|

|

点击蓝字

关注我们

来源:OECD官网

编译:思迈特财税国际税收服务团队

作为OECD/G20关于BEPS包容性框架正在进行工作的一部分,OECD正在实施双支柱解决方案,以应对经济数字化带来的税收挑战。目前OECD正在对《支柱一金额A下的联结度和收入来源规则立法模板》(以下简称“规则草案”) 进行公开征求意见。

2022年2月4日发布的这份公众咨询文件(法国称之为法律意见书)仅包含支柱一下涉及联结度和收入来源的第一个组成模块。包容性框架已同意发布本文件,以获取公众意见,但该规则草案并未反映关于文件实质内容的共识。利益相关者对规则草案的意见将有助于包容性框架成员进一步完善和最终确定相关规则。

请感兴趣的各方在2022年2月18日之前发送书面意见。咨询文件中提供了提交意见的说明。

背景

收入来源规则的目的是允许范围内的跨国公司识别产生收入的相关市场管辖区,并应用基于收入的分配要素。正如2021年10月协议中所指出的,收入来源于使用或消费商品或服务的最终市场管辖区。

为此,《收入来源规则》提供了确定特定交易类别终端市场所需的详细信息。通过为不同类别的交易提供不同的规则,这些规则寻求将相关的商业背景考虑在内,并确保这些规则是完整的,以便适用于所有类型的跨国公司。但并非所有类别都与每种类型的跨国公司相关。例如,一些消费品跨国公司只需要适用与制成品相关的规则,而不需要适用任何其他类别的来源规则;其他的可能会为他们的大部分收入适用在线广告规则。

收入来源规则旨在实现准确识别市场管辖权和相关收入的政策目标,同时尽可能限制和简化合规负担。这种平衡是通过多种方式实现的。

首先,用于确定市场管辖权(定义为该类别)的规则旨在允许跨国公司在经营业务时尽可能利用其已经收集和使用的信息,并避免改变信息收集做法或产生新的报告义务。虽然这些规则为终端市场提供了一致的标识,但它们的设计在跨国公司如何应用该规则方面具有内在的灵活性,而没有规定必须使用哪个数据点。这就认识到,不同类型的商业模式将有不同类型的信息来源。

《收入来源规则》承认,在某些情况下,跨国公司无法获得交易信息,或者获取交易信息的负担过重。在这些情况下,规则允许使用包括分配要素在内的“替代变量”,而不需要高度复杂和新的信息报告系统,也不需要改变商业合约安排。分配要素使用行业或宏观经济数据来提供一种简化的方法以近似最终市场,这样就提供了确定性,同时确保所有收入来源没有缺口。这将大大减轻最困难的收入来源案例中的合规负担,例如通过独立分销商销售、组件销售和B2B服务。

合规负担还可以通过其他一些方式解决。这包括在交易层面无法合理确定市场(如通过独立分销商销售)的情况下,对小批量销售采取实质性方法;考虑到欧盟单一市场分销安排的性质;最大限度地利用跨国公司可获得的商业信息,这些信息可以“淘汰”不太可能出现的市场,从而产生更为确定的分配要素;允许以与主交易相同的方式获取某些“补充”微量交易,以限制需要应用的不同类型的规则。它还包括来源规则中的一致性设计,以便在某些收入流的分类可能存在重叠的情况下识别相同的终端市场,从而缓解了特征化问题的压力,并通过预测与早期确定性过程相关的系统级合规方法,该过程是多边且具有约束力的争端预防和解决机制的一部分。

然而,在任何规则设计中,在准确性和操作现实之间取得平衡都是一个挑战。利益相关者的投入在确定可以更好地实现这一平衡的情况,以及最终确定实现预期政策目标但同时又切实可行并避免不必要负担的收入来源规则的交付方面尤其有价值。

后续工作进展

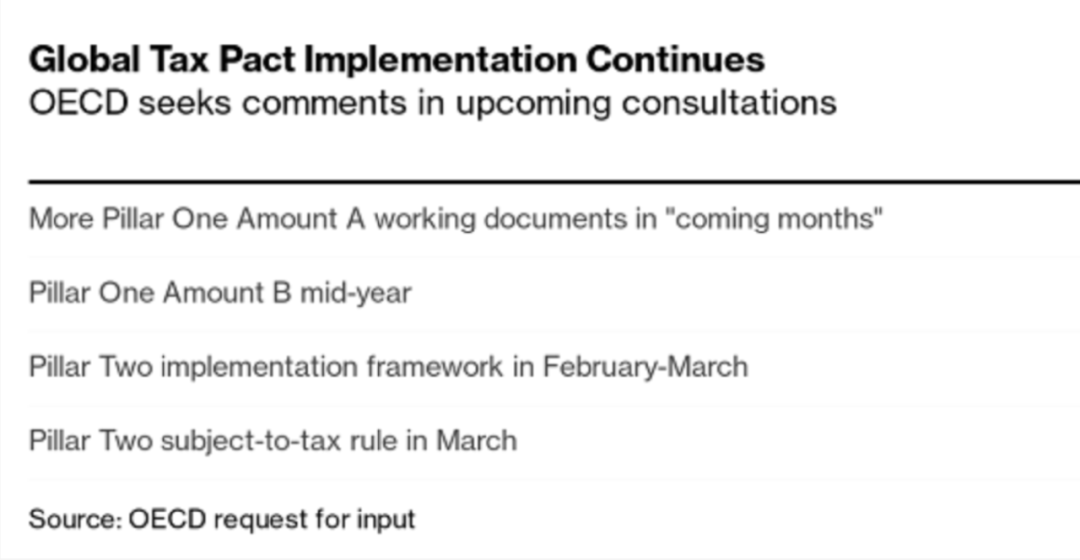

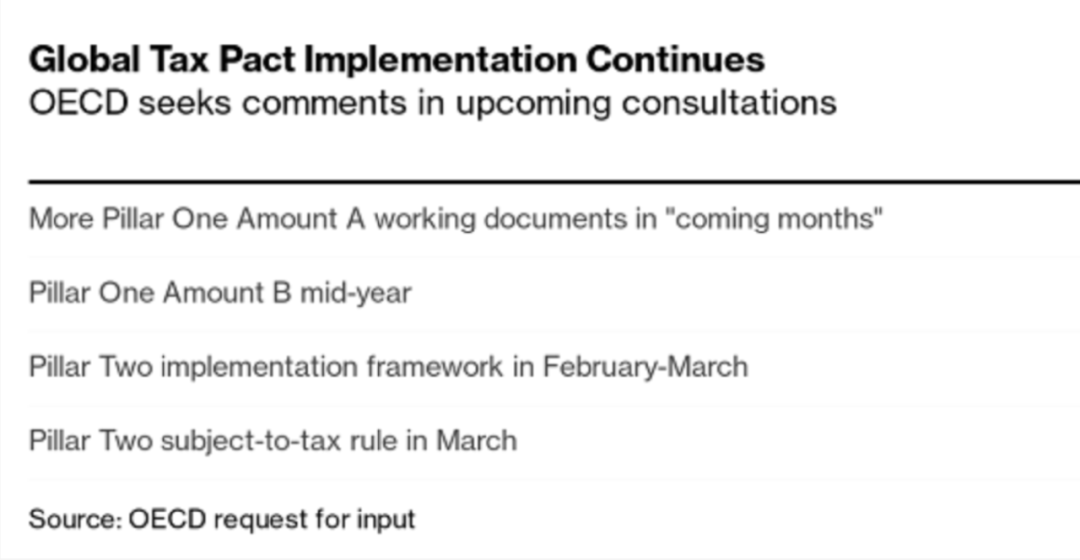

针对支柱一金额A,包容性框架将分阶段进行公众咨询,通过发布关于每个组成部分的工作文件,以便在工作完成之前快速获得公众反馈。这种方法不是等待一份全面的文件准备好,而是允许并行工作,以确保各项工作按 2021年10月商定的时间表进行。

对于支柱一金额B,包容性框架将于2022年年中发布公众咨询文件,并在征求意见期之后举行公众咨询活动。

针对支柱二,包容性框架正在制定一个实施框架,以促进 GloBE 规则的协调实施,并将解决征管和合规问题。2月份晚些时候将启动关于实施框架的公众咨询,并在 3 月举行咨询活动。

对于支柱二的应税规则(STTR),示范条款草案及其评论将于2022 年3 月发布。一份关于制定多边工具以促进STTR实施的公开讨论草案也将同时发布以征求意见。

如需更多信息或查询,请联系tfde@oecd.org.

*请注意,所有收到的书面意见都将公开。以集体“团体”或“联盟”的名义提交的意见,或由代表另一个人或团体提交意见的任何人提交的意见,应指明属于该集体团体的所有企业或个人,或评论员代表其行事的人。即将举行的公众咨询会议的发言人和其他参与者将从及时提供书面意见的人中选出。

相关NEWS如下:

NEWS 1:OECD invites public input on the draft rules for nexus and revenue sourcing under Pillar One Amount A

As part of the ongoing work of the OECD/G20 Inclusive Framework on BEPS to implement theTwo-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy, the OECD is seeking public comments on the Draft Rules for Nexus and Revenue Sourcing under Pillar One Amount A.

This public consultation document (également disponible en fran?ais), issued on 4 February 2022, contains the first building blocks under Pillar One for which public input will be sought, relating to nexus and revenue sourcing.

The Inclusive Framework has agreed to release this document in order to obtain public comments, but the draft rules do not reflect consensus regarding the substance of the document. The stakeholder input received on the Draft Rules for Nexus and Revenue Sourcing will assist members of the Inclusive Framework in further refining and finalising the relevant rules.

Interested partiesare invited to send their written comments* no later than 18 February 2022. Instructions for submitting comments can be found in the consultation document.

Background

The purpose of the revenue sourcing rules is to allow in-scope MNEs to identify the relevant market jurisdictions from which revenue is derived, and to apply the revenue-based allocation key. As noted in the October 2021 agreement, revenueis sourced to the end market jurisdictions where goods or services are used or consumed.

To do this, the revenue sourcing rules provide the detail that is necessary to identify the end market for specific categories of transactions. By providing different rulesfor different categories of transactions, the rules seek to take the relevant commercial context into account, and ensure that the rules are complete so that they can be applied to all types of MNEs. Not all categories are relevant for each type of MNE. For example, some consumer goods MNEs will only need to apply the rules related to finished goods and will not need to apply any of the other categories of sourcing rules; others might apply the rules for online advertising for much of their revenue.

The revenue sourcing rules have been designed to fulfil the policy objective of accurately identifying the market jurisdiction and the associated revenue, while limiting and simplifying compliance burdens as much as possible. This balance is struckin a number of ways.

First, the rulesused to identify the market jurisdiction (as defined for that category) are designed to allow MNEs to, as much as possible, draw on information that they are already collecting and using as they operate their business, and avoid the need to change information collection practices or create new reporting obligations. While the rules provide a consistent identification of the end market, they have been designed with in-built flexibility as to how the MNE applies that rule, without being prescriptive as to which data point must be used. This recognises that different business models will have different types of information at hand.

The revenue sourcing rules acknowledge that there will be cases where transactional information is not available to the MNE or where it would be disproportionately burden some to obtain it. In these cases the rules allow for the use of proxies including allocation keys, rather than require highly complex and new information reporting systems, or changes in commercial contracting arrangements. The allocation keys use either industry or macro-economic data to provide a simplified way to approximate the end market, that provides certainty while ensuring that all revenue is sourced without gaps. This should significantly ease compliance burdens in the most difficult revenue sourcing cases, such assales through independent distributors, sales of components, and B2B services.

Compliance burdensare also addressed in a number of other ways. This includes a materiality approachto smaller sets of sales where the market cannot reasonably be identified at transactional level (such as sales through independent distributors); taking into account the nature of distribution arrangements in the EU single market;maximising the commercial information available to the MNE that can “knock-out”unlikely markets to result in a more tailored allocation key; allowing certain“supplementary” de minimis transactions to be sourced in the same way as the main transaction to limit the different types of rules that need to be applied.It also includes a coherent design in the sourcing rules to identify the same end market in cases where there is a potential for an over lap in the categorisation of certain revenue streams, thus easing the pressure oncharacterisation questions and by anticipating a systems level compliance approach in connection with an early certainty process that is part of a multilateral and binding dispute prevention and resolution regime.

However, striking the balance between accuracy and operational realities is a challenge in anyrule design. Stakeholder input will be especially valuable in identifying cases where this balance could be better achieved, and finalising the delivery of revenue sourcing rules that achieve the desired policy objective but at the same time are practical and avoid unnecessary burdens.

For furtherinformation or inquiries, please contact tfde@oecd.org.

*Please note thatall written comments received will be made publicly available. Comments submitted in the name of a collective "grouping" or"coalition", or by any person submitting comments on behalf of another person or group of persons, should identify all enterprises orindividuals who are members of that collective group, or the person(s) on whose behalf the commentator(s) are acting. Speakers and other participants at theupcoming public consultation meeting will be selected from among thoseproviding timely written comments.

NEWS 2:OECD launches public consultation on the tax challenges of digitalisation with the release of a first building block under Pillar One

04/02/2022 -Following the agreement reached in October 2021 by over 135 members of the OECD/G20 Inclusive Framework on BEPS to a two-pillar solution to address the tax challenges arising from digitalisation and globalisation of the economy,work on the implementation of the two-pillar plan is well under way. As part ofthis next phase, the Inclusive Framework will consult stakeholders on a numberof aspects of Pillar One and Pillar Two over the coming months.

Pillar One

For Amount A of Pillar One, the Inclusive Framework is launching a public consultation that will occur in stages, by releasing Secretariat working documents on each building block to obtain feedback quickly and before the work is finalised.This approach, rather than waiting for a comprehensive document to be ready,will allow work to continue in parallel, in order to remain within the political timetable agreed in October 2021.

Today the first building block is released for public comments. The Draft Rules for Nexus and Revenue Sourcing have been agreed for release by the Inclusive Framework to obtain public comments, but the draft rules do not reflect consensus regarding the substance of the document. Interested parties are invited to send their written comments no later than 18 February 2022.

For Amount B ofPillar One, a public consultation document will be issued in mid-2022, with apublic consultation event to follow the comment period.

Pillar Two

The Pillar Two Model Rules issued in December 2021 provide a template for domestic implementation of the GloBE Rules. These Rules will be supported by a Commentary to provide tax administrations and taxpayers with guidance on the interpretation and application of those Rules, which is currently underdevelopment, also drawing on input from a Business Advisory Group set up by BIAC.

An Implementation Framework is being developed to facilitate the co-ordinated implementation of the GloBE rules and will address administrative and compliance issues,including the development of safe harbours. A public consultation on the Implementation Framework will be launched later this month, with a consultation event to follow in March.

For the Subject toTax Rule (STTR) of Pillar Two, the draft model provision and its commentary will be released in March 2022 with a defined set of questions set for input. Apublic discussion draft on the development of a multilateral instrument to facilitate the implementation of the STTR would also be released for comment at the same time.

Further information on the two-pillar solution for addressing the tax challengesarising from digitalisation and globalisation of the economy is available at https://oe.cd/bepsaction1.

Enquiries shouldbe directed to Achim Pross (+33 1 45 24 98 92), Head of CTPA’s InternationalCo-operation and Tax Administration Division or to tfde@oecd.org.

END

【特别提醒】针对2021年度及以前年度同期资料主体文档、本地文档及特殊事项文档准备,同学们如有任何疑问和需求,可通过以下方式联系我们,我们经验丰富的转让定价专业服务人员会及时为您答疑解惑。

联系人:谢维潮(高级合伙人)

电话:0755-82810900

手机:13088827747(微信同号,加好友请注明“同期资料咨询”) |

-

|

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

【全网最全】31个省市!残保金政策汇编及申

【全网最全】31个省市!残保金政策汇编及申

全网最全|2022年失业保险稳岗补贴政策汇总

全网最全|2022年失业保险稳岗补贴政策汇总

2021年个税汇算容易出现哪些错误?税务总局

2021年个税汇算容易出现哪些错误?税务总局

【全网最全】历史上最高规模退税减税!2022

【全网最全】历史上最高规模退税减税!2022