|

|

您的非常满意,

是我们的无限动力!

阅读导览:

Directions for Reading:

本期主题:小型微利企业企业所得税优惠之政策介绍

Topic of this Passage: Introduction to the policies of enterprise income tax incentives for small and micro enterprises

关键字:小型微利企业、企业所得税、税收优惠

Keywords: small and micro enterprises, enterprise income tax, tax incentives

全文字数:中文— 约1100字

Length of the passage:English(about 836 words)

预计阅读时间:11分钟

Estimated time for reading:11 minutes

最近疫情又卷土重来

让本不富裕的生意是雪上加霜

Recently, the COVID-19 has made a comeback, which added more difficulties to the operation of enterprises.

好在国家出台了小型微利企业

企业所得税优惠政策

减轻了我们的负担!

Fortunately, China has issued the policies of enterprise income tax incentives for small and micro enterprises, which has greatly reduced their burdens caused by the COVID-19.

那么,下面就让我们具体看看小型微利企业可以享受的企业所得税优(yí)惠(wèn)政(sān)策(lián)吧~

Let’s take a closer look at the policies of enterprise income tax incentives for small and micro enterprises through Q&As.

01

问

我能不能享受呢?

Can I enjoy the policies?

只要符合以下的前提条件,就属于小型微利企业,可以享受最新税收优惠!

As long as your enterprise meets the following requirements, it can be recognized as a small and micro enterprise and thus can enjoy the latest tax incentives!

敲黑板!一定要以下条件均符合才可以享受优惠哦~

Attention! Only when your enterprise must meet all the following requirements can your enterprise enjoy the tax incentives.

1. 从事国家非限制和禁止行业

2. 符合年度应纳税所得额不超过300万元

3. 从业人数不超过300人

4. 资产总额不超过5000万元

1.Belonging to national non-restricted and non-prohibited industries;

2. Annual taxable income not exceeding 3 million yuan;

3. The number of employees not exceeding 300;

4. Total assets not exceeding 50 million yuan;

滑动查看中英文对照>>

Slide to see English Version>>

名词解释 / Explanation of Terms

点我一下/Click me

按照《财政部税务总局关于实施小微企业普惠性税收减免政策的通知》(财税〔2019〕13号)规定,从业人数应按企业全年的季度平均值确定。具体计算公式如下:季度平均值=(季初值+季末值)÷2,全年季度平均值=全年各季度平均值之和÷4。年度中间开业或者终止经营活动的,以其实际经营期作为一个纳税年度确定上述相关指标。

According to the Circular on Implementing the Inclusive Tax Deduction and Exemption Policies for Micro and Small Enterprises(Ministry of Finance and State Administration of Taxation, Document No.13, 2019), the number of employees should be determined based on the quarterly average for the whole year. The specific calculation formula is as follows: quarterly average = (the number at the beginning of the quarter + the number at the end of the quarter) ÷ 2, annual quarterly average = sum of quarterly averages ÷ 4. In case of starting or discontinuing business activities in the middle of the year, the actual business period shall be recognized as a tax year to determine the above-mentioned relevant indicators.

e

02

问

优惠多少啊?力度大不大?

How many incentives can I enjoy based on the policies?

政策原文

Original link of the policy:

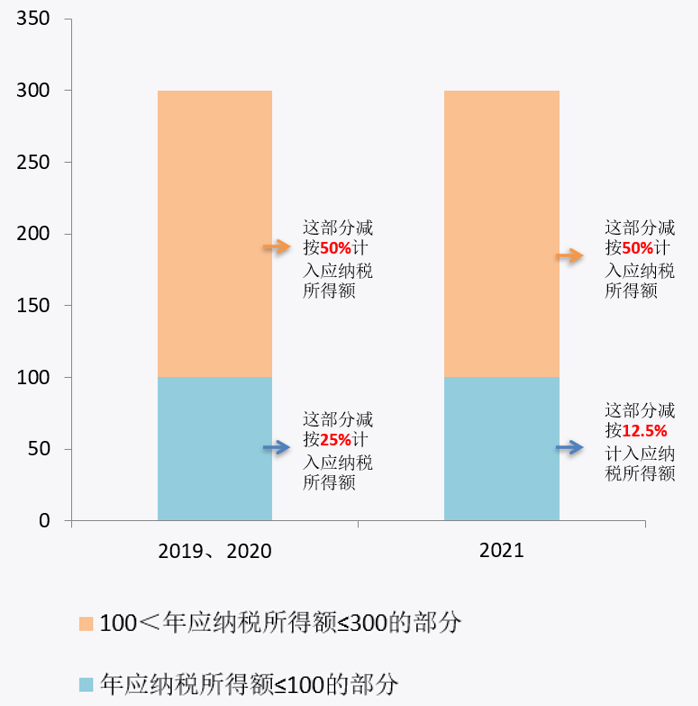

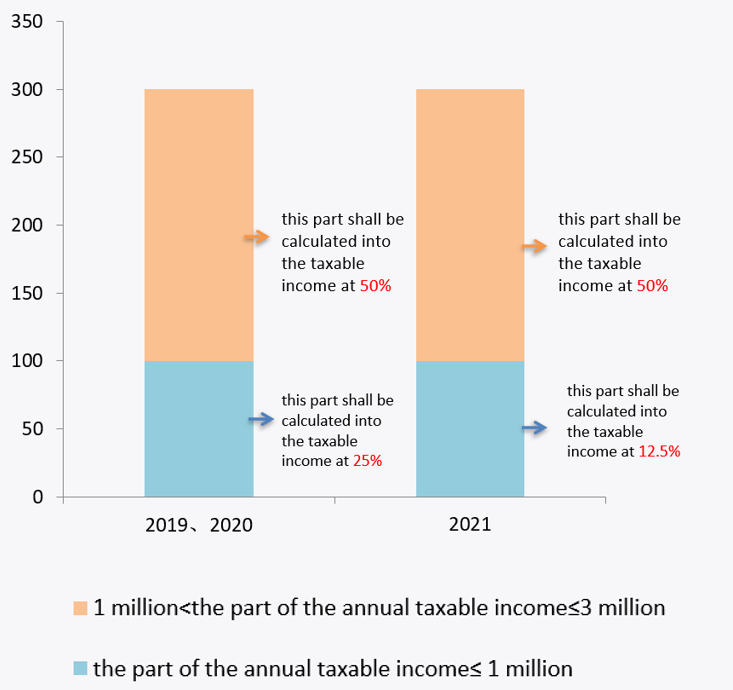

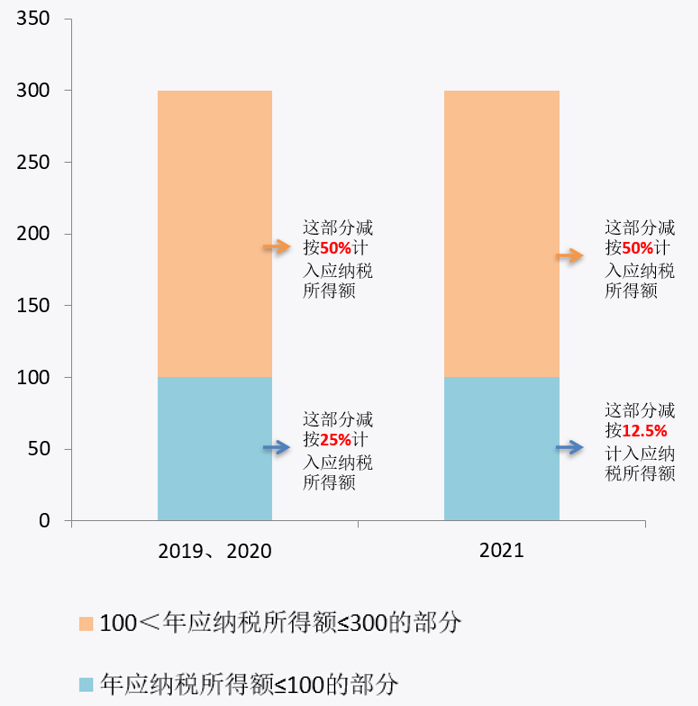

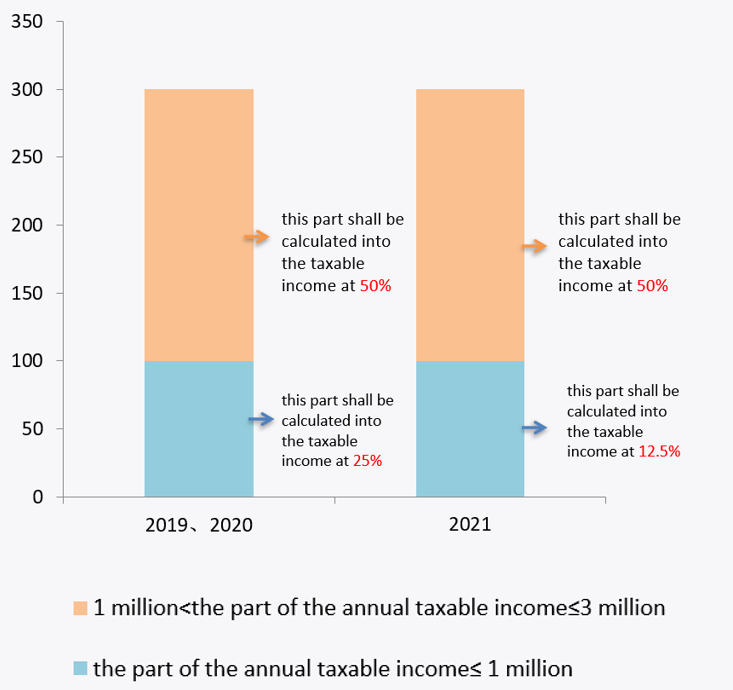

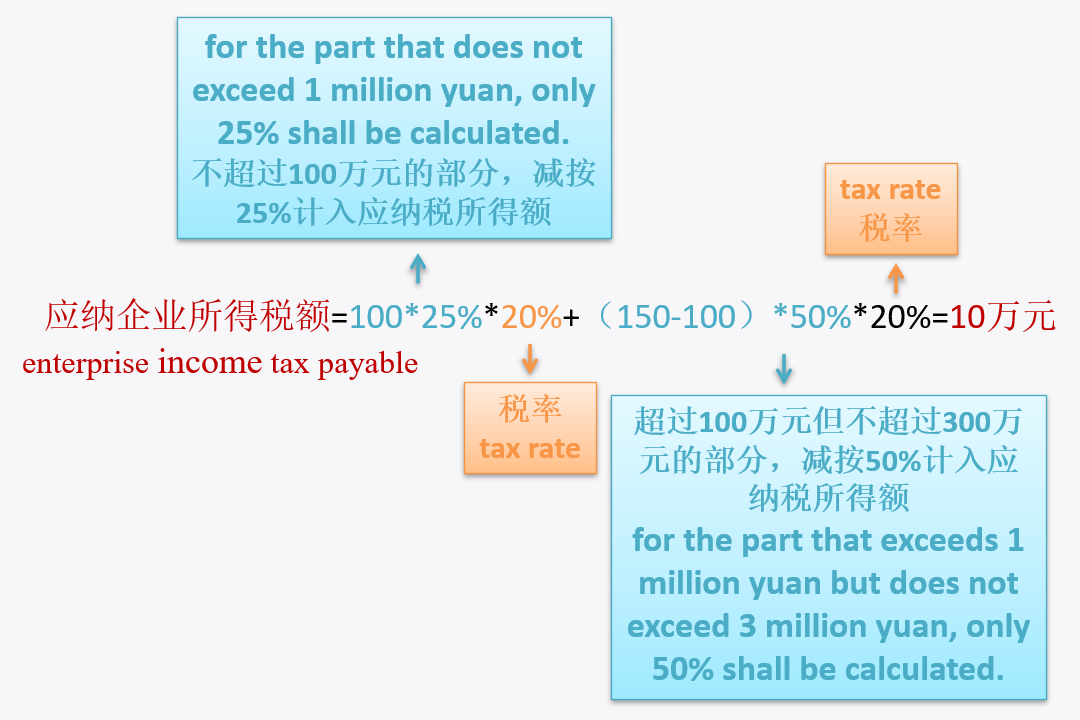

根据政策规定,自2019年1月1日至2021年12月31日,对小型微利企业年应纳税所得额不超过100万元的部分,减按25%计入应纳税所得额,按20%的税率缴纳企业所得税;对年应纳税所得额超过100万元但不超过300万元的部分,减按50%计入应纳税所得额,按20%的税率缴纳企业所得税。

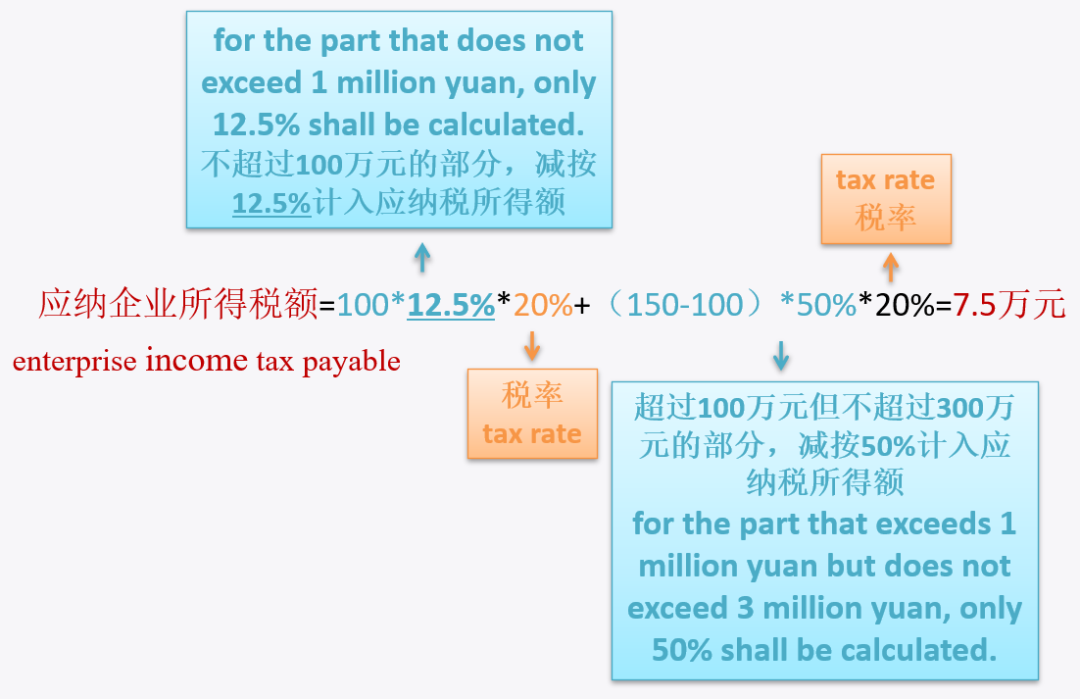

自2021年1月1日至2022年12月31日,对小型微利企业年应纳税所得额不超过100万元的部分,减按12.5%计入应纳税所得额,按20%的税率缴纳企业所得税。

According to the policy, from January 1, 2019 to December 31, 2021, for the part of the annual taxable income of a small and micro enterprise that does not exceed 1 million yuan, only 25% of the enterprise income shall be calculated, and the tax rate shall be reduced to 20%; for the part of the annual taxable income that exceeds 1 million yuan but does not exceed 3 million yuan, only 50% of shall be calculated, and the tax rate shall be reduced to 20%.

From January 1, 2021 to December 31, 2022, for the part of the annual taxable income of a small and micro enterprise that does not exceed 1 million yuan, only 12.5% of the enterprise income shall be calculate, and the tax rate shall be reduced to 20%.

一张图读懂新优惠

Here is a chart to help you understand

the new policy:

滑动查看中英文对照>>

Slide to see English Version>>

03

问

咋的算呢!我看不懂啊!

How can I calculate the tax I should pay?

举个栗子

Let’s look at the example

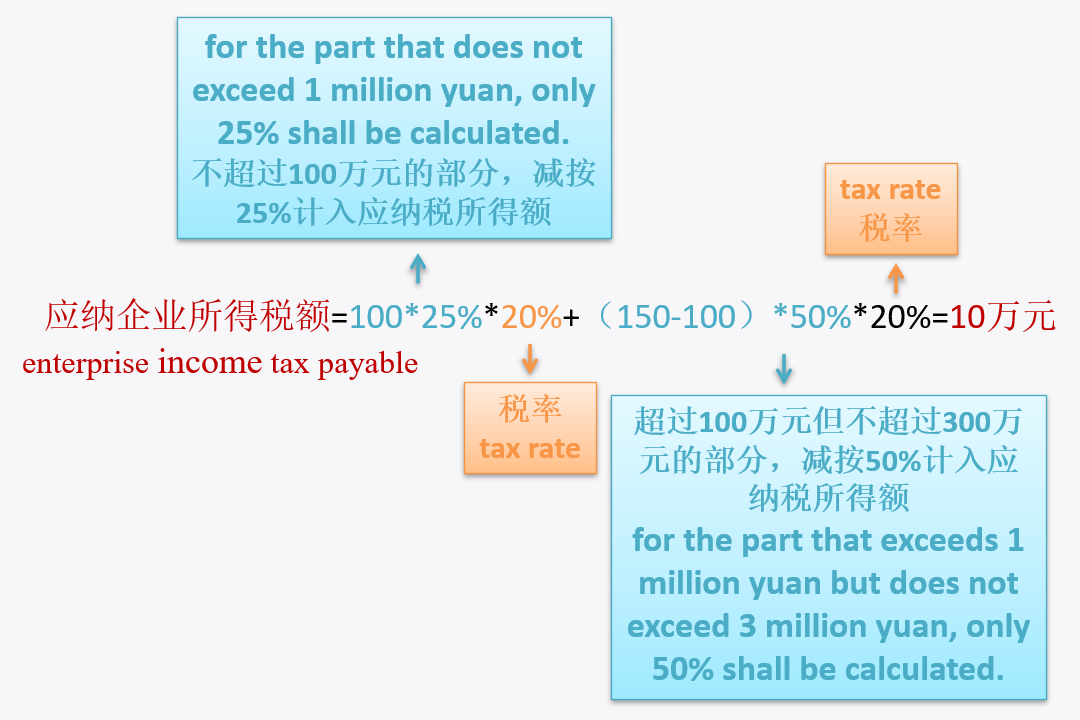

假定A企业2020年符合小型微利企业,且应纳税所得额为150万元,则其2020年度汇算清缴申报时,应纳企业所得税额如下:

Assuming that enterprise A is a small and micro enterprise in 2020 and its taxable income is 1.5 million yuan, the enterprise income tax payable for the year 2020 during the annual final settlement is as follows:

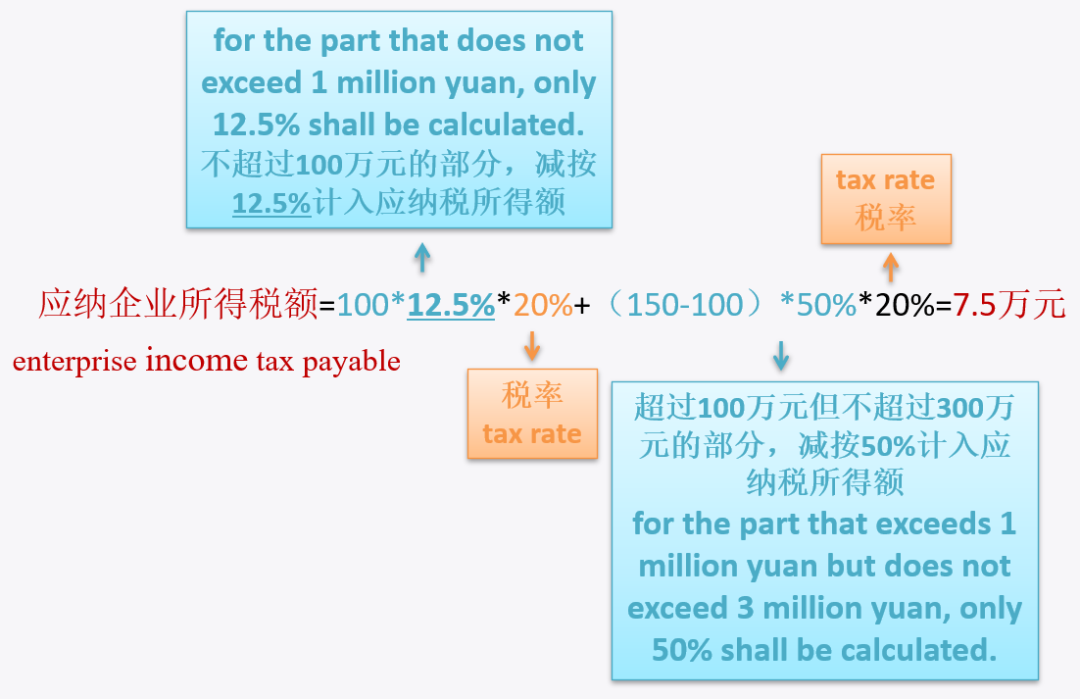

假定A企业2021年仍然符合小型微利企业,且第一季度应纳税所得额为150万元,则其2021年第一季度预缴申报时,应纳企业所得税额如下:

Assuming that enterprise A is still qualified as a small and micro enterprise in 2021 and the taxable income in the first quarter is 1.5 million yuan, the enterprise income tax payable during the prepayment declaration in the first quarter of 2021 is as follows:

名词解释 / Explanation of Terms

点我一下/ Click me

应纳税所得额是企业所得税的计税依据,按照企业所得税法的规定,应纳税所得额为企业每一个纳税年度的收入总额减除不征税收入、免税收入、各项扣除以及允许弥补的以前年度亏损后的余额。基本公式为:

Taxable income is the basis for the calculation of enterprise income tax. According to the provisions of the Enterprise Income Tax Law, the amount of an enterprise taxable income is the total income of the enterprise in each tax year deducting the non-taxable income, tax-free income, various deductions and allowable losses of previous years. The basic formula is:

应纳税所得额=收入总额-不征税收入-免税收入-各项扣除-允许弥补的以前年度亏损后的余额。

Taxable income = total income-non-taxable income-tax-exempt income-various deductions-allowable losses of previous years

本期【小型微利企业企业所得税优惠之

政策介绍】到这里就结束了

Here is the end of our introduction to the policies of enterprise income tax incentives for small and micro enterprises.

如果确定您符合小型微利企业条件

If you meet the standards for small and micro enterprise,

记得关注下期【小型微利企业企业所得税

优惠之申报指引】~

please keep an eye on our next passage: Guidelines for the Declaration of Corporate Income Tax for Small and Micro Enterprises

深圳蛇口税务

长按二维码即可关注

本期小编:特特特 Cecilia Echo

|

-

|

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

京公网安备 11010802035448号

( 京ICP备19053597号-1,电话18600416813,邮箱1479971814@qq.com ) 了解Tax100创始人胡万军

优化与建议

隐私政策

【全网最全】31个省市!残保金政策汇编及申

【全网最全】31个省市!残保金政策汇编及申

全网最全|2022年失业保险稳岗补贴政策汇总

全网最全|2022年失业保险稳岗补贴政策汇总

2021年个税汇算容易出现哪些错误?税务总局

2021年个税汇算容易出现哪些错误?税务总局

【全网最全】历史上最高规模退税减税!2022

【全网最全】历史上最高规模退税减税!2022