|

|

来源:OECD官网

翻译:思迈特财税国际税收服务团队

Overview of the Key Operating Provisions ofthe GloBE Rules

GloBE规则关键操作条款概述

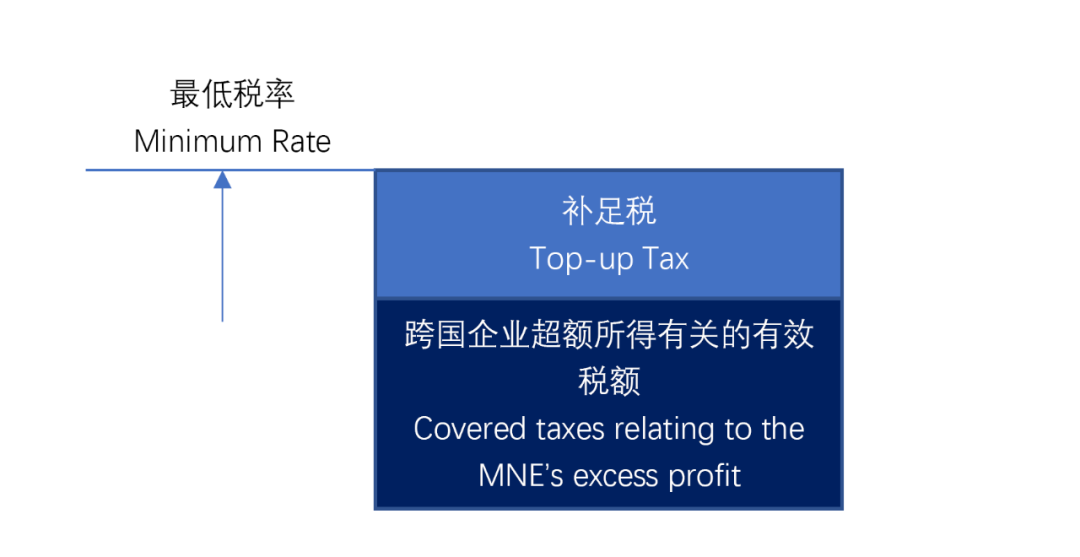

Simplified Top-up tax mechanism

补足税机制简化示意图

The GloBE rules apply a system of top-uptaxes that brings the total amount of taxes paid on an MNE’s excess profit in ajurisdiction up to the minimum rate of 15%.

GloBE规则采用了补足税机制,使跨国企业在一个辖区的超额所得所缴纳的税额达到最低税率为15%。

The tax imposed under the GloBE Rules is a“top-up tax” calculated and applied at a jurisdictional level. The GloBE rulesuse a standardized base and definition of covered taxes to identify thosejurisdictions where an MNE is subject to an effective tax rate below 15%. Itthen imposes a coordinated tax charge that brings the MNE’s effective tax rateon that income up to the minimum rate (after taking into account asubstance-based carve-out). The design of the GloBE Rules as a top-up taxfacilitates the coordinated application of the GloBE Rules.

根据GloBE规则征收的税款是在辖区内计算和应用的“补足税”。GloBE规则使用标准化基础和涵盖税种的定义来确定跨国企业在这些辖区的有效税率低于最低税率15%。然后,其征收协调税款,使跨国企业对该收入的有效税率达到最低税率(考虑基于实质排除后)。GloBE规则设计了补足税有助于GloBE规则的协调应用。

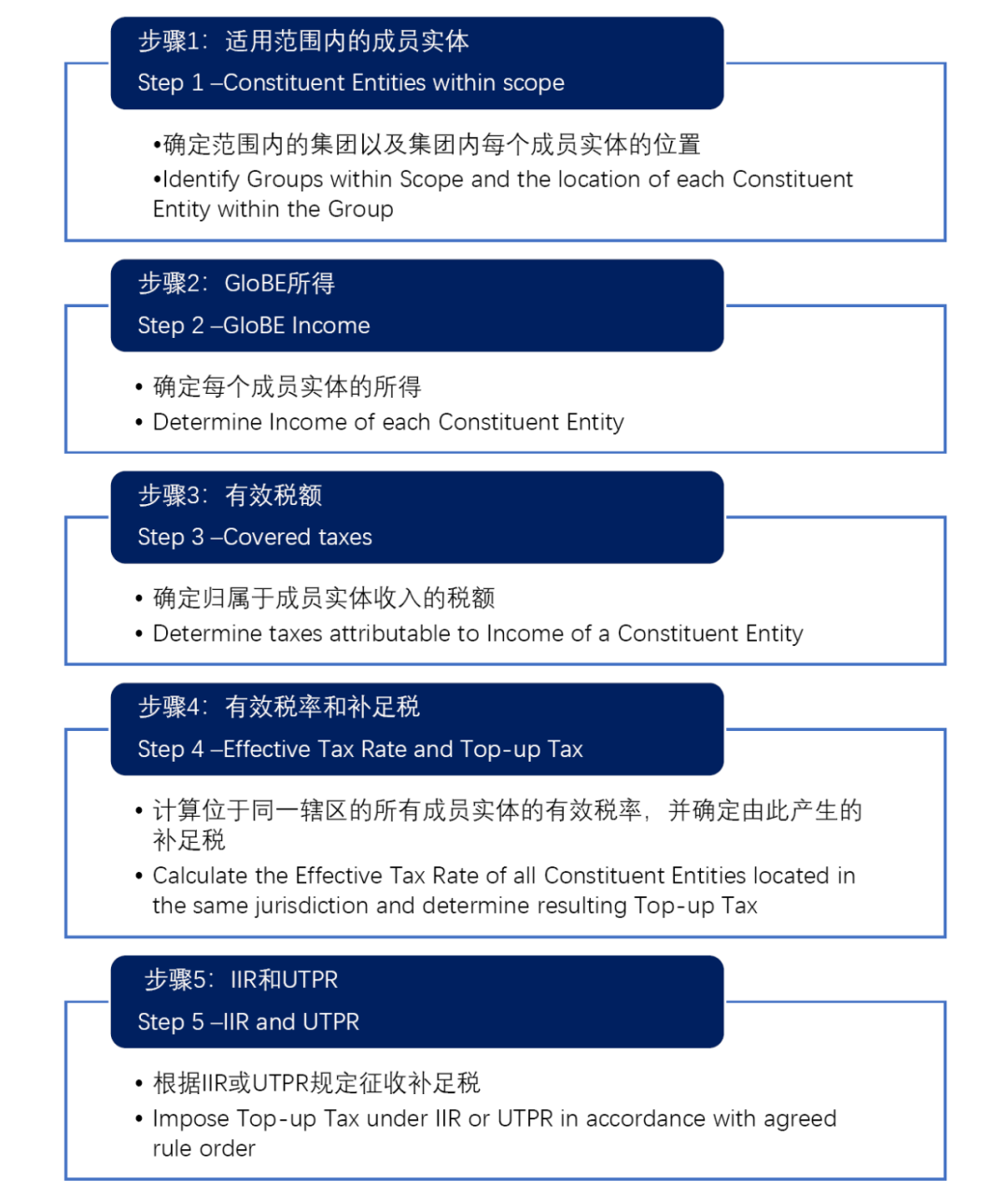

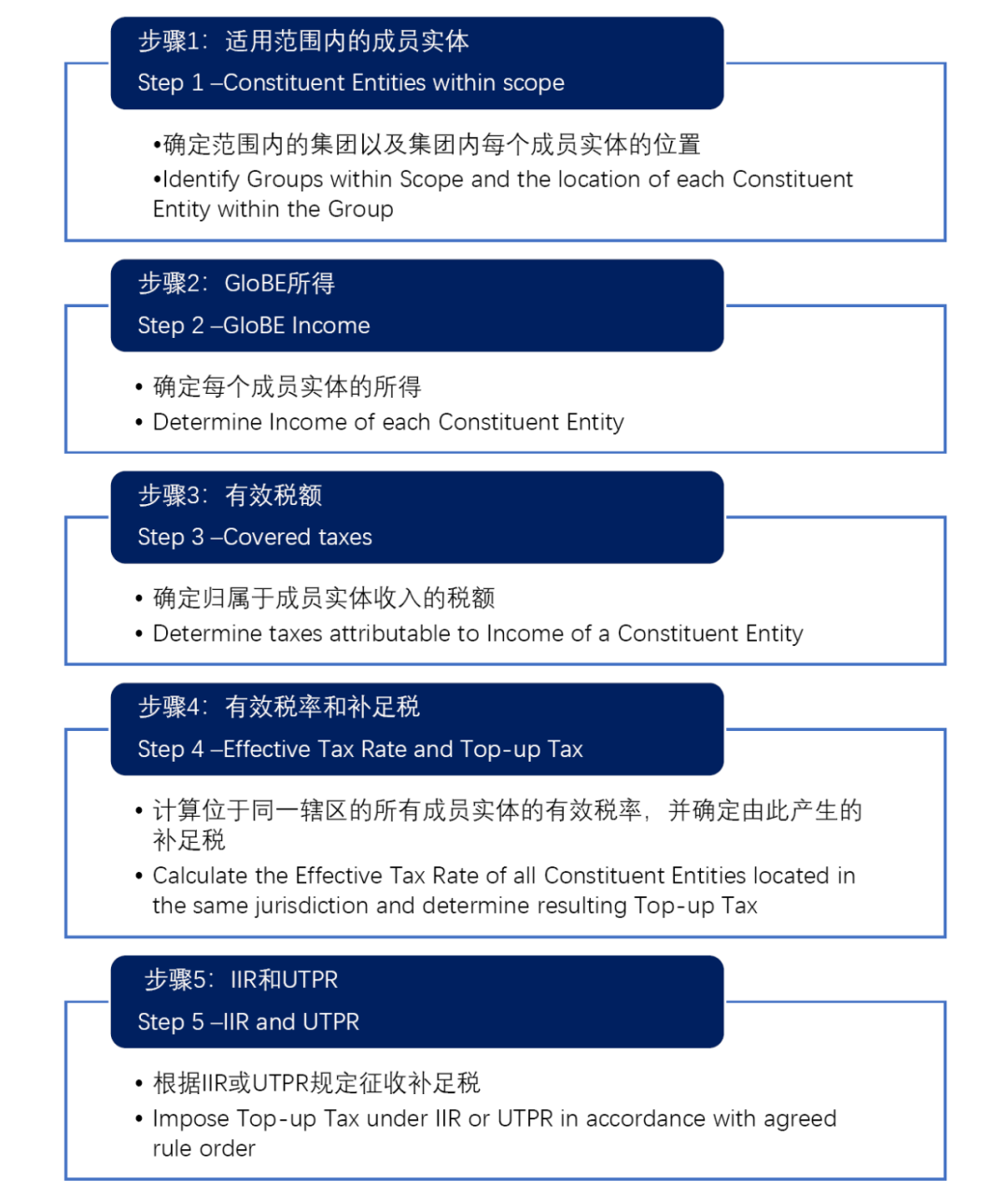

Steps in determining top-up tax liability for an MNE

确定跨国企业补足税纳税义务的步骤:

This figure illustrates the steps that anMNE might undertake in order to apply the GloBE rules.

以上步骤说明了跨国企业为适用GloBE规则可能采取的步骤。

- In Step 1an MNE Group determines whether it is within the scope of the GloBE rulesand identifies the constituent entities within the Group and their location.

- Step 2 and Step 3 determine the effective tax rate of each constituent entity.

- In the event an MNE is subject to an effective tax rate below 15% in any jurisdiction, Step 4sets out the mechanism for calculating the top-up tax in respect of that low tax jurisdiction.

- This top-up tax is then imposed on a group entity under an IIR or UTPR under Step 5.

- 在步骤1中,跨国企业集团确定其是否在GloBE规则的范围内,并确定集团内的成员实体及其位置。

- 步骤2和3确定每个成员实体的有效税率。

- 如果跨国企业在任何辖区的有效税率低于15%,则步骤4规定了计算该低税辖区(即有效税率低于最低税率)的补足税机制。

- 然后,根据步骤5的IIR或UTPR规定,对集团实体征收补足税。

Each of these Steps is described in furtherdetail in the following information sheets.

以下详细地描述每一个步骤的信息。

- Step1 –Constituent Entities within scope

- 步骤一:适用范围内的成员实体

Summary

概述

MNE Groups are in scope of the GloBE rulesif their consolidated revenue exceeds EUR 750m.

The Constituent Entities of an MNE Groupinclude all the entities within the Group with any permanent establishment of agroup entity being treated as a separate Constituent Entity. Excluded entitiesare, however, not within scope and excluded from the operation of the GloBErules.

The location of each Constituent Entity isdetermined based on its local tax treatment.

如果跨国企业集团的合并收入超过7.5亿欧元,则该跨国企业集团纳入GloBE规则适用范围。

跨国企业集团的成员实体包括集团内的所有实体,集团实体的任何常设机构被视为单独的成员实体。然而,被排除的实体不在适用范围之内,并且被排除在GloBE规则适用范围之外。

每个成员实体的所在地是根据其当地税收协定确定的。

- Step1 Identify MNE Groups within scope

- Step2 Identify Constituent Entities

- Step3 Remove any Excluded Entities

- Step4 Identify location of each Constituent Entity

- 步骤1确定适用范围内的跨国企业集团

- 步骤2确定成员实体

- 步骤3剔除任何排除实体

- 步骤4确定每个成员实体的位置

Step1 Identify MNE Groups within scope of the GloBE Rules

步骤1:确定GloBE规则适用范围内的跨国企业集团

EUR 750m consolidated revenue test MNEGroups are in scope if the revenue in their Consolidated Financial Statementsexceeds EUR 750m. The test is based on the two of the four Fiscal Yearsimmediately preceding the tested Fiscal Year (Article 1.1.1) Special rulesaddress the effect of mergers or demergers with respect to the consolidatedrevenue test (Article 6.1).

7.5亿欧元的合并收入测试。如果跨国企业集团的合并财务报表中收入总和超过7.5亿欧元,则属于该范围。该测试年度是基于紧接在测试财政年度之前的四个财政年度中的两个财政年度(第1.1.1条)。特殊规则处理合并或分立对合并收入测试的影响(第6.1条)。

Step2 Identify Constituent Entities

步骤2:确定成员实体

Constituent Entities. Constituent Entitiesare those Group Entities that are subject to the operative provisions of theGloBE Rules. The term comprises all entities included in a group and permanentestablishments (PEs)(Article 1.3.1).

Permanent Establishments. Any PE that is aConstituent Entity is treated as a separate Constituent Entity from the MainEntity and any other PE of the Main Entity (Article 1.3.2).

成员实体。成员实体是指受GloBE规则约束的集团实体。该术语包括集团中的任何实体及其任何常设机构(第1.3.1条)。

常设机构。作为成员实体的任何常设机构,应视为独立于主体实体和该主体实体的任何其他常设机构(第1.3.2条)。

Step3 Remove any Excluded Entities

步骤3:剔除任何排除实体

Excluded Entities. Excluded Entities arenot subject to the operative provisions of the GloBE Rules however theirrevenue is still taken into account for purposes of the consolidated revenuetest.

Excluded Entities are Governmental Entities, International Organisations, Non-profit Organisations, and PensionFunds as well as any Investment Fund or Real Estate Investment Vehicle that isthe UPE of the MNE Group (Article 1.5.1).

The definition of Excluded Entities is alsoextended to cover some entities owned by excluded entities and that hold assetsor invest funds and only carry out ancillary activities, or that mostly deriveincome that is excluded from the GloBE tax base. (Article 1.5.2).

The exclusion from the operative provisionsof the GloBE rules does not extend to an Excluded Entity’s ownership interestin other Constituent Entities.

排除实体。作为排除实体的实体不受GloBE规则的约束,但在合并收入测试时仍将其收入考虑在内。

排除实体是政府实体、国际组织、非营利组织和养老基金以及作为跨国企业集团最终控股实体的投资基金和房地产投资工具(第1.5.1条)。

排除实体的定义也扩展到包括排除实体持有资产或投资基金,仅从事开展辅助性活动,或主要获得不包括在GloBE税基之外的收入。(第1.5.2条)。

GloBE规则执行条款中的排除不适用于排除实体在其他成员实体中的所有者权益。

Step4 Identify location of each Constituent Entity

步骤4:确定每个成员实体的位置

Entity located where it is tax resident. Ifan entity is tax resident in a jurisdiction based on its place of management,place of creation or similar criteria, it is located in that jurisdiction. Inall other cases, it is located in the jurisdiction where it was created(Article 10.3.1). Flow-through entities are subject to special treatment underthe rules (Article 10.3.2).

PE located where it is situated. APE islocated in the source jurisdiction where it is treated as a PE and subject totax (Article 10.3.3). Special rules apply for PEs that are exempt from tax.

税收居民所在地的实体。如果实体根据其管理地、设立地或类似标准是某个辖区的税收居民,则该实体位于该辖区。在其他情况下,它位于设立地辖区(第10.3.1条)。根据规则(第10.3.2条),穿透实体受到特殊处理。

常设机构的所在地。常设机构的所在地位于视其为常设机构并须征税的辖区(第10.3.3条)。特别规则适用于免税的常设机构。

- Step2 -GloBE Income or Loss

- 步骤二:GloBE所得或亏损

Summary

概述

Under Chapter 3, the amount of GloBE Incomeor Loss of a Constituent Entity is determined by taking the FinancialAccounting Net Income or Loss for the Constituent Entity for the Fiscal Yearunder Article 3.1 and then adjusting the amount under Articles 3.2 through 3.5to arrive at that Entity’s GloBE Income or Loss.

GloBE Income or Loss is then allocatedbetween a Permanent Establishment and Main Entity or to owners of aFlow-through Entity in accordance with local tax treatment

根据第3章,成员实体的GloBE所得或亏损金额是根据第3.1条,取成员实体财年中按照财务会计确定的净收益或亏损,然后根据第3.2条至3.5条,将这一数额调整为该实体的GloBE所得或亏损。

然后,GloBE所得或亏损根据当地税务处理在常设机构和主体实体之间分配或者分配给穿透实体的所有者。

Step1 Determination of Financial Accounting Net Income

步骤1:财务会计净所得的确定

Financial Accounting Net Income or Loss Thestarting point for determining a Constituent Entity’s GloBE income is the netincome or loss that is used for preparing Consolidated Financial Statements ofthe Ultimate Parent Entity prior to the elimination of intra-groupitems.(Article 3.1).

财务会计净所得或亏损是指在对集团内部交易进行任何调整抵消之前用于编制合并财务报表时成员实体所确定的净所得或损失。(第3.1条)。

Step2 Adjust Financial Accounting Net Income or Loss to GloBE Base

步骤2:将财务会计净所得或亏损调整为GloBE所得或亏损

The net income or loss determined under Step 1 is adjusted to eliminate a number of common book to tax differenceswhere that adjustment is justified on policy grounds (Article 3.2). Theseadjustments include:

?Excluded Dividends; Excluded Equity Gainor Loss –Avoids double counting of previously taxed income and aligns withparticipation exemptions and similar relief common to many IF jurisdictions

?Policy Disallowed Expenses –Disallowsdeduction for illegal payments

?Stock-based compensation –Prevents top-uptax arising in respect of book-to-tax differences associated with stock-basedcompensation plans.

?Asymmetric Foreign Currency Gains andLosses –Adjustments are made to avoid distortions from arising where thefunctional currencies used for accounting and tax are different.

?Exclude International Shipping Income(Article 3.3)

调整步骤1确定的净所得或亏损,以消除一些因政策原因而导致的常见的会计和税收差异(第3.2条)。这些调整包括:

- 排除的股息,排除的权益损益-避免对以前的收入重复计税,并与许多包容性框架辖区的参与豁免和类似救济保持一致。

- 政策不允许的费用-不允许扣除非法付款。

- 基于股票的薪酬-防止因与基于股票的薪酬计划相关的账面与税款差异而产生的补足税。

- 非对称汇兑损益-进行调整以避免因用于会计和税收的功能货币不同而造成的失真。

国际海运所得排除(第3.3条)。

Step3 GloBE Income or Loss allocated to Permanent Establishments or through Flow-through Entities where necessary

步骤3:GloBE所得或损失分配给常设机构或在必要时通过穿透实体分配

GloBE Income or Loss is allocated between aPermanent Establishment and Main Entity (Article 3.4) or to owners of aFlow-through Entity (Article 3.5) in accordance with local tax treatment. Theseallocation rules ensures an appropriate allocation of financial net income orloss between these Entities and their owners in line with the applicable localtax rules

GloBE所得或亏损根据当地税务处理在常设机构和主体实体之间分配(第3.4条)或者分配给流通实体的所有者(第3.5条)。这些分配规则确保根据适用的当地税收规则,在这些实体与其所有者之间适当分配财务净所得或亏损。

- Step3 -Adjusted Covered Taxes

- 步骤三:经调整的有效税额

Summary

概述

The amount of a Constituent Entity’s Covered Taxes is determined by taking the Constituent Entity’s current taxesfor the Fiscal Year, adjusted to reflect certain timing differences. CoveredTaxes are allocated from one Constituent Entity to another in certain cases. Tothe extent there are changes in tax liability after filing, additions orreductions to taxes are identified and allocated to a particular jurisdictionand time period.

有效税额是按照成员实体在该财年的当期税额确定的,并进行调整以反映某些时间性差异。在某些情况下,将有效税额从一个成员实体分配给另一个成员实体。

如果申报后纳税义务发生变化,则确定增税或减税并将其分配到特定的辖区和时间段。

Step1 Identification of Covered Taxes

步骤1:有效税额的定义

Identify Covered Taxes (Articles 4.1 and4.2): The starting point for the computation of Covered Taxes is the currenttax expense accrued for Financial Accounting Net Income or Loss. Adjustments tothe current tax expense amount are made under Articles 4.1.2 through 4.1.5 forGloBE purposes. Tax credits that are refundable after four or more years aretreated as a reduction in covered taxes in the year such credits are granted.On the other hand, qualified refundable tax credits, which must be paid withinfour years, are added to covered taxes when such credits are used to reducecurrent tax expense.

有效税额的定义(第4.1和4.2条):有效税额的计算应以财务会计净所得或亏损中的当期税收费用为起点,以GloBE为目的,根据第4.1.2至4.1.5条规定对当期税收费用进行调整。四年或更长时间后可退还的税收抵免被视为在授予此类抵免当年有效税额的减少。另一方面,必须在四年内支付的合格可退还税收抵免,当此类抵免用于减少当期税收费用时,会被作为有效税额的增加。

Step2 Adjust Covered Taxes for temporary differences and losses

步骤2:针对暂时性差异和损失调整有效税额

?An adjustment is made to Covered Taxes by way of the Total Deferred Tax Adjustmentamount to take temporary differences and prior year losses into account forGloBE purposes (Article 4.4).

?Article4.4 includes a number of safeguards designed to protect the integrity of theETR calculation under the GloBE rules. These safeguards include limiting therecognition of the deferred tax assets and liabilities to the minimum rate anda recapture rule to ensure that amounts claimed as Covered Taxes are actuallypaid within a set period of time.

?Asimplified loss carry-forward equivalent may be elected under Article 4.5inlieu of applying the deferred tax accounting rules set out in Article 4.4.whichprovides appropriate recognition of losses arising in no or low-taxjurisdictions.

- 通过递延所得税调整总额对有效税额进行调整,以考虑GloBE目的的临时差异和上年亏损(第4.4条)。

- 第4.4条包括了一系列保障措施,旨在保护GloBE规则下的ETR计算的完整性。这些保障措施包括,将递延所得税资产和负债的确认限制在最低税率以内,并制定转回规则,以确保在规定的时间内,实际支付了有效税额。

- 可以根据第4.5条规定选择简化损失结转等值物,以代替适用第4.4条规定的递延所得税会计规则。对在无税或低税辖区产生的损失给予适当的确认。

Step3 Allocate Covered Taxes to other Constituent Entities as necessary

步骤3:必要时将有效税额分配给其他成员实体

Covered Taxes are allocated to otherConstituent Entities when necessary (Article 4.3) Such taxes that may requireallocation include CFC taxes, distribution taxes (withholding tax), and tax inrespect of a Permanent Establishment, Tax Transparent Entity, or a HybridEntity.

必要时将有效税额分配给其他成员实体(第4.3条)。可能需要分配的税款包括受控外国公司制度下征收的税款、分配税(预提所得税),以及针对常设机构、税收透明实体和混合实体的税款。

Step4 Take post-filing adjustments into account

步骤4:考虑申报后调整

Special rules apply when there is an adjustment to a tax liability for a prior year(e.g., as the result of an audit or the filing of an amended return to correctan error).

The sespecial rules require the ETR to be recalculated for a prior year where there is a material reduction in tax liability for that year. To the extentadditional Top-up Tax liability results from the adjustment, such amount ofTop-up Tax is paid in the current fiscal year (i.e., no amended return isrequired for the prior year). Increases in tax amounts for prior years areadded to Covered Taxes in the current fiscal year. (Article 4.6)

当对上一年的纳税义务进行调整时(例如,由于审计或提交更正申报表以更正错误),适用特殊规则。

这些特殊规则要求在上一年的纳税义务有实质性减少的情况下重新计算ETR。如果调整导致额外的补足税责任,则在当前财政年度支付此类补足税额(即不需要对上一年进行更正申报)。前几年税额的增加将被结转到本财政年度的有效税额中。(第4.6条)

- Step4 -Effective Tax Rate and Top-up Tax

- 步骤四:有效税率和补足税

Summary

概述

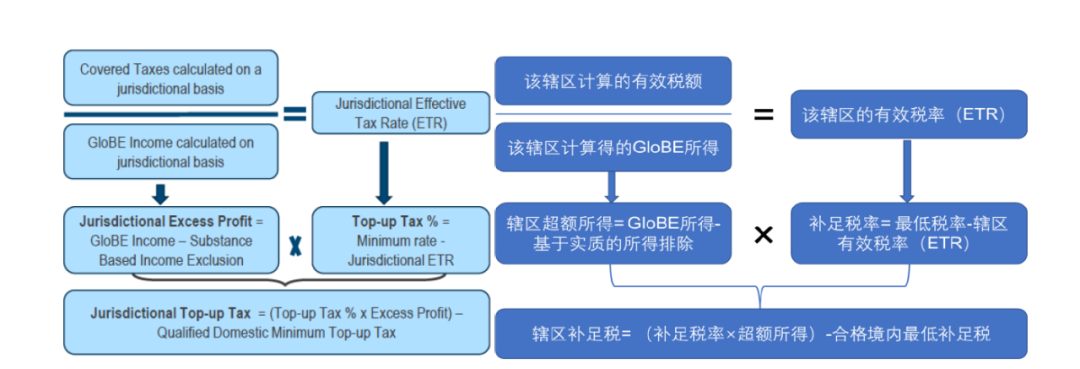

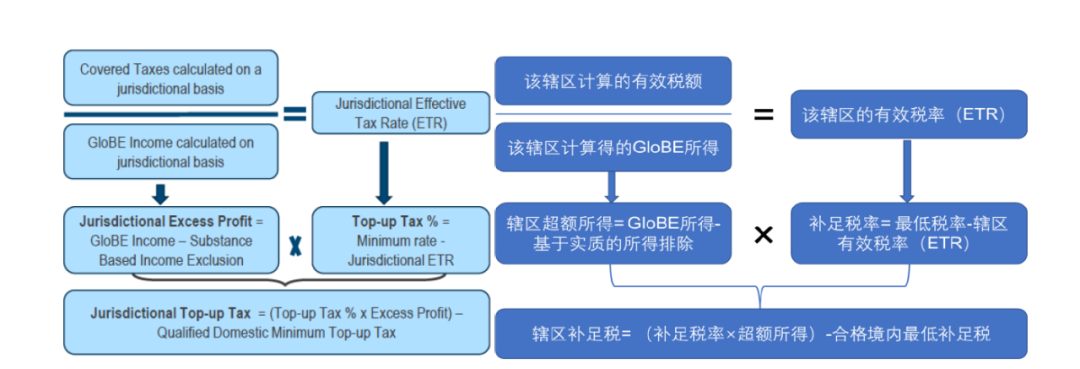

Under Chapter 5 the Top-up Tax of eachLow-Taxed Constituent Entity is computed by:

(i)calculating the Top-up Tax Percentagefor each Low-tax Jurisdiction;

(ii)applying the Top-up Tax Percentage tothe Excess Profits of the Jurisdiction;

(iii)deducting the amount of top-up taximposed under a qualified domestic minimum tax; and

(iv)allocating the Jurisdictional Top-upTax to the Constituent Entities in the Jurisdiction in proportion to theirGloBE Income.

在第五章,每个低税成员实体的补足税计算步骤为:

1. 计算每个低税辖区的补足税比率;

2. 应用补足税比率确定该辖区的超额所得;

3. 减去任何合格的国内最低补足税的金额;和

4. 通过按低税辖区各成员实体的GloBE所得占比分配补足税。

Computation of the Jurisdictional Top-upTax

辖区补足税的计算:

Step1 Computation of jurisdictional Top-up Tax for low-taxed jurisdictions

步骤1 低税辖区的补足税计算

The amount of Covered Taxes with respect toa jurisdiction are divided by the GloBE Income in such jurisdiction todetermine the Effective Tax Rate (ETR) for such jurisdiction. (Article 5.1)

2.When the ETR is below the Minimum Rate,the Top-up Tax percentage for the jurisdiction must be calculated. This iscomputed by subtracting the ETR from the Minimum Rate (e.g., if the ETR is 10%,the Top-up Tax percentage is equal to 15% -10% = 5%). (Article 5.2.1)

3.The Top-up Tax percentage is then multipliedby the Excess Profit (Article 5.2.2) in the jurisdiction to determine theamount of Top-up Tax. The Excess Profit for the jurisdiction is equal to theGloBE Income less the Substance Based Income Exclusion (i.e., an excludedroutine return on tangible assets and payroll) (Article 5.3).

4.Finally, the Top-up Tax for thejurisdiction is reduced by any applicable Qualified Domestic Minimum Top-upTax. (Article 5.2.3)

1. 一个辖区的有效税额除以该辖区的GloBE所得,以确定该辖区的有效税率(ETR)。(第5.1条)

2. 当ETR低于最低税率时,必须计算辖区的补足税比率。这是通过从最低税率中减去ETR计算得出的(例如,如果ETR为10%,则补足税比率等于15%-10%=5%)。(第5.2.1条)

3. 然后将补足税比率乘以辖区围内的超额所得(第5.2.2条)以确定补足税额。该辖区的超额所得等于GloBE所得减去基于实质的所得排除(即排除的有形资产和工资成本的固定回报)(第5.3条)。

4. 最后,该辖区的补足税减去任何适用的合格境内最低补足税。(第5.2.3条)

Step2 Allocation of the Top-up Tax between Low Taxed Constituent Entities

步骤2 低税成员实体之间的补足税分配

Identificationof Constituent Entities with GloBE Income. The Jurisdictional Top-up Tax isallocated to Constituent Entities in the Low Tax Jurisdiction that have GloBEIncome for the Fiscal Year (and in proportion to such income) in order todetermine which entities trigger a charge to Top-up Tax under Step 5 (Article5.2.4).

确认具有GloBE所得的组成实体。辖区补足税分配给在本财政年度拥有GloBE所得的低税辖区的组成实体(并与此类收入成比例),以确定哪些实体适用步骤五(第5.2.4条)。

Exceptions:GloBErules provide for de minimis exclusion and allow for development ofsafe-harbours.

例外:GloBE规则规定了微利排除并允许安全港的安排。

De Minimis Exclusion (Article 5.5)

for jurisdictions where the MNE has (i) anAverage GloBE Revenue that is less than |

-

|

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

【全网最全】31个省市!残保金政策汇编及申

【全网最全】31个省市!残保金政策汇编及申

全网最全|2022年失业保险稳岗补贴政策汇总

全网最全|2022年失业保险稳岗补贴政策汇总

2021年个税汇算容易出现哪些错误?税务总局

2021年个税汇算容易出现哪些错误?税务总局

【全网最全】历史上最高规模退税减税!2022

【全网最全】历史上最高规模退税减税!2022