|

|

点击蓝字

关注我们

来源:OECD官网

编译:思迈特财税国际税收服务团队

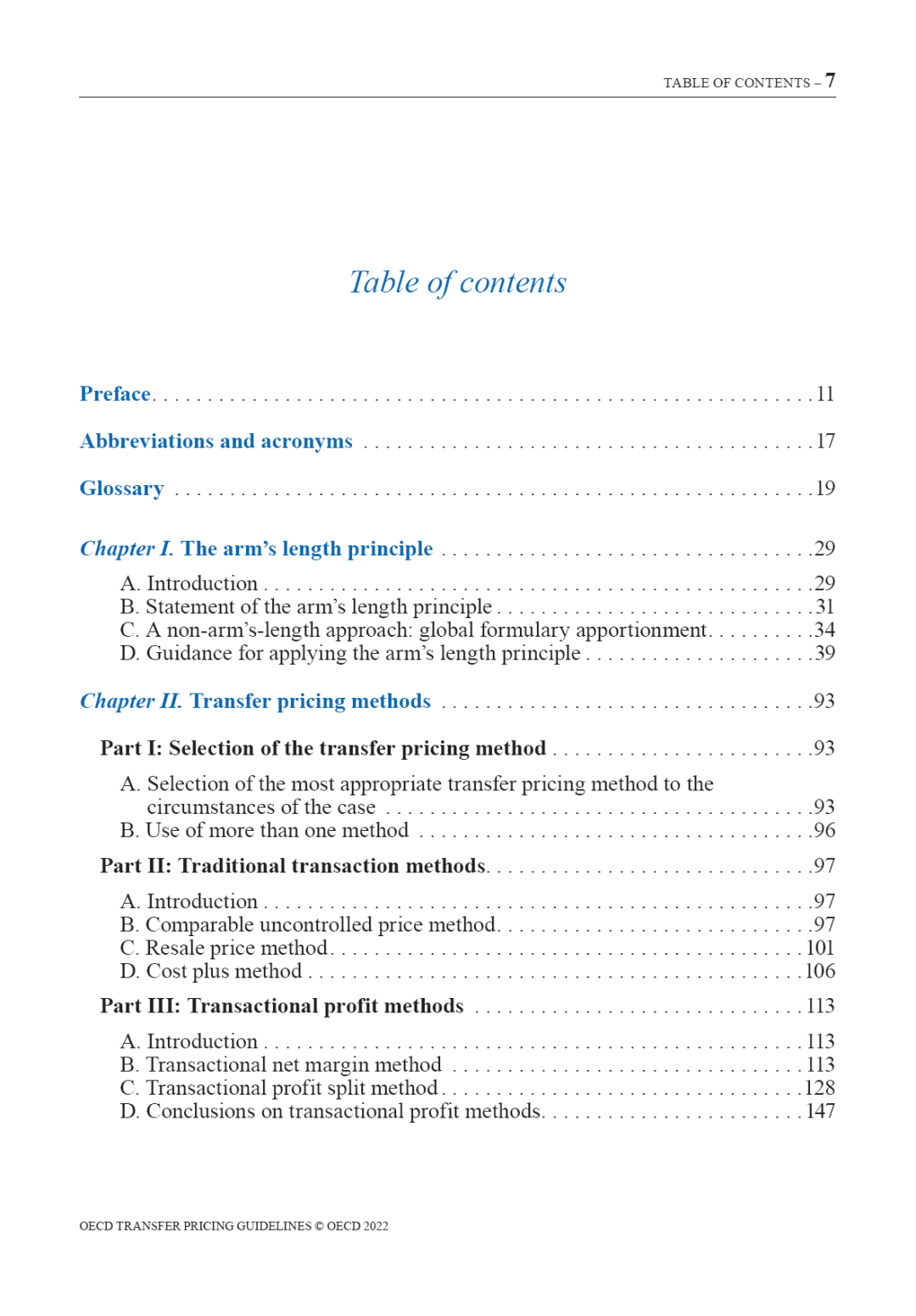

2022年1月20日,OECD发布《跨国企业与税务机关转让定价指南》(2022年版,以下简称《2022年版转让定价指南》或“新指南”),这是继2021年4月17日联合国发布2021版《发展中国家转让定价操作手册》(第三版)后国际税收领域的又一个具有里程碑意义的事件。

“独立交易原则”依然是《2022年版本转让定价指南》的核心宗旨,各国税务机关将根据独立交易原则的具体要求对跨国企业跨境关联交易定价进行分析评估。在跨国企业扮演重要角色的全球经济中,各国政府必须确保跨国公司的应纳税利润不被人为地转移到其管辖范围之外,并确保跨国企业满足“利润应在经济活动发生地和价值创造地征税”的要求。对纳税人来说,如何正确适用独立交易原则指导其关联交易至关重要。

新指南对2017年版《转让定价指南》进行了修订,主要修订包括:

新增2018年6月4日批准的《交易利润分割法应用指南》,取代了2017年版《转让定价指南》第二章附件二和附件三中第二章C节(第2.114-2.151段)中的相关内容;

新增2018年6月4日批准的《关于难以估值的无形资产税务管理应用指南》,已纳入新指南第六章附件二;以及

新增2020年1月20日正式发布的《金融交易转让定价指南》,已纳入新指南第一章D节1.2.2和新指南的第十章。

最后,新指南对2017年版《转让定价指南》其他部分的一致性进行了修订。

新指南已于2022年1月7日获得OECD/G20 BEPS包容性框架的批准。

相关NEWS如下:

OECD releases latest edition of the Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations

20/01/2022– Today, the OECD releases the 2022 edition of the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations.

The OECD Transfer Pricing Guidelines provide guidance on the application of the "arm’s length principle", which represents the international consensus on the valuation, for income tax purposes, of cross-border transactions between associated enterprises. In today’s economy where multinational enterprises play an increasingly prominentrole, transfer pricing continues to be high on the agenda of tax administrations and taxpayers alike. Governments need to ensure that the taxable profits of MNEs are not artificially shifted out of their jurisdiction and that the tax base reported by MNEs in their country reflects the economic activity undertaken therein and taxpayers need clear guidance on the properapplication of the arm’s length principle.

This latest edition consolidates into a single publication the changes to the 2017 edition of the Transfer Pricing Guidelines resulting from:

The report Revised Guidance on the Transactional Profit Split Method, approved bythe OECD/G20 Inclusive Framework on BEPS on 4 June 2018, and which replaced the guidance in Chapter II, Section C (paragraphs 2.114-2.151) found in the 2017 Transfer Pricing Guidelines and Annexes II and III to Chapter II;

The report Guidance for Tax Administrations on the Application of the Approach to Hard-to-Value Intangibles, approved by the OECD/G20 Inclusive Framework on BEPSon 4 June 2018, which has been incorporated as Annex II to Chapter VI;

The report Transfer Pricing Guidance on Financial Transactions, adopted by the OECD/G20 Inclusive Framework on BEPS on 20 January 2020, which has been incorporated into Chapter I (new Section D.1.2.2) and in a new Chapter X;

The consistency changes to the rest of the OECD Transfer Pricing Guidelines needed to produce this consolidated version of the Transfer Pricing Guidelines, which were approved by the OECD/G20 Inclusive Framework on BEPS on 7 January 2022.

Formore information on the OECD Transfer Pricing Guidelines, visithttps://oe.cd/tpg 2022

Mediaqueries should be directed to Pascal Saint-Amans (+33 1 45 24 91 08), Directorof the OECD Centre for Tax Policy and Administration (CTPA), Manuel de losSantos (+33 1 45 24 91 42), Acting Head of CTPA’s Transfer Pricing Unit, or to CTPA’s Communications Office.

END

【特别提醒】针对2020年度及以前年度同期资料主体文档、本地文档及特殊事项文档准备,同学们如有任何疑问和需求,可通过以下方式联系我们,我们经验丰富的转让定价专业服务人员会及时为您答疑解惑。

联系人:谢维潮(高级合伙人)

电话:0755-82810900

手机:13088827747(微信同号,加好友请注明“同期资料咨询”) |

-

|

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

【全网最全】31个省市!残保金政策汇编及申

【全网最全】31个省市!残保金政策汇编及申

全网最全|2022年失业保险稳岗补贴政策汇总

全网最全|2022年失业保险稳岗补贴政策汇总

2021年个税汇算容易出现哪些错误?税务总局

2021年个税汇算容易出现哪些错误?税务总局

【全网最全】历史上最高规模退税减税!2022

【全网最全】历史上最高规模退税减税!2022