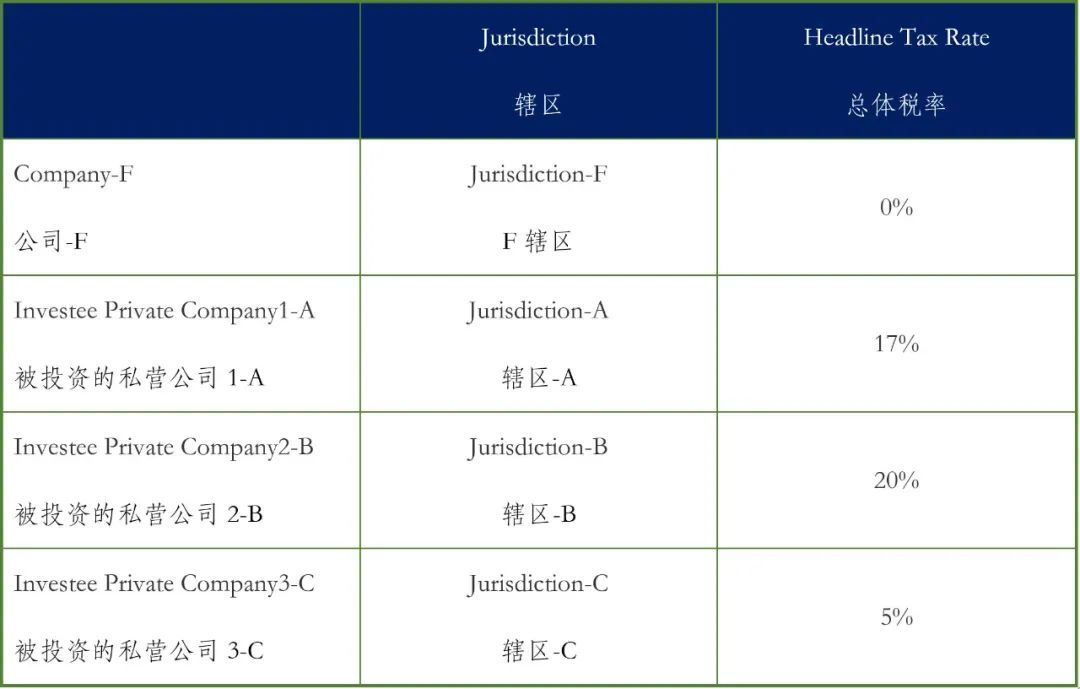

The facts are the same as those in Example 11, except that the headline tax rates of Jurisdiction-A, Jurisdiction-B and Jurisdiction-C for the year of 2023 were as follows:

事实与示例11相同,只是辖区-A、辖区-B和辖区-C在2023年的总体税率如下:

Holding Company-HK failed to satisfy the “subject to tax” condition as the aggregate amount of the related downstream income which was subject to tax in Jurisdiction-A and Jurisdiction-B at headline tax rates equal to or higher than 15% ($100 + $70 = $170) was smaller than that of the subject income.

控股公司-HK未能满足“应税”条件,因为在辖区-A和辖区-B按等于或高于15%的总体税率应税的相关下游收入总额(100美元+70美元=170美元)小于标的收入。

Example 13-Interaction between the territorial source principle and economic substance requirement

示例13:地域来源原则和经济实质要求之间的相互作用

Company-HK carried on an investment business, other than money lending and intra-group financing, in Hong Kong. The company occasionally lent its idle funds to some non-resident associates and received interest from the associates. The terms of the loans were negotiated and agreed outside Hong Kong. The loans were also made available to the associates outside Hong Kong. In addition, Company-HK also placed a deposit with a foreign bank outside Hong Kong and received interest on the deposit.

公司-HK在香港从事投资业务,但不包括资金借贷和集团内部融资。该公司偶尔将其闲置资金借给一些非居民关联公司,并从该关联公司收取利息。这些贷款的条款是在香港以外的地方谈判和商定的。这些贷款也被提供给香港以外的关联公司。此外,公司-HK还在香港以外的一家外国银行存放了一笔存款,并收取存款利息。

Company-HK made strategic decisions in relation to its investments in Hong Kong. It established a physical office in Hong Kong, which had a significant staff establishment and incurred a significant amount of operating expenditures in Hong Kong.

公司-HK就其在香港的投资做出了战略决策。其在香港设立了一个实体办公室,有大量的雇员编制,并在香港产生大量经营开支。

Company-HK was not a pure equity-holding company as it carried on a shipping business, which was clearly not an activity that is incidental to the holding of equity participations.

公司-HK不是一家纯股权持有公司,因为它从事的是航运业务,而航运业务显然不是持有股权参与的附带活动。

Company-HK could meet the economic substance requirement and will continue to be exempt from profits tax in respect of its foreign-sourced interest from the non-resident associates and overseas deposit although the income generating activities with regard to the income were undertaken outside Hong Kong.

公司-HK可以满足经济实质要求,并将继续就其来自非居民关联公司和海外存款的外地利息获得豁免利得税,尽管与收入有关的创收活动是在香港以外开展。

Economic substance requirement 经济实质要求

Example 14-Pure equity-holding entity

示例14:纯股权持有实体

Company-HK was a pure equity-holding entity incorporated in Hong Kong and held equity interests in one investee entity outside Hong Kong. It engaged a service provider to handle the registration and filing matters under the Business Registration Ordinance (Cap. 310) (“BRO”) and the Companies Ordinance (Cap. 622) (“CO”) and shared an office with an associated company in Hong Kong. It had 2 resident directors for holding and managing its equity investments. It maintained a bank account in Hong Kong for receiving dividends from investee entities and paying business expenses.

公司-HK是一个在香港注册成立的纯股权持有实体,在香港以外的一个被投资实体中持有股权。该公司聘请了一家服务提供商来处理《商业登记条例》(第310章)和《公司条例》(第622章)下的登记和备案事宜,并与一家在香港的关联公司共用一个办公室。该公司有两名常驻董事,负责持有和管理其股权投资。它在香港有一个银行账户,用于收取被投资实体的股息和支付营业费用。

Since Company-HK complied with its statutory registration and filing obligations and had adequate human resources and premises for carrying out the specified economic activities in Hong Kong, it could satisfy the economic substance requirement.

由于公司-HK遵守了其法定的注册和备案义务,并有足够的人力资源和场所在香港开展指明经济活动,所以它可以满足经济实质要求。

Example 15-Pure equity-holding entity

示例15:纯股权持有实体

Company-F was a pure equity-holding entity incorporated in Hong Kong and held equity interests in one investee entity outside Hong Kong. While Company-F engaged a service provider to handle the registration and filing matters under the BRO and the CO, it only had one nominee director and a bank account for receiving dividends in Hong Kong. The holding and management of equity investments were undertaken by the company’s shareholders and directors outside Hong Kong.

公司-F是一家在香港注册成立的纯股权持有实体,在香港以外的一个被投资实体中持有股权。虽然公司-F聘请了一家服务提供商来处理《商业登记条例》和《公司条例》规定的注册和备案事宜,但它只有一名提名董事和一个在香港收取股息的银行账户。股权投资的持有和管理是由该公司的股东和董事在香港以外的地方开展的。

Since Company-HK did not carry out the specified economic activities in Hong Kong, it could not meet the economic substance requirement.

由于公司-HK没有在香港从事指明经济活动,所以它不能满足经济实质要求。

Example 16-Non-pure equity-holding entity

示例16:非纯股权持有实体

Company-HK1 was incorporated in Hong Kong. Apart from holding shares or equitable interests in companies and deriving dividend income and disposal gains, Company-HK1 provided funding to its subsidiaries and fellow subsidiaries located in both Hong Kong and overseas. Company-HK1 had no directors resident in Hong Kong. Company-HK2, which was a subsidiary of Company-HK1 incorporated in Hong Kong, was engaged in the provision of management services to group companies. Company-HK2 had 1 director and 3 employees, including a manager, an accountant and an administrative officer, based in Hong Kong. Company-HK2’s director and manager made strategic decisions in relation to Company-HK1’s equity investments and financing arrangements with its subsidiaries and fellow subsidiaries.

公司-HK1是在香港注册成立的公司。除了持有公司的股份或衡平法权益并获得股息收入和处置收益外,公司-HK1还向其位于香港和海外的子公司和同系子公司提供资金。公司-HK1没有居住在香港的董事。公司-HK2是公司-HK1在香港注册的子公司,从事向集团公司提供管理服务。公司-HK2有1名董事和3名雇员,包括1名经理、1名会计和1名行政人员,都在香港。公司-HK2的董事和经理就公司-HK1的股权投资以及与其子公司和同系子公司的融资安排作出战略决策。

Company-HK1 could satisfy the economic substance requirement by outsourcing its specified economic activities to Company-HK2, provided that the outsourcing arrangement, including the activities performed by Company-HK2 for Company-HK1, was documented and that the outsourced activities were adequately monitored.

公司-HK1可以通过将其指明经济活动外包给公司-HK2来满足经济实质要求,但前提是外包安排(包括公司-HK2为公司-HK1执行的活动)必须有文件证明,而且外包活动受到充分的监控。

Example 17-Listed company

示例 17:上市公司

Listed Company-A was a company incorporated in Jurisdiction A and listed on the Hong Kong Stock Exchange. It was registered as a non-Hong Kong company under the CO, and it registered its business under the BRO. Listed Company-A’s sole function was to hold shares or equity interests in subsidiaries which were incorporated and carrying on trading and manufacturing businesses in Jurisdiction A. Listed Company A employed a company secretary who was a qualified individual and two authorized representatives in Hong Kong to comply with the listing rules and corporate filing requirements under the CO and the BRO. It also maintained a registered office in Hong Kong, where its authorized representatives managed its equity participations in the subsidiaries.

上市公司-A是一家在辖区A注册成立并在香港证券交易所上市的公司。它根据《公司条例》注册为非公司-HK,并根据《商业登记条例》注册其业务。上市公司-A的唯一功能是持有在A辖区注册成立并从事贸易和制造业务的子公司的股份或股权。上市公司-A在香港雇佣了一名合格个人公司秘书和两名授权代表,以遵守《公司条例》和《商业登记条例》的上市规则和公司备案要求。它还在香港设有一个注册办公室,其授权代表在办事处管理其在子公司的股权。

Listed Company-A was a pure equity-holding entity. In view that Listed Company-A complied with the listing rules and filing requirements under the CO and the BRO; and that it had adequate human resources and premises for carrying out the specified economic activities in Hong Kong, Listed Company-A could satisfy the economic substance requirement.

上市公司-A是一个纯股权持有实体。鉴于上市公司-A符合《公司条例》和《商业登记条例》的上市规则和备案要求,以及它有足够的人力资源和场所在香港开展指明经济活动,上市公司-A可以满足经济实质要求。

Example 18-Listed company

示例18:上市公司

Listed Company-A was a company incorporated in Jurisdiction A and listed on the Hong Kong Stock Exchange. It was registered as a non-Hong Kong company under the CO, and it registered its business under the BRO. Listed Company-A’s sole function was to hold shares in a number of Hong Kong and overseas subsidiaries, including a wholly-owned subsidiary, Subsidiary-HK, which was incorporated in Hong Kong and employed a significant number of employees in its office in Hong Kong for the provision of management services to group companies. Listed Company-A neither leased any office nor employed any employees in Hong Kong. Instead, it outsourced the administrative activities to Subsidiary-HK to handle all matters relating to the compliance with Hong Kong listing rules and filing requirements under the CO and the BRO as well as the management of its equity participations in overseas subsidiaries. Subsidiary-HK carried out all such activities in Hong Kong.

上市公司-A是一家在辖区A注册成立并在香港证券交易所上市的公司。它根据《公司条例》注册为非公司-HK,并根据《商业登记条例》注册其业务。上市公司-A的唯一功能是持有多家香港和海外子公司的股份,包括一家在香港注册成立的全资子公司,子公司-HK,该公司在香港的办公室雇佣了大量的雇员,为集团公司提供管理服务。上市公司-A既没有在香港租赁任何办公室,也没有雇佣任何雇员。相反,它将行政活动外包给子公司-HK,以处理所有与遵守香港上市规则和《公司条例》及《商业登记条例》的备案要求有关的事项,以及管理其在海外子公司的股权。子公司-HK在香港从事了所有这些活动。

Listed Company-A could satisfy the economic substance requirement by outsourcing its specified economic activities to Subsidiary-HK, provided that the outsourcing arrangement, including the activities performed by Subsidiary-HK for Listed Company-A, was documented and that the outsourced activities were adequately monitored.

上市公司-A可以通过将其指明经济活动外包给子公司-HK来满足经济实质要求,但前提是外包安排(包括子公司-HK为上市公司-A所执行的活动)必须有文件证明,而且外包活动受到充分的监控。

Example 19 – Insurance business

示例19:保险业务

A regulated insurance MNE group, Insurance Group-K, was headquartered in Jurisdiction K. Insurance Group-K had significant substance in Hong Kong and had Hong Kong based customers. Insurance Group-K operated a locally incorporated insurance company, Insurance Company-HK, that was authorized by the Insurance Authority under the Insurance Ordinance (Cap. 41) to carry on an insurance business in Hong Kong. Insurance Company-HK employed 100 qualified insurance professionals and 100 administrative staff in Hong Kong and had more than HK$1 billion in assets.

一家受监管的保险MNE集团,保险集团-K,总部设在辖区K,保险集团-K在香港有重要的业务,并拥有香港的客户。保险集团-K经营着一家在本地注册的保险公司,保险公司-HK,该公司根据《保险条例》(第41章)被保险业监管局授权在香港经营保险业务。保险公司-HK在香港雇佣了100名合格保险专业人员和100名行政人员,拥有超过10亿港元的资产。

In addition to Insurance Company-HK, Insurance Group-K invested in a number of other entities incorporated or established in Hong Kong (collectively “Insurance Entities-HK”) that conducted a range of different business activities and received specified foreign-sourced income. Insurance Entities-HK were generally supported by the employees and infrastructure of Insurance Company-HK in Hong Kong which incurred significant operating expenditures annually. All Insurance Entities-HK signed service level agreements (“SLAs”) with Insurance Company-HK for undertaking the specified economic activities in Hong Kong at an arm’s length fee. Insurance Company-HK was adequately monitored in respect of its undertaking of the outsourced activities in Hong Kong.

除保险公司-HK外,保险集团-K还投资了其他一些在香港注册或成立的实体(统称为“保险实体-HK”),这些实体从事一系列不同的商业活动并获得指明外地收入。保险实体-HK一般由保险公司-HK在香港的雇员和基础设施提供支持,每年产生大量的经营开支。所有保险实体-HK都与保险公司-HK签订了服务级别协议(SLAs),以独立交易价格在香港开展指明经济活动。保险公司-HK就其在香港开展的外包活动受到充分的监控。

Insurance Company-HK was a regulated financial entity. The foreign-sourced interest, dividend and disposal gain derived from its regulated insurance business in Hong Kong would not fall within the definition of “specified foreign-sourced income”. As for Insurance Entities-HK, given the adequate number of employees and adequate amount of operating expenditures incurred by Insurance Company-HK in carrying out the outsourced activities for Insurance Entities-HK, as well as the adequate monitoring of such activities, Insurance Entitles-HK could meet the economic substance requirement.

保险公司-HK是一个受监管金融实体。源自其在香港的受监管保险业务的外地利息、股息和处置收益将不属于“指明外地收入”的定义范围。至于保险实体-HK,鉴于保险公司-HK在为保险实体-HK开展外包活动时有足够的雇员人数和足够的经营开支,以及对这些活动的充分监控,保险实体-HK可以满足经济实质要求。

Example 20-Banking business

示例20:银行业务

A regulated banking MNE group, Banking Group-R, was headquartered in Jurisdiction R. Banking Group-R had a branch in Hong Kong which was regulated by the Monetary Authority in Hong Kong (“HK-Branch”). HK-Branch employed 100 full time employees in Hong Kong, leased dedicated office premises in Hong Kong for use by the Hong Kong employees and incurred expenditures in Hong Kong of around HK$50 million annually. It was the primary employing entity in Hong Kong. In addition to HK-Branch in Hong Kong, Banking Group-R had a number of other entities incorporated or established in Hong Kong that conducted a range of business activities, including some entities licensed by or registered with the Securities and Futures Commission (“SFC”) to carry out regulated activities. Banking Group-R also maintained entities that generated specified foreign-sourced income only (“HK-Entities”). HK-Entities in Hong Kong were supported by the employees and infrastructure of HK-Branch. HK-Entities had SLAs with HK-Branch for undertaking the specified economic activities in Hong Kong at an arm’s length fee. HK Branch was adequately monitored in respect of its undertaking of the outsourced activities in Hong Kong.

一家受监管的银行MNE集团,银行集团-R,总部设在R辖区。银行集团-R在香港有一家受香港金融管理局监管的分行(“HK-分行”)。HK-分行在香港雇佣了100名全职雇员,在香港租赁了专门的办公场所供香港雇员使用,每年在香港的支出约为5000万港元。它是香港的主要雇佣实体。除HK-分行外,银行集团-R还有其他一些在香港注册或成立的实体,从事一系列商业活动,包括一些获得证券及期货事务监察委员会(“SFC”)许可或注册的实体,从事受监管活动。银行集团-R还拥有只产生指明外地收入的实体(“HK-实体”)。在香港的HK-实体由HK-分行的雇员和基础设施支持。HK-实体与HK-分行签订了SLAs,以独立交易价格在香港开展指明经济活动。HK-分行在香港开展外包活动时受到充分的监控。

HK Branch and those entities licensed by or registered with the SFC were regulated financial entities. The foreign-sourced interest, dividend and disposal gain derived from their regulated banking business or regulated activities in Hong Kong would not fall within the definition of “specified foreign-sourced income”.

HK-分行和那些经SFC许可或注册的实体是受监管金融实体。源自其在香港的受监管银行业务或受监管活动的外地利息、股息和处置收益将不属于“指明外地收入”的定义范围。

As for other HK-Entities, given the adequate number of employees and adequate amount of operating expenditures incurred by HK Branch in carrying out the outsourced activities for HK Entities, as well as the adequate monitoring of such activities, HK Entities could meet the economic substance requirement.

至于其他HK-实体,鉴于HK-分行在为HK-实体开展外包活动时有足够的雇员人数和足够的经营开支,以及对这些活动的充分监控,HK-实体可以满足经济实质要求。

温馨提示:点击“阅读原文”,可下载中国香港新FSIE制度草案完整英文版!

END

|

-

|

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

【全网最全】31个省市!残保金政策汇编及申

【全网最全】31个省市!残保金政策汇编及申

全网最全|2022年失业保险稳岗补贴政策汇总

全网最全|2022年失业保险稳岗补贴政策汇总

2021年个税汇算容易出现哪些错误?税务总局

2021年个税汇算容易出现哪些错误?税务总局

【全网最全】历史上最高规模退税减税!2022

【全网最全】历史上最高规模退税减税!2022